Digital care is steadily increasing as a mainstream healthcare channel, with Hims & Hers Well being, Inc. HIMS and Teladoc Well being, Inc. TDOC leveraging digital-first fashions to scale entry. HIMS is a consumer-first, subscription-based telehealth platform that lets customers uncover remedies on-line, seek the advice of licensed suppliers and obtain recurring prescription and wellness merchandise via its built-in digital pharmacy mannequin. TDOC is a world digital care chief that delivers providers via its Built-in Care section — providing digital medical visits, continual care applications and enabling expertise for employers, well being plans and suppliers — and BetterHelp, its direct-to-consumer on-line remedy platform.

Whereas Hims & Hers prioritizes a personalised, subscription-led expertise constructed round recurring engagement and comfort, Teladoc Well being scales digital care via enterprise relationships alongside its shopper remedy providing. With each benefiting from the continued shift towards digital well being and consumer-centric healthcare spending, the query stays: which inventory presents the extra engaging alternative proper now? Let’s take a better look.

Inventory Efficiency & Valuation: HIMS vs. TDOC

HIMS (down 37.4%) has underperformed TDOC (down 9.7%) over the previous three months. Prior to now 12 months, Hims & Hers has rallied 22.1% towards Teladoc Well being’s lack of 22.5%.

Picture Supply: Zacks Funding Analysis

In the meantime, HIMS is buying and selling at a ahead 12-month price-to-sales (P/S) ratio of two.9X, above its median of two.6X over the previous three years. TDOC’s ahead gross sales a number of sits at 0.5X, under its final three-year median of 0.7X. Whereas TDOC seems low-cost in comparison with the Medical sector common of two.2X, HIMS appears to be costly. At present, Hims & Hers and Teladoc Well being shares have a Worth Rating of C and B, respectively.

Picture Supply: Zacks Funding Analysis

Elements Driving Hims & Hers Inventory

Hims & Hers’ inventory momentum is being supported by the corporate’s regular push into higher-demand specialties that develop its addressable market past its earlier core classes. The platform has just lately broadened its scope in males’s well being with the launch of low testosterone care, combining at-home lab testing with customized therapy plans. Importantly, HIMS can be collaborating with Marius Prescribed drugs to convey an unique branded oral testosterone (KYZATREX) to its platform, which is anticipated to launch in 2026 — strengthening differentiation and deepening long-term engagement.

One other key driver is the corporate’s shift towards a extra data-driven, proactive healthcare mannequin. With the introduction of Hims & Hers Labs, the corporate is extending its care pathway into diagnostics, giving clients entry to in-depth testing, biomarker monitoring and clinically guided plans that may inform therapy selections and follow-up care. This method helps extra customized care over time and might strengthen retention as customers more and more depend on the platform for broader well being administration.

Hims & Hers is accelerating worldwide growth, supported by acquisitions and focused product rollouts. The corporate formally entered Canada following the acquisition of Livewell, whereas additionally scaling its worldwide footprint via the launch of its complete Weight Loss Programme within the U.Ok., alongside the official introduction of the Hers platform there. This international growth technique continues to widen HIMS’ attain and helps its longer-term progress narrative.

Elements Driving Teladoc Well being Inventory

Teladoc Well being’s inventory narrative is being formed by its positioning as an built-in, enterprise-scale digital care platform with broad medical depth. The corporate is concentrated on constructing an built-in suite that spans major care, continual situation administration and psychological well being, supported by expertise and data-driven insights. This mannequin is designed to strengthen long-term engagement with members and deepen worth for employers, well being plans, hospitals and well being techniques by providing a broader continuum of care somewhat than standalone digital visits.

One other driver is Teladoc Well being’s continued growth of hospital and well being system capabilities, the place it’s including new use instances tied to operational help and care-team workflows. The corporate just lately enhanced its Readability monitoring resolution by introducing a office security functionality that may detect escalating incidents and alert employees to help earlier intervention. With implementation anticipated in choose techniques in early 2026, this strengthens TDOC’s footprint in acute-care environments past conventional telehealth providers.

Teladoc Well being can be gaining consideration for its efforts to stabilize efficiency whereas sharpening execution throughout its two segments. In third-quarter 2025, the corporate delivered leads to the higher half of its steerage vary, reflecting regular execution in Built-in Care and continued priorities comparable to advancing progress initiatives in Built-in Care and increasing insurance coverage acceptance inside BetterHelp. This regular progress reinforces confidence that Teladoc Well being can enhance consistency because it executes towards its strategic roadmap.

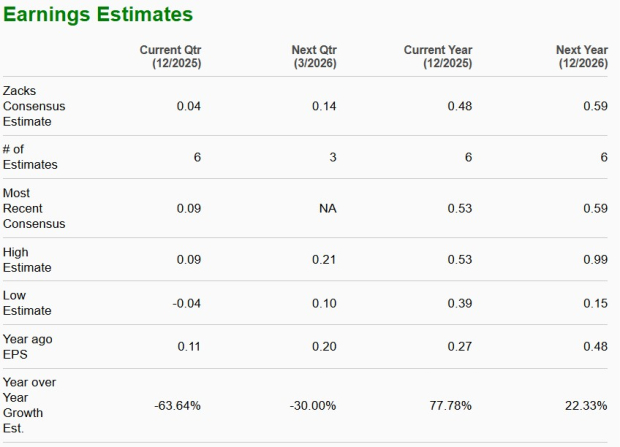

Evaluating EPS Projections: HIMS vs. TDOC

The Zacks Consensus Estimate for HIMS’ 2025 earnings per share (EPS) suggests a 77.8% enchancment from 2024.

