Be part of Our Telegram channel to remain updated on breaking information protection

Florida Home Republican Webster Barnaby has refiled a crypto reserve invoice after a earlier effort failed, increasing it from permitting investments in Bitcoin alone to crypto ETFs, NFTs, and different blockchain-based property.

The laws, Florida Home Invoice 183, would enable as much as 10% of sure public funds, together with pension property, to be allotted to digital property. It additionally introduces new custody, documentation, and fiduciary requirements for holding and lending these property.

By increasing the scope to a number of cryptocurrencies and ETFs, the revision provides the state extra funding flexibility whereas assembly regulatory and oversight necessities.

🇺🇸 NEW: Florida recordsdata first Strategic Bitcoin Reserve invoice of the 2026 legislative session.

Home Invoice 183 would enable the state to speculate 10% of public funds in digital property, and permits retirement fund funding. pic.twitter.com/sI4bUBiiB3

— Bitcoin Legal guidelines (@Bitcoin_Laws) October 16, 2025

The invoice would additionally enable Florida residents to pay sure taxes and charges in digital property whether it is authorised. These funds would then be transformed into {dollars} and transferred to the state’s basic fund.

The revised invoice appears to be like to take impact on July 1 subsequent yr. It additionally goals to authorize the State Board of Administration to speculate pension and different funds into crypto.

Solely Three State Crypto Payments Enacted Into Regulation

Barnaby’s invoice is the most recent in a sequence of crypto reserve payments that have been launched in state legislatures throughout the 2025 legislative season.

However most of the proposed payments have been rejected. Solely three of them, particularly ones from Arizona, Texas, and New Hampshire, have been enacted into legislation.

Arizona’s HB 2749 solely permits for the creation of a crypto reserve utilizing unclaimed property, whereas the Texas Senate Invoice 21 particularly establishes a Bitcoin-only reserve.

In the meantime, New Hampshire’s HB 302 provides the treasurer the flexibility to speculate as much as 5% of public funds in digital property. Nonetheless, these property should have a market cap of greater than $500 billion to be included.

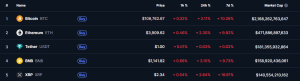

High 5 cryptos by market cap (Supply: CoinMarketCap)

Trying on the high 5 largest cryptos by market cap, Bitcoin is the one digital asset that meets HB 302’s capitalization requirement. Altcoin chief Ethereum (ETH) may additionally meet the requirement quickly if there’s a sturdy sufficient value enhance, with its capitalization of over $471.98 billion, in line with CoinMarketCap information.

Florida Seeks To Ease Regulation Round Stablecoin Issuers

Along with the revised crypto reserve invoice, Barnaby can be trying to ease the regulatory necessities for stablecoin issuers in Florida with the submitting of HB 175.

That invoice goals to make clear that acknowledged cost stablecoin issuers shouldn’t be required to acquire separate licenses or registrations. Below this invoice, stablecoin issuers should be absolutely collateralized with both US {dollars} or treasuries. These companies should conduct public audits of their reserves no less than as soon as a month as properly.

Just like HB 183, the Florida lawmaker needs the stablecoin invoice to take impact on July 1 subsequent yr.

Stablecoin companies that need to problem their tokens within the US already must observe the Guiding and Establishing Nationwide Innovation for US Stablecoins (GENIUS) Act. It was signed into legislation by US President Donald Trump on July 18, 2025, after passing each the Senate and the Home with bipartisan help. This act can be the primary US federal statute to manage “cost stablecoins.”

One of many GENIUS Act’s predominant objectives is to scale back regulatory ambiguity within the stablecoin market. Just like HB 175, the act requires that cost stablecoins by absolutely backed by liquid property. The composition of those backing reserves must be clear as properly.

Issuers additionally want to supply periodic disclosures, audit experiences, and reserve composition in order that customers and regulators can monitor the property’ backing.

The regulatory readability has boosted the stablecoin market, which lately noticed its capitalization soar to a brand new all-time excessive of $314 billion. A lot of the expansion was seen by Tether’s (USDT) and Circle’s USD Coin (USDC), that are at present the 2 greatest stablecoins out there with respective capitalizations of $181.37 billion and $75.96 billion.

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be part of Our Telegram channel to remain updated on breaking information protection