- The GBP/USD weekly forecast stays below stress amid dismal UK financial knowledge.

- The US greenback stays agency amid receding Fed price reduce expectations.

- All eyes on the UK Autumn funds and US inflation knowledge that might form the market expectations.

The GBP/USD weekly forecast reveals sustained stress because the gentle UK knowledge, like a 1.1% MoM drop in UK retail gross sales in October, whereas annual progress got here at 0.2%, each nicely under expectations.

-Are you in search of the most effective AI Buying and selling Brokers? Test our detailed guide-

In the meantime, sterling got here below stress amid rising odds of the Financial institution of England’s tilt in the direction of a looser coverage within the close to time period on account of weaker home demand and protracted fiscal considerations forward of the Autumn funds. The UK PMI knowledge remained combined, failing to generate any shopping for traction. Alternatively, the US Federal Reserve signaled warning as inflation stays a danger, shrinking December price reduce expectations. The web impact is GBP/USD staying inside a slim vary close to 1.3100 after discovering a backside round 1.3050.

Throughout the Atlantic, the US greenback stays agency after hawkish FOMC assembly minutes that dampened expectations for price cuts, as revealed by the CME FedWatch instrument, to round 35%. The US NFP knowledge exceeded expectations, reflecting 119k jobs added towards the anticipated 55k. The October knowledge will not be more likely to be launched, though a few of it will likely be mirrored within the November knowledge, which can be key to observe. In the meantime, US PMI readings confirmed a gentle enchancment, with no vital affect on the US greenback.

GBP/USD Key Occasions Subsequent Week

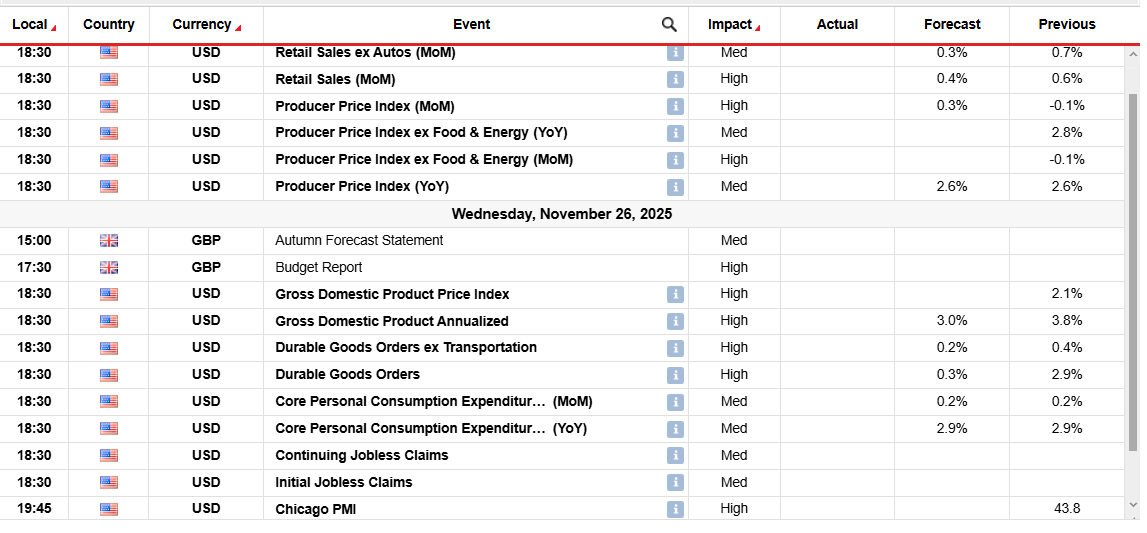

Shifting forward to the following week, the outlook stays tilted to the draw back until sterling receives a constructive increase. On the UK facet, the market contributors can be awaiting indicators of stabilization in shopper spending after poor retail gross sales. Nonetheless, the first focus stays on the UK funds. Within the US, the main focus lies on the labor and inflation knowledge, together with additional remarks from Fed officers. The numerous occasions scheduled for subsequent week embrace Core PCE, PPI, Retail Gross sales, and the GDP Value Index.

GBP/USD Weekly Technical Forecast: Bears paused by 1.3050

The GBP/USD every day chart reveals a weak construction close to the damaged demand zone. A powerful bearish candle, adopted by a bearish pinbar, reveals the chances of extra draw back. Nonetheless, 1.3050 acts as an intermediate help forward of 1.3000. As UOB states, the pound is unlikely to discover a sustained breakout under 1.3000. However a breakout may appeal to extra sellers and take a look at the 1.2900 degree.

-Are you in search of the most effective MT5 Brokers? Test our detailed guide-

Alternatively, any acceptance above the 1.3100 space may collect shopping for momentum and goal to check the 1.3200 degree. Whereas the RSI has begun rising from the oversold area, it stays under 50.0, indicating impartial momentum.

Seeking to commerce foreign exchange now? Make investments at eToro!

75% of retail investor accounts lose cash when buying and selling CFDs with this supplier. It is best to take into account whether or not you possibly can afford to take the excessive danger of shedding your cash.