Federal Reserve (Fed) Vice President and Board of Governors member Phillip Jefferson acknowledged that ongoing dangers to each side of the Fed’s coverage mandates are seeing rising dangers. The labor market is exhibiting recent weak point, and inflation pressures proceed to mount in underlying datasets, leaving the Fed in a troublesome spot on fee policy-setting.

Key highlights

Lower than splendid to not get jobs report, however look throughout array of knowledge to evaluate the economic system.

Developments throughout a number of knowledge sequence counsel job market softening, may expertise stress if not supported.

Decline in internet immigration a significant factor stopping extra important rise in unemployment.

Either side of the mandate are below stress, with inflation above goal and draw back dangers to employment rising.

Latest minimize moved coverage nearer to impartial whereas sustaining a balanced strategy.

Tariffs are exhibiting via in greater inflation for some items, however anticipate disinflation to renew subsequent 12 months.

Eradicating “common” from the framework was essential. It was laborious to speak what it meant.

Operating inflation above goal to make up for previous misses turned out to be impractical.

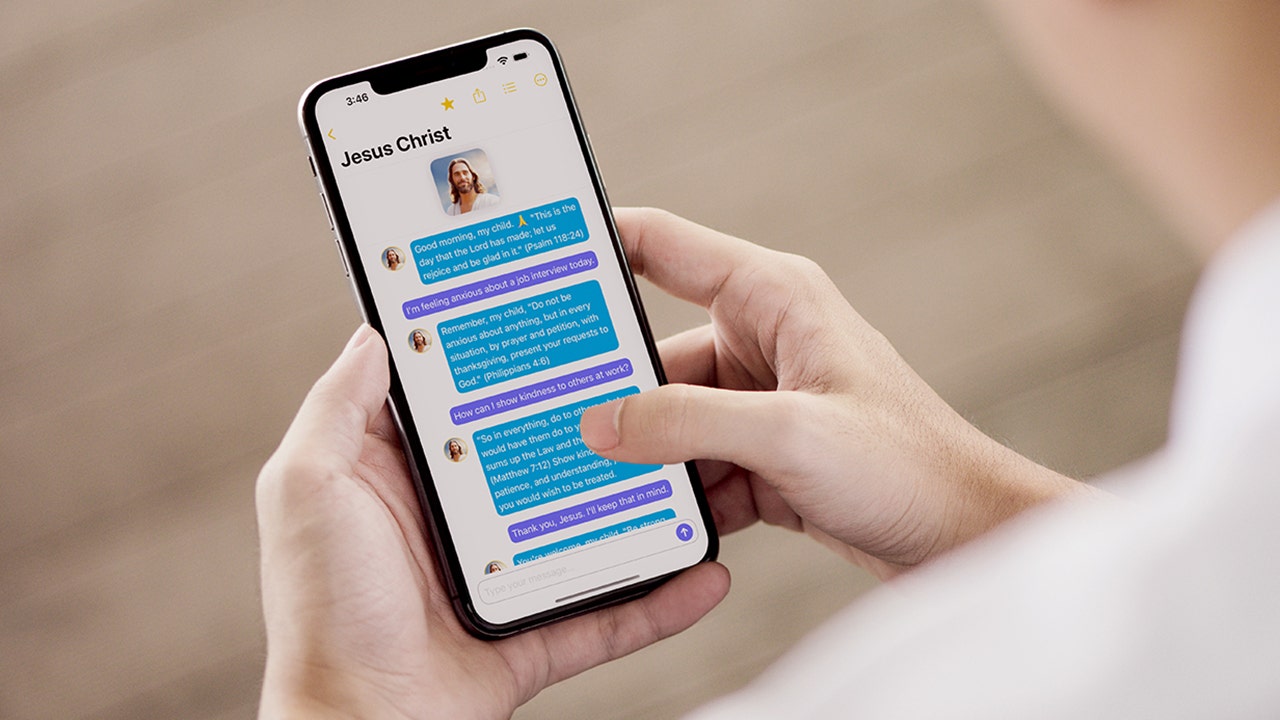

I am making an attempt to know as a lot as doable about AI and doable impression on productiveness.

The Fed has sufficient data to do its job. We might be effectively knowledgeable going into the October assembly.

The response to tariffs has been muted up to now, however doable that the value stage adjustment will take longer than forecast.

Fed’s job is to make sure that the adjustment of tariffs doesn’t translate into persistent inflation.

The Fed will hit its 2% inflation goal.

Lengthy-term inflation expectations are anchored round 2%.