Traders would possibly need to begin shopping for the perfect AI shares after Taiwan Semiconductor posted blockbuster, synthetic intelligence-boosted fourth-quarter outcomes on Thursday.

The semiconductor foundry large that manufactures Nvidia’s AI chips provided spectacular steering, confirming that the AI arms race stays full steam forward in 2026.

Take a look at the Zacks Earnings Calendar to remain forward of market-making information.

Taiwan Semi TSM and different semiconductor and AI shares soared on Thursday as Wall Avenue races into best-in-class AI shares earlier than the AI hyperscalers equivalent to Amazon and Alphabet begin reporting.

Let’s dive proper into just a few of the perfect AI shares (Vertiv and AMD) that traders ought to take into account shopping for proper now after Taiwan Semi raised its outlook on bullish AI development in 2026.

Why Traders Should Purchase AI and Tech Shares in 2026

Decrease rates of interest and powerful earnings development are the lifeblood of inventory market bull runs.

December’s CPI information reveals that inflation stays in verify, additional cementing Wall Avenue bets that the Fed will decrease charges once more in 2026.

On prime of that, complete S&P 500 earnings are anticipated to develop 12.8% in 2026, boosted by 20% Tech sector growth, with 14.8% earnings development projected in 2027. These outlooks would prime 2025’s 12.1% projected bottom-line growth, highlighting the huge AI-boosted run.

Picture Supply: Zacks Funding Analysis

Wall Avenue is more and more upbeat about forecasted earnings growth throughout the complete economic system. All 16 Zacks sectors are projected to publish constructive earnings development for the primary time since 2018.

The chart under highlights how a lot the Tech sector’s 2026 earnings outlook has improved from early July till now, as demonstrated by the Magazine 7.

Picture Supply: Zacks Funding Analysis

These earnings estimates are seemingly to enhance since they don’t issue within the broadly bullish steering Taiwan Semi offered for the complete AI and tech economic system.

TSMC, which makes the cutting-edge chips for Nvidia, Apple, and others, raised its 2026 capex steering to $52 billion to $56 billion, blowing away 2025’s $40.9 billion. TSMC expects its income to climb one other 30% in 2026, with gross sales set to develop at a CAGR of ~25% from 2024 to 2029.

Purchase AI Infrastructure Inventory VRT Earlier than It Soars Once more

Vertiv Holdings Co VRT is a know-how infrastructure and continuity options agency that’s reworked right into a must-buy picks and shovels AI inventory. VRT works straight with Nvidia NVDA to assist resolve essential behind-the-scenes challenges within the AI information middle world, equivalent to cooling.

The tech firm is poised to be a long-term AI winner regardless of how the know-how evolves from the present giant language fashions (LLMs) and which AI corporations ultimately dominate.

Vertiv is an AI darling that has soared over 1,000% prior to now three years. But, its common Zacks worth goal presents 15% upside from its present worth, and it is down 12% from its October highs at the same time as Taiwan Semi and different AI shares skyrocket to contemporary peaks to begin 2026.

Picture Supply: Zacks Funding Analysis

The AI infrastructure firm’s portfolio of {hardware}, software program, analytics, and ongoing companies is constructed round energy, cooling, and IT infrastructure. The Ohio-based agency’s rising portfolio helps make certain the high-density computing energy that drives technological innovation and the economic system is working as easily as doable 24/7.

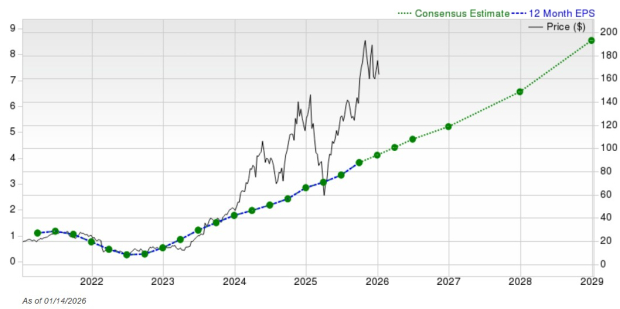

Vertiv is projected to develop its income by 28% in 2025 and 22% in FY26 to $12.43 billion—greater than doubling its gross sales between 2022 and 2026.

The behind-the-scenes AI inventory is anticipated to develop its adjusted EPS by 45% and 29%, respectively, following 60% development in 2024 and 236% growth in 2023—climbing from $0.53 in 2022 to $5.33 in FY26.

Picture Supply: Zacks Funding Analysis

The AI information middle infrastructure firm’s upward earnings revisions earn VRT a Zacks Rank #2 (Purchase). Vertiv discovered help at its January 2025 breakout ranges a number of occasions over the previous few months.

The tech inventory appears able to presumably surge to new highs earlier than or after its This fall earnings launch (due on Feb. 11, in accordance with the Zacks earnings calendar) because it makes an attempt to maneuver meaningfully above its 50-day transferring common.

