- Understanding the Quest to Construct a Crypto Change

- Able to Launch Your Crypto Change?

- Estimated Price Breakdown Desk

- Extra Concerns that Affect Closing Prices

- Challenges in Implementation

- Frequent Misconceptions

- Planning to Construct a Safe Crypto Change?

- Sensible Ideas for Constructing Your Change on a Price range

- Constructing on Earlier Factors with New Insights

- Conclusion: Charting a Course for 2025

Understanding the Quest to Construct a Crypto Change

Once we discuss in regards to the “value to develop a crypto alternate,” we’re actually speaking about what number of assets are poured into a number of essential areas. And as of late, because the crypto market matures, constructing an alternate isn’t nearly coding a web site. It’s about weaving collectively user-friendly design, top-notch safety requirements, sturdy buying and selling options, compliance measures, and an environment friendly operational technique.

Able to Launch Your Crypto Change?

Get a customized quote and knowledgeable steerage on your crypto platform as we speak.

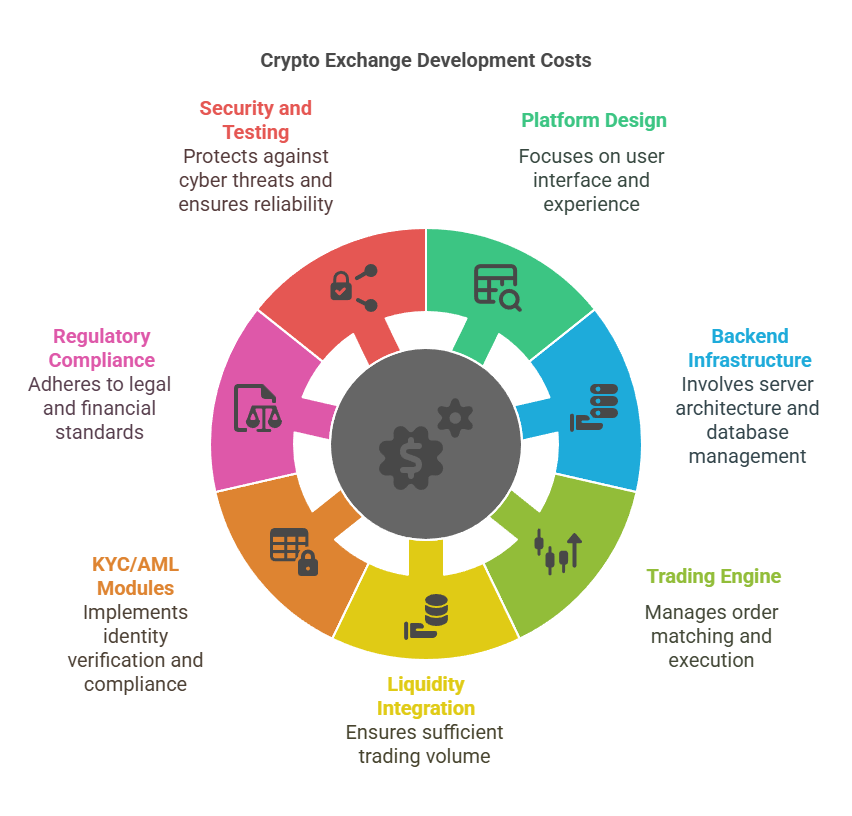

Briefly, listed here are the core areas that can form your crypto alternate growth value:

- Platform Design and Consumer Expertise

- Backend Infrastructure

- Buying and selling Engine

- Liquidity Integration

- KYC/AML Modules

- Regulatory Compliance

- Safety and Testing

Every of this stuff contributes to that remaining determine. For those who’re making an attempt to estimate the price to construct a crypto alternate in 2025, you’ll have to think about all of those. The extra complexity you introduce (like superior buying and selling pair configurations or algorithmic buying and selling), the upper your alternate app growth bills climb.

