Be a part of Our Telegram channel to remain updated on breaking information protection

The Ethereum worth jumped 2.4% within the final 24 hours to commerce at $4,186 as of 4:05 a.m. EST on buying and selling quantity that surged 41% to $36.2 billion.

This comes as BitMine chairman Tom Lee says ETH is priced at ‘a reduction to the longer term’ with future adoption of the blockchain by Wall Avenue and AI corporations set to push the token increased.

“We proceed to consider Ethereum is among the largest macro trades over the subsequent 10-15 years,” Lee stated. “Wall Avenue and AI shifting onto the blockchain ought to result in a higher transformation of at present’s monetary system. And the vast majority of that is going down on Ethereum.”

Lee’s phrases come as BitMine introduced on Monday that its holdings stand at 2.65 million Ether value $11.6 billion.

🔥 BitMine now holds 2.65M ETH ($11B) — by far the world’s largest ETH treasury.

Chairman Tom Lee: “ETH is buying and selling at a reduction to the longer term” 🚀 as Wall Avenue + AI adoption speed up.

Bit Digital additionally eyes a $100M increase to stack extra ETH. pic.twitter.com/D7WQ5GFvhT

— Jessica Gonzales (@lil_disruptor) September 30, 2025

ETH treasury corporations are actually sitting on an Ethereum hoard value $15.8 billion, in line with Coingecko information. This represents just below 10% of the overall Ethereum provide.

With the buildup gaining traction, can the value of ETH proceed hovering?

Ethereum Value Restoration Try: Can The Bulls Reclaim Management?

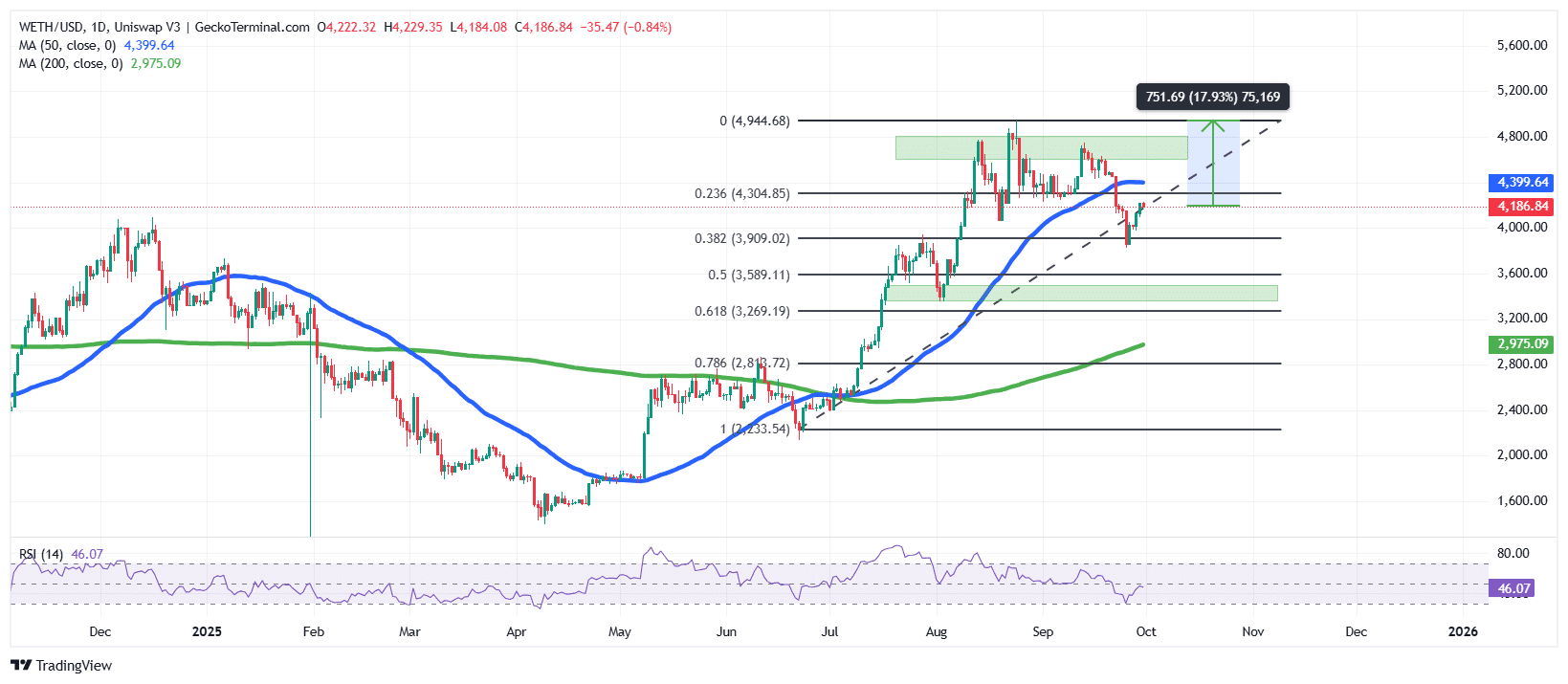

The ETH worth is at present buying and selling round $4,186 after bouncing off current lows. The broader pattern since mid-summer has been bullish, with a robust rally that took ETH above $4,900 earlier than retracing.

This retracement discovered help across the 0.382 Fibonacci stage close to $3,909, from the place patrons stepped in.

ETH is in a short-term upward channel (dashed trendline), suggesting that the current dip could have been a corrective transfer inside a broader bullish construction.

Nonetheless, the value of ETH is buying and selling slightly below the 50-day Easy Transferring Common (SMA) ($4,399), which is performing as rapid resistance. A decisive breakout above this stage may verify a renewed bullish momentum.

In the meantime, the Relative Power Index (RSI) is at 46, a impartial studying that leans barely bearish. This implies that Ethereum is neither overbought nor oversold, leaving room for momentum to shift both method relying on upcoming worth motion.

In accordance with the Fibonacci Retracement ranges, $4,304 (0.236) is rapid resistance, whereas $3,909 (0.382) acts because the closest help.

A breakdown under $3,909 may expose ETH to deeper pullbacks towards $3,589 (0.5 retracement). On the flip facet, a breakout above $4,304 may set the stage for a push towards the $4,900 zone once more.

If Ethereum can break and maintain above the $4,304–$4,400 zone, momentum may favor the bulls, probably sending the value towards the $4,900 area as soon as once more, a transfer that represents a couple of 17% upside from present ranges.

However, failure to clear the 50-day SMA and a drop under $3,909 may set off additional draw back towards the $3,600–$3,270 help vary.

In accordance with analyst Ali Martinez, ETH may nonetheless plunge to $2,400.

Is it loopy to assume Ethereum $ETH may drop to $2,400? pic.twitter.com/nBpoDYwd4g

— Ali (@ali_charts) September 30, 2025

Associated Information:

Finest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be a part of Our Telegram channel to remain updated on breaking information protection