The pullback, combined with its robust earnings outlook, has VRT buying and selling at a 25% low cost to its highs at 32.5X ahead earnings. Vertiv can be removed from overheated when it comes to RSI ranges, at the same time as many different AI shares look a bit bloated within the quick run.

Purchase AI Chip Inventory and Nvidia Rival AMD Now and Maintain

Superior Micro Gadgets AMD designs high-performance semiconductors. Most significantly for traders, AMD is making an attempt to eat away at its a lot bigger rival Nvidia’s dominance within the AI chip market.

AMD stays far behind AI chip chief Nvidia when it comes to market share. However being second finest within the AI chips race is hardly a nasty place to be, contemplating the long-term upside. AMD boasts that its increasing portfolio of AI-optimized CPUs, GPUs, networking, and software program options assist energy “billions of experiences throughout cloud and AI infrastructure” and past.

Picture Supply: Zacks Funding Analysis

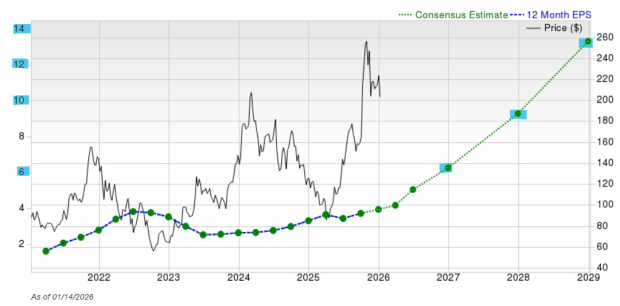

The AI chip firm posted robust Q3 outcomes and offered a bullish long-term outlook in early November. AMD outlined its “long-term plan to develop information middle and AI management with better than 35% income CAGR and better than $20 non-GAAP EPS goal” over the “subsequent three to 5 years.”

AMD grew its income from $6.7 billion in 2019 to $25.8 billion in 2024, benefitting from the growth of knowledge facilities, gaming, PCs, and extra. The GPU large is projected to develop its income by 32% in 2025 and 28% in 2026 to achieve a whopping $43.43 billion.

Its earnings development outlook can be sturdy, with AMD anticipated to spice up its EPS by 20% in FY25 and 58% in 2026 to achieve $6.26 a share vs. $3.31 in 2024. The chart under highlights that AMD’s earnings are projected to climb to effectively over $12 a share over the subsequent a number of years.

Picture Supply: Zacks Funding Analysis

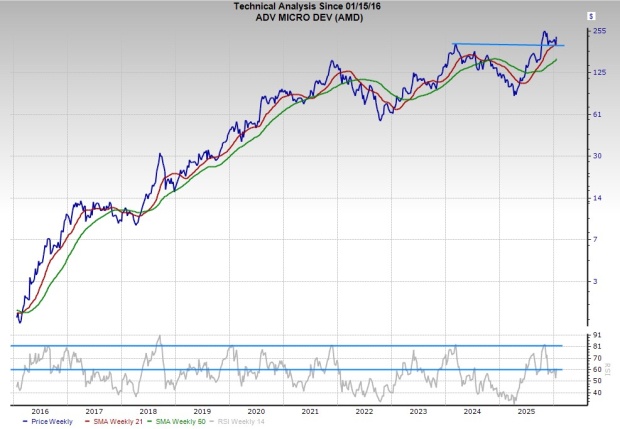

AMD inventory blew away the Tech sector and each Magazine 7 firm outdoors of Nvidia over the previous decade, having soared ~11,400%. The AI chip inventory’s spectacular run features a 97% surge prior to now 12 months, greater than doubling Nvidia. Regardless of the run, its common Zacks worth goal presents 28% upside from its present ranges.

The AI chip firm just lately discovered help close to its long-term 21-week transferring common and its early 2024 highs (which it climbed again above in October). This technical backdrop, coupled with the truth that it trades at a 50% low cost to its five-year highs at 40X 12-month earnings, might imply AMD is able to publish new highs earlier than later. AMD reviews its This fall outcomes on Tuesday, February 3.

Zacks Names #1 Semiconductor Inventory

This under-the-radar firm focuses on semiconductor merchandise that titans like NVIDIA do not construct. It is uniquely positioned to benefit from the subsequent development stage of this market. And it is simply starting to enter the highlight, which is strictly the place you need to be.

With robust earnings development and an increasing buyer base, it is positioned to feed the rampant demand for Synthetic Intelligence, Machine Studying, and Web of Issues. World semiconductor manufacturing is projected to blow up from $452 billion in 2021 to $971 billion by 2028.

See This Inventory Now for Free >>

Superior Micro Gadgets, Inc. (AMD) : Free Inventory Evaluation Report

NVIDIA Company (NVDA) : Free Inventory Evaluation Report

Taiwan Semiconductor Manufacturing Firm Ltd. (TSM) : Free Inventory Evaluation Report

Vertiv Holdings Co. (VRT) : Free Inventory Evaluation Report

This text initially revealed on Zacks Funding Analysis (zacks.com).

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.