1. Platform Design and Consumer Expertise

At first look, good design may appear to be a “nice-to-have,” however it may be an actual game-changer. A visually interesting platform that’s straightforward to navigate can set your alternate aside. In case your alternate structure feels cumbersome or complicated, potential merchants could enroll elsewhere sooner than you possibly can say “login button.”

- Primary Design [approx. $3,000 – $7,000]: This covers a easy interface and basic front-end parts.

- Superior UI/UX [approx. $8,000 – $20,000+]: This degree of effort contains customized design parts, animated transitions, consumer onboarding flows, and thorough consumer testing.

One may surprise: Is it potential to chop prices by skipping elaborate design? The reply is sure, however you threat alienating customers with a subpar expertise. I’d strongly suggest investing thoughtfully in UI/UX as a result of even probably the most refined buying and selling engine received’t matter if folks can’t navigate your alternate with ease.

2. Backend Infrastructure and Structure

Many enterprise homeowners consider the visible design first, however the true heavy lifting occurs within the backend. This part is usually the place nearly all of your crypto alternate growth value is allotted. Right here’s why: the backend should deal with real-time information requests, course of a big quantity of transactions per second, and preserve ironclad safety.

Constructing a strong backend means leveraging programming languages, frameworks, and servers that may deal with excessive throughput. In case your platform is meant for enterprise-level operations, the backend structure must be each scalable and fault-tolerant. For instance, microservices-based architectures—the place the alternate is damaged down into many particular person companies—have gotten more and more fashionable. This strategy permits every service to scale independently with out taking down all the system.

- Primary Backend Setup [approx. $5,000 – $15,000]: Appropriate for smaller exchanges aiming to serve a distinct segment market with reasonable transaction volumes.

- Superior Backend Infrastructure [approx. $20,000 – $50,000+]: This contains high-scale structure designed for very massive consumer bases, real-time processing, load balancing, database replication, and superior caching mechanisms.

3. The Buying and selling Engine

On the coronary heart of any cryptocurrency alternate is its buying and selling engine. That is the part that matches purchase and promote orders, processes transactions, and maintains consumer balances. It should be correct and constantly dependable, provided that even a small glitch may result in disgruntled merchants or, worse, monetary discrepancies.

- Core Buying and selling Engine Elements: Matching algorithms, order books, transaction histories, price calculations, and real-time updates.

- Extra Options: Margin buying and selling, automated (algorithmic) buying and selling, superior charting, futures contracts, and extra.

Buying and selling engines can vary from comparatively simple to extremely complicated. A smaller alternate may solely function with a single buying and selling pair and easy restrict orders. In the meantime, a bigger alternate may embody a number of buying and selling pairs, margin capabilities, and presumably even leveraged tokens. Every characteristic you add will improve the alternate app growth bills.

4. Liquidity Integration

Liquidity refers to how simply you should buy or promote an asset with out drastically affecting its value. An alternate with little or no liquidity is about as interesting as a celebration with no snacks. Customers could log in, however as soon as they see that nobody’s buying and selling, they’ll shortly depart.

Liquidity could be improved in a number of methods:

- Connecting to Exterior Liquidity Suppliers: This usually entails forging partnerships with different exchanges or brokers to pool order books.

- Market Making Providers: Some companies outsource to skilled market makers.

Both route provides prices. You may pay integration charges, month-to-month service charges, or a portion of transactional income. However sturdy liquidity fosters belief and vigorous buying and selling exercise, so it’s a necessary component in the price to develop a crypto alternate.

5. KYC/AML Modules

Consumer verification is extra than simply an optionally available layer. With international regulators casting a watchful eye on the crypto area, KYC [Know Your Customer] and AML [Anti-Money Laundering] processes have turn into customary. For those who neglect these, you threat authorized repercussions or potential fines.

KYC/AML modules sometimes embrace:

- ID Verification: Automated checks of passports, driver’s licenses, or different nationwide IDs.

- AML Database Checks: Screening customers towards databases of sanctioned or high-risk people.

