GBP/USD resumes its uptrend on Friday, trimming a few of Thursday’s losses because the US Greenback (USD) recovers some floor. Inflation information within the US saved regular the possibilities of a Federal Reserve (Fed) lower on the December assembly, weighing on the Buck. On the time of writing, the pair trades at 1.3349, up 0.19%.

GBP/USD rallies as US Core PCE reaffirms Fed price lower in December

The Core Private Consumption Expenditures (PCE) Value Index, the Fed’s favourite inflation gauge, which excludes meals and vitality, rose by 0.2% MoM in September, unchanged from August and aligned with estimates. Within the twelve months to September, it ticked decrease from 2.9% to 2.8%.

On the identical time, the College of Michigan Client Sentiment in December rose to 53.3, above estimates of 52 and up from November’s last studying of 51. Joanne Hsu, the Director of the Surveys of Client, famous that “customers see modest enhancements from November on just a few dimensions, however the general tenor of views is broadly somber.”

Individuals’ one-year inflation expectations in December dipped from 4.5% to 4.1%. For a five-year interval, it decreased from 3.4% in November to three.2%.

Given the backdrop, expectations for a 25 foundation factors (bps) Fed price lower subsequent week remained unchanged at 84%, as revealed by Capital Edge Charge Expectations Overview information.

After the information launch, GBP/USD bounced in direction of 1.3350 after meandering round 1.3340 because the US Greenback tumbled to expectations of additional easing.

In a be aware, Morgan Stanley stated it expects a 25-bps lower in December, in January, and in April of 2026. They anticipate the Fed funds price to finish at 3%-3.25%.

The British Pound (GBP) shrugged off worries about final month’s finances, whereas enterprise exercise confirmed some enchancment, in line with S&P International.

Regardless of this, the Financial institution of England is projected to scale back charges by 25 bps to three.75% within the December 18 assembly after pausing its easing cycle in November.

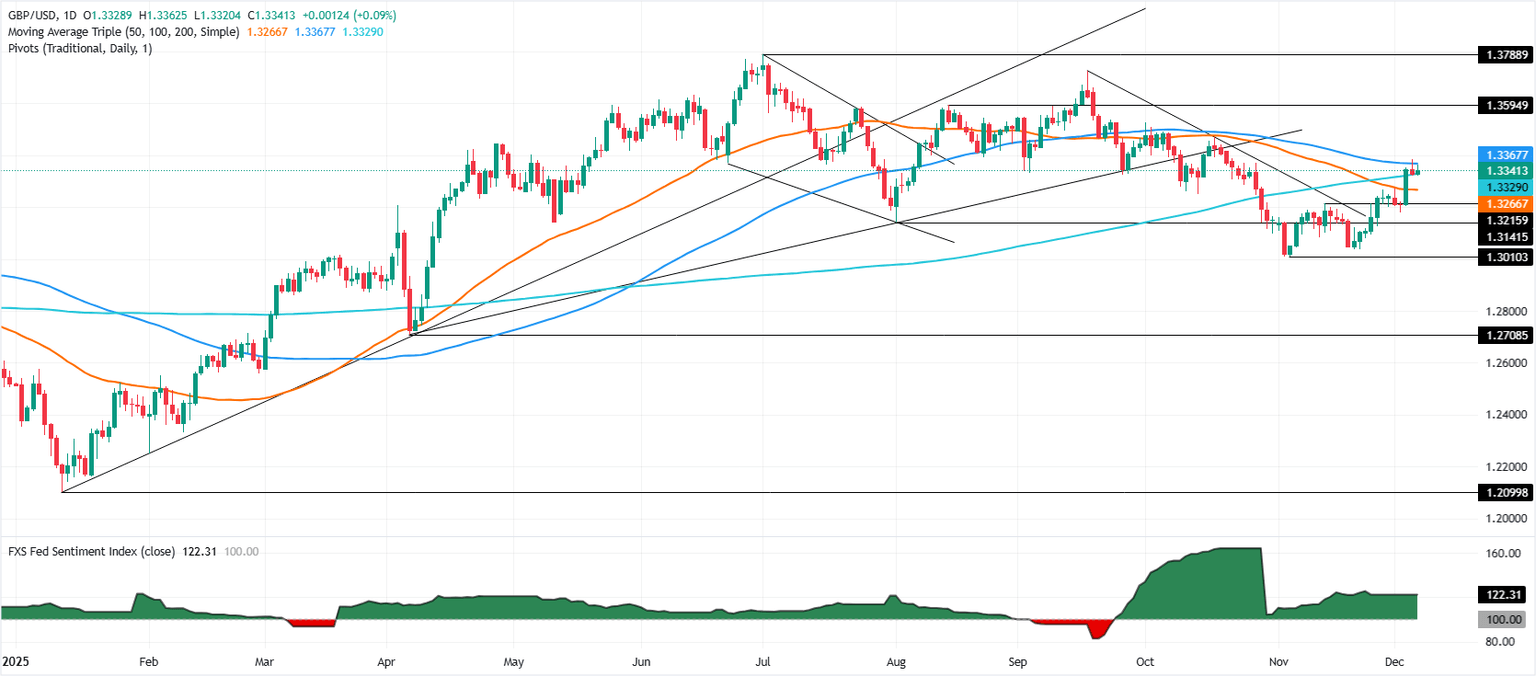

GBP/USD Value Forecast: Technical outlook

GBP/USD appears capped by the 100-day Easy Shifting Common (SMA) at 1.3365, regardless that the pair crossed above the 200-day SMA at 1.3326. Due to this fact, additional consolidation lies forward, and with the Fed’s subsequent assembly looming, a breach of the 100-day SMA is probably going.

In that end result, the subsequent key resistance is 1.3400. As soon as surpassed, the subsequent cease could be the October 17 excessive at 1.3471 forward of 1.3500. On the flip aspect, GBP/USD’s drop under 1.3300 exposes the 50-day SMA at 1.3264, adopted by 1.3200.

Pound Sterling Value This week

The desk under reveals the share change of British Pound (GBP) towards listed main currencies this week. British Pound was the strongest towards the Swiss Franc.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.42% | -0.77% | -0.54% | -0.89% | -1.39% | -0.79% | 0.12% | |

| EUR | 0.42% | -0.35% | -0.11% | -0.47% | -0.98% | -0.37% | 0.54% | |

| GBP | 0.77% | 0.35% | 0.50% | -0.12% | -0.63% | -0.03% | 0.90% | |

| JPY | 0.54% | 0.11% | -0.50% | -0.35% | -0.87% | -0.26% | 0.65% | |

| CAD | 0.89% | 0.47% | 0.12% | 0.35% | -0.56% | 0.10% | 1.01% | |

| AUD | 1.39% | 0.98% | 0.63% | 0.87% | 0.56% | 0.61% | 1.53% | |

| NZD | 0.79% | 0.37% | 0.03% | 0.26% | -0.10% | -0.61% | 0.92% | |

| CHF | -0.12% | -0.54% | -0.90% | -0.65% | -1.01% | -1.53% | -0.92% |

The warmth map reveals proportion adjustments of main currencies towards one another. The bottom foreign money is picked from the left column, whereas the quote foreign money is picked from the highest row. For instance, should you decide the British Pound from the left column and transfer alongside the horizontal line to the US Greenback, the share change displayed within the field will signify GBP (base)/USD (quote).