Picture Supply: Zacks Funding Analysis

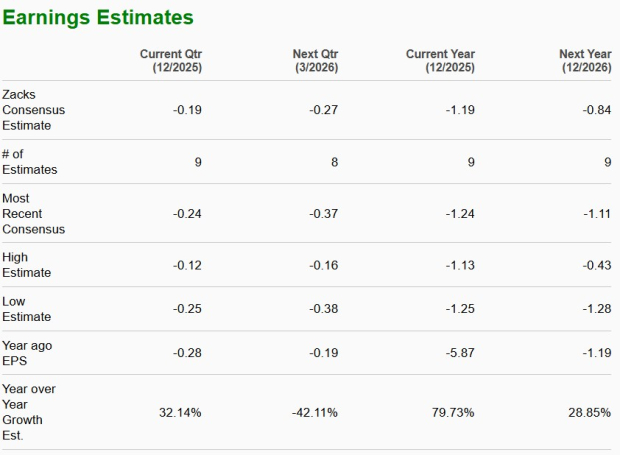

The Zacks Consensus Estimate for TDOC’s 2025 loss per share implies an enchancment of 79.7% from 2024.

Picture Supply: Zacks Funding Analysis

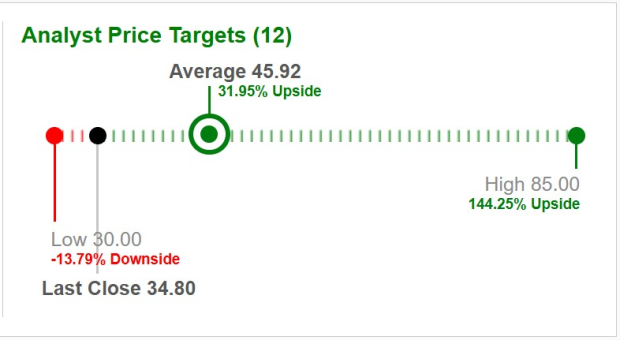

Worth Goal: Hims & Hers vs. Teladoc Well being

Primarily based on short-term value targets supplied by 12 analysts, the typical value goal for Hims & Hers is $45.92, implying a rise of 31.9% from the final shut.

Picture Supply: Zacks Funding Analysis

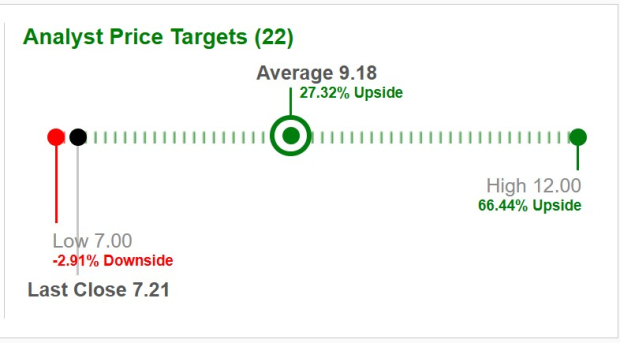

Primarily based on short-term value targets supplied by 22 analysts, the typical value goal for Teladoc Well being is $9.18, implying a rise of 27.3% from the final shut.

Picture Supply: Zacks Funding Analysis

Select HIMS Over TDOC Now

Whereas each Hims & Hers and Teladoc Well being are benefiting from the continued shift towards digital care, HIMS, a Zacks Rank #3 (Maintain) agency, presents a extra steady and financially sound funding alternative at this stage. With increasing specialty choices, a stronger push into diagnostics and accelerating worldwide growth, HIMS is constructing a broader digital well being ecosystem that helps recurring engagement and long-term scalability. You’ll be able to see the whole record of in the present day’s Zacks #1 Rank (Robust Purchase) shares right here.

Teladoc Well being, additionally a Zacks Rank #3 inventory, stays a number one enterprise-focused digital care supplier, supported by its Built-in Care platform and BetterHelp remedy enterprise. Its increasing hospital and well being system capabilities and efforts to sharpen execution throughout its two segments strengthen its longer-term stability narrative, although the corporate stays extra uncovered to enterprise demand cycles and segment-level volatility. For buyers prioritizing subscription-led shopper healthcare progress with increasing classes and worldwide runway, Hims & Hers stands out because the extra compelling choose at this stage.

Zacks Naming High 10 Shares for 2026

Wish to be tipped off early to our 10 prime picks for the whole lot of 2026? Historical past suggests their efficiency could possibly be sensational.

From 2012 (when our Director of Analysis Sheraz Mian assumed accountability for the portfolio) via November, 2025, the Zacks High 10 Shares gained +2,530.8%, greater than QUADRUPLING the S&P 500’s +570.3%.

Now Sheraz is combing via 4,400 corporations to handpick the most effective 10 tickers to purchase and maintain in 2026. Don’t miss your likelihood to get in on these shares once they’re launched on January 5.

Be First to New High 10 Shares >>

Teladoc Well being, Inc. (TDOC) : Free Inventory Evaluation Report

Hims & Hers Well being, Inc. (HIMS) : Free Inventory Evaluation Report

This text initially revealed on Zacks Funding Analysis (zacks.com).

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.