- Doc Overview: Some platforms additionally require customers to add financial institution statements or utility payments for proof of handle.

You possibly can both construct these modules from scratch or combine with third-party APIs. The inclusion of automated identification verification instruments will elevate your cryptocurrency platform pricing breakdown. Nevertheless, it additionally diminishes handbook checks, saving you time in the long term.

6. Regulatory Compliance

Compliance stands out as a separate class from KYC/AML as a result of it encompasses a broader set of obligations, reminiscent of registering with related monetary authorities, adhering to information safety requirements, and sustaining ample capital reserves in some jurisdictions. The price to launch a crypto alternate in a closely regulated market is considerably increased than in an space with lax rules.

Right here’s the place issues can get tough: compliance budgets differ dramatically relying in your goal markets. Are you planning to function globally or simply in a single area? Every nation has its personal necessities and licensing processes, and also you may want an area authorized crew to navigate them. Implementation delays, authorities charges, and annual audits [among other considerations] may all issue into your total construct crypto alternate price range.

7. Safety and Testing

Blockchain-based property current thrilling new alternatives, however additionally they invite hackers seeking to exploit vulnerabilities. Even established exchanges have been focused. In some instances, stolen funds totaled hundreds of thousands. That’s why you’ll want superior safety measures—even in the event you’re engaged on a smaller-scale challenge.

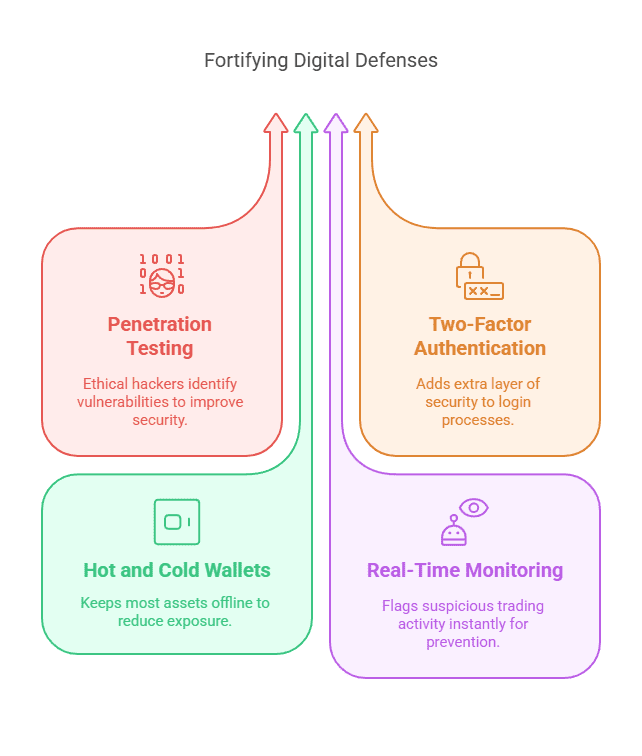

Frequent safety investments embrace:

- Penetration Testing: Hiring moral hackers to identify weaknesses.

- Two-Issue Authentication: Strengthening login protocols with a further verification technique.

- Scorching and Chilly Pockets Structure: Minimizing publicity of consumer funds by holding most property offline.

- Actual-Time Monitoring: Utilizing instruments that instantly flag suspicious buying and selling exercise.

Sure, these measures add to your crypto buying and selling app value estimate, however they’re not frivolous. A single breach can evaporate belief virtually immediately. Do you actually need your alternate to be identified for failing consumer safety? In all probability not.

