Be part of Our Telegram channel to remain updated on breaking information protection

The Ethereum worth rose a fraction of a % prior to now 24 hours to commerce at $2,926 as of three:50 a.m. EST on a 30% drop in buying and selling quantity to $20 billion.

That surge within the ETH worth comes as treasury agency BitMine, led by Fundstrat co-founder Tom Lee, expanded its holdings on Dec. 16 with one other buy of 48,049 ETH value $140.58 million.

In its newest disclosure launched on Monday, the NYSE–listed agency mentioned it holds a complete of three,967,210 ETH, purchased at a median worth of $3,074. At present market costs, BitMine’s ETH holdings are value about $11.6 billion, making it the world’s largest company holder of the largest altcoin.

以太坊最大的财库公司 Bitmine (BMNR) 在今天继续增持了 ETH:

4 小时前从 FalconX 收到 48,049 枚 ETH ($1.4 亿)。https://t.co/jjNeeSKIR0https://t.co/tuCmEEIS5P———————————————————

本文由 @Bitget 赞助|Bitget VIP,费率更低,福利更狠 https://t.co/vOiXbZllWI pic.twitter.com/r0mY9rFXuY— 余烬 (@EmberCN) December 17, 2025

The corporate has adopted an aggressive shopping for technique all year long, repeatedly saying it believes Ethereum is in a ”supercycle” and can play a rising position in international finance. As a part of its long-term technique, the agency goals to regulate 5% of Ethereum’s whole circulating provide.

Regardless of the continuing market downturn, BitMine just lately stepped up its purchases. The corporate purchased 240,711 ETH within the first two weeks of December alone, underlining its sturdy conviction in Ethereum’s long-term prospects.

Tom Lee says the “greatest days for crypto” are nonetheless forward. He pointed to constructive developments resembling progress on crypto regulation in Washington and growing curiosity from Wall Road establishments.

Ethereum Value Slides As Bears Take Management

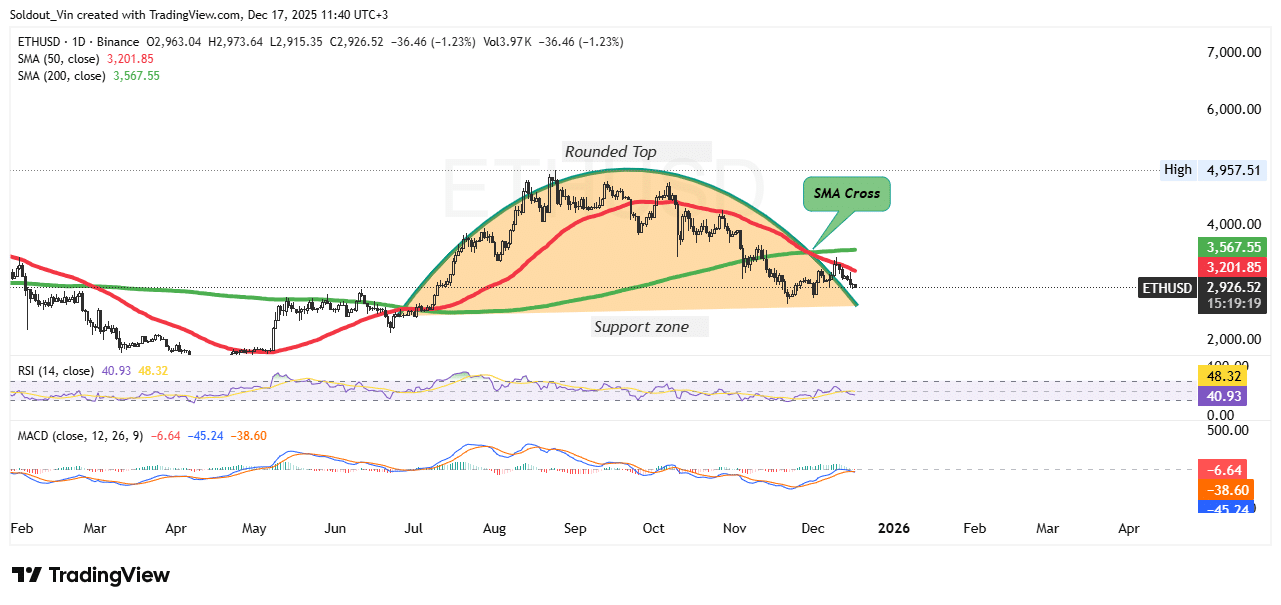

Ethereum is going through sustained bearish stress after failing to remain above key resistance ranges. The token is at present buying and selling round $2,935, which is nicely under each the 50-day easy shifting common (SMA) at $3,202 and the 200-day SMA at $3,568.

The 50-day SMA has crossed under the 200-day SMA, forming a “loss of life cross,” a powerful technical sign that means continued draw back danger for the market. This setup exhibits that sellers stay in management, and the broader development continues to be detrimental.

The worth motion additionally highlights a rounded high sample. This construction shaped after ETH peaked close to $4,950 earlier this yr and progressively misplaced momentum.

Rounded tops usually point out a shift from bullish to bearish management, and the next breakdown confirms that Ethereum has entered a corrective part. This sample provides weight to the bearish outlook on the day by day timeframe.

At present, ETH is testing a key help zone between $2,850 and $2,900. This zone has traditionally acted as a requirement space, making it essential for short-term course. If Ethereum closes under this help, the subsequent draw back targets might be $2,500 and, within the occasion of elevated promoting stress, $2,200.

Alternatively, if consumers defend this stage, a short-term bounce stays doable, although it will doubtless be corrective reasonably than the beginning of a brand new uptrend.

Ethereum Value Targets Key $2,850 Assist Stage For A Reversal

The Relative Energy Index (RSI) is close to 41, which is under the impartial 50 stage, indicating bearish momentum, however it isn’t but in oversold territory. This means there may be room for additional draw back.

In the meantime, the MACD stays detrimental, with the MACD line under the sign line. Whereas the histogram exhibits indicators of flattening, signaling that bearish momentum could also be slowing, there is no such thing as a clear bullish crossover but. This implies any near-term restoration could also be non permanent.

Ethereum stays technically bearish on the day by day chart. Bulls have to reclaim the $3,200 stage and push above the 50-day SMA to scale back draw back dangers.

Till this occurs, the $2,850 help zone would be the key stage to observe, as a break under it might open the door to deeper losses. Brief-term bounces are doable, however general the development favors sellers.

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be part of Our Telegram channel to remain updated on breaking information protection