Estimated Price Breakdown Desk

To supply a clearer cryptocurrency platform pricing breakdown, right here’s a fast snapshot of the everyday ranges you may encounter. Precise numbers could differ based mostly in your area or the actual builders you rent, however this desk offers you a tough thought.

| Part | Estimated Price Vary (USD) |

|---|---|

| Design (Primary to Superior) | $3,000 – $20,000 |

| Backend Infrastructure | $5,000 – $50,000+ |

| Buying and selling Engine | $10,000 – $100,000+ |

| Liquidity Integration | $5,000 – $30,000+ |

| KYC/AML Modules (third Social gathering/Customized) | $2,000 – $15,000+ |

| Regulatory Compliance | $5,000 – $200,000+ |

| Safety and Testing | $3,000 – $50,000+ |

Take note, these numbers aren’t chiseled in stone. They’re meant to provide you a ballpark of how your alternate app growth bills may add up. Once you’re calculating your personal value to develop a crypto alternate, contemplate beginning with one or two core markets and minimal options, then scaling up when you’ve validated consumer curiosity.

Extra Concerns that Affect Closing Prices

1. Third-Social gathering Integration

Need superior charting instruments or an in-app analytics dashboard? There’s a superb likelihood you’ll undertake third-party integration. Fee gateway setups, on-chain useful resource integrations, or superior order optimization instruments [often used by institutional traders] can elevate your value to launch a crypto alternate. And every integration sometimes has its personal upkeep or licensing charges. For those who take away these fancy extras, you’ll cut back your price range, but additionally threat limiting the attraction of your platform.

2. Market Analysis and Preliminary Testing

Early-phase analysis, which incorporates competitor evaluation and consumer demand analysis, can prevent a bundle in the long run. Having a agency understanding of your goal demographic’s ache factors will show you how to fine-tune your providing. Truly, I’d refine that assertion: it’ll show you how to design options your customers really crave, avoiding guesswork in growth.

3. Ongoing Upkeep and Buyer Help

Launching is just one facet of the coin. Sustaining your platform day in and day trip can carry ongoing prices. Software program updates, bug fixes, buyer tickets, and safety patching all require a devoted crew (or at the very least some part-time help). It’s straightforward to miss these bills in the event you’re focusing solely on the preliminary value to develop a crypto alternate, however ignoring them can result in chaos later down the road.

4. Advertising and Branding

You possibly can have the best-designed, most safe alternate on the planet, but when no one is aware of it exists, then visitors will likely be fleeting. Some new alternate operators dedicate a portion of their construct crypto alternate price range to advertising and marketing efforts, influencer partnerships, or referral packages. The quantity you determine to put money into promotional actions will hinge in your go-to-market technique. In my expertise, a strong launch marketing campaign anchored by an genuine model message could be integral in standing out from the competitors.

Challenges in Implementation

It’s tempting to assume you possibly can simply rent a number of builders, spin up some servers, and be achieved. However that’s hardly ever the fact. Companies usually wrestle with altering regulatory landscapes, the complexities of connecting a number of crypto property, scaling the system to accommodate heavy hundreds, and guaranteeing 24/7 dependable help. Let’s not neglect the potential problem of constructing model credibility in a fast-paced market that’s all the time in search of the most well liked new alternate.

One much less apparent consideration is how swiftly the crypto market evolves. An alternate that appeared cutting-edge one yr may seem outdated simply 12 months later if new options or buying and selling experiences turn into customary throughout the business. For those who plan your technique just for as we speak’s situations, you might need to shell out extra alternate app growth bills tomorrow to remain aggressive.

Frequent Misconceptions

You may surprise, “Can I simply purchase a low-cost white-label answer and name it a day?” The reply is you can buy pre-built options that cut back growth time. These could be glorious beginning factors in case your price range is tight. Nevertheless, you’ll nonetheless face licensing charges, customization prices, and potential safety constraints. In case your objective is a high-profile alternate with distinctive branding, superior options, or specialised consumer flows, a fast white-label deployment may not suffice.

One other false impression is that when you deal with the compliance for a single area, you’re golden worldwide. The truth is that native regulatory our bodies could have drastically completely different necessities. In case your ambition is to function in a number of nations, you’ll must be ready for mounting compliance bills, authorized consultations, and presumably reconfiguring your KYC checks for every new territory.

Planning to Construct a Safe Crypto Change?

Perceive your growth prices, must-have options, and timelines.

Sensible Ideas for Constructing Your Change on a Price range

- Begin with an MVP: Launch with important buying and selling options, then improve your platform over time.

- Discover the Proper Improvement Associate: Respected corporations may cost extra, however they will usually prevent cash in the long term by delivering a steady, safe product.

- Scope Documentation: Clearly define the options you want, particularly within the early phases, to keep away from rework.

- Use Respected Elements: Implement examined modules for KYC and liquidity relatively than creating all the pieces from scratch.

- Leverage Group Suggestions: Interact small teams of beta testers to spotlight usability points and potential safety blind spots.

As an apart, contemplate that every tip should be frequently revisited. You may uncover that your MVP is well-received, which prompts you to increase your advertising and marketing. Otherwise you may discover that your preliminary liquidity technique is weaker than anticipated, so that you pivot to combine an aggregator that improves your order books.

Constructing on Earlier Factors with New Insights

One facet we touched on earlier is the buying and selling engine. Let’s construct on that by highlighting the significance of complete testing. It’s not sufficient to check your primary buy-sell performance. That you must see in case your engine performs constantly when the market is unstable and orders flood in at breakneck velocity. In case your system can’t deal with that stress, you threat meltdown throughout essential buying and selling moments. This meltdown can result in dissatisfied clients, or worse, a tarnished status. And that’s not precisely a price you possibly can simply put a quantity on—although it definitely influences the broader cryptocurrency platform pricing breakdown by way of reputational harm management.

Conclusion: Charting a Course for 2025

The price to develop a crypto alternate varies broadly based mostly on the options you combine, the markets you goal, and the safety requirements you undertake. In 2025, it’s not unrealistic to see simple exchanges developed with $25,000, whereas large-scale operations may cross nicely over the $1 million mark when you think about regulatory approvals and sturdy liquidity. Finally, your personal crypto alternate growth value will rely on the way you prioritize design, performance, compliance, consumer help, and advertising and marketing.

Now, you may be considering, “So, ought to I do it?” For those who’re ready to navigate the complexities of alternate app growth bills, together with regulatory compliance, superior safety measures, and protracted platform upgrades, the reply is a sure. Many companies pivot into crypto as a result of they see potential on this rising monetary frontier. On the similar time, prudence is essential. Thorough analysis and a deliberate construct crypto alternate price range can mitigate extreme monetary dangers.

For those who’d like extra background or need to hash out potential approaches, don’t hesitate to attach. There’s no substitute for a direct dialog with a crew that has been via the method earlier than. Every part—out of your buying and selling engine to your liquidity partnerships—will form what you finally pay. By breaking down your objectives, analyzing your target market, and planning every step, you possibly can confidently deal with the price to launch a crypto alternate with out overextending your assets.

And who is aware of? Perhaps you’ll be the following title in crypto that customers flock to once they’re able to commerce. In any case, understanding the core elements and the way they roll up into the ultimate crypto buying and selling app value estimate is your first main step towards success.

Concerning the Writer

I’m the Head of Crypto Options at Blocktech Brew, and I’ve spent the final a number of years serving to companies worldwide embrace blockchain know-how, develop sturdy crypto exchanges, and streamline digital asset operations. Our crew has guided enterprises of all sizes via regulatory mazes, pockets integrations, and a lot extra. We’re right here that will help you at each stage of your crypto journey. For those who’re intrigued by the chances, let’s discuss. Your enterprise may be the following massive leap in shaping the crypto future.

About Blocktech Brew

Blocktech Brew is a world chief in blockchain-based growth and consultancy. We provide full-stack options—from conceptualization and growth to deployment and ongoing help. Our consultants keep on the slicing fringe of innovation, guaranteeing your challenge advantages from the most recent developments and insights within the crypto world. Attain out in the event you’d wish to collaborate or just study extra. We stay up for being a part of your success story!