Be part of Our Telegram channel to remain updated on breaking information protection

Tom Lee, the CIO of Fundstrat Capital and the Chairman of Bitmine Immersion Applied sciences, says that Ethereum “stays in an excellent cycle” as stablecoin demand and on-chain exercise proceed to rise.

Previously 24 hours, the most important altcoin by market cap soared greater than 4% to commerce at $4,168.35 as of 5:38 a.m. EST, information from CoinMarketCap reveals. This current achieve was sufficient to flip the crypto’s weekly efficiency into the inexperienced as properly. Nevertheless, the altcoin continues to be down over 16% from the all-time excessive (ATH) of $4,953.73 that it reached on Aug. 24.

Ethereum Value Has Not Caught Up To Robust Fundamentals

In a current X submit, Lee stated that more often than not, a crypto’s value “leads” fundamentals. He added that there are some situations the place the basics lead the worth.

Within the submit, the Fundstrat CIO additionally shared an interview he had with CNBC.

Throughout the interview, he stated that Ethereum is seeing “a lot development” in its layer-1 (L1) and layer-2 (L2) ecosystems due to stablecoins. Lee then famous that this rise in stablecoin exercise has not but mirrored in ETH’s value, including that “it does take time.”

Lee went on to say that “elementary exercise on Ethereum is admittedly selecting up.” He stated that this helps the argument that the altcoin is poised to expertise a “massive transfer” in the direction of the top of the yr.

Stablecoin Market Cap Surges After GENIUS Act Signing

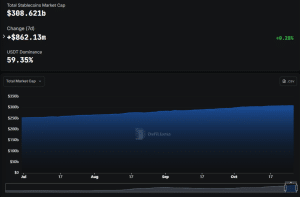

Lee’s remarks come because the stablecoin market continues to develop, with the sector’s capitalization standing at over $308.62 billion, in line with information from DefiLlama.

Stablecoin market cap (Supply: DefiLlama)

A catalyst for the stablecoin market’s development was the signing of the GENIUS Act into legislation by US President Donald Trump in July. Since then, the stablecoin market cap has risen from roughly $257 billion to its present degree.

Close to market share, a lot of the world stablecoin provide resides on the Ethereum blockchain. Further information from DefiLlama reveals that Ethereum has a 53.32% share of the market presently, which equates to roughly $162.84 billion. That is greater than double the second-largest market share of 25.78%, which belongs to Tron.

Ethereum TVL Jumps 5% In 24 Hours

Alongside the dominance within the stablecoin market, the Ethereum blockchain has additionally seen its whole worth locked (TVL) rise greater than 5% previously 24 hours. In consequence, the determine stands at over $90.11 billion. That is additionally greater than 63% of the entire TVL within the crypto market. The subsequent-biggest worth of 8.4% belongs to Solana.

On-chain exercise for Ethereum has additionally soared previously twelve months.

Information from YCharts reveals that the variety of day by day transactions on Ethereum presently stands at roughly 1.311 million. Whereas it is a greater than 16% lower from the 1.567 million transactions seen yesterday, the most recent determine marks an over 14% improve from a yr in the past.

BitMine Holds Hundreds of thousands Of ETH On Its Stability Sheet

BitMine is presently the most important company holder of Ethereum globally, in line with information from StrategicETHReserve.

With round 3.24 million ETH tokens on its steadiness sheet, the corporate’s holdings are valued at greater than $13.47 billion at present costs.

BitMine’s final buy was on Oct. 19, when the corporate purchased 203.8K ETH for over $848 million, and was the most recent transfer within the firm’s efforts to personal 5% of the crypto’s provide.

After the current interview and ETH’s 24-hour achieve, BitMine’s share value rose over 2%. Nevertheless, the corporate’s share value continues to be greater than 5% down on the longer-term month-to-month time-frame.

BitMine share value (Supply: Google Finance)

In the meantime, Ethereum treasury competitor Sharplink Gaming, which is the second-largest company ETH holder with 859.4K tokens on its steadiness sheet, executed its newest buy within the final 24 hours.

In an X submit, on-chain analytics platform Onchain Lens stated that Sharplink added one other 19,271 ETH price $80.37 million to its strategic reserve.

Sharplink Gaming (@SharpLinkGaming) has added one other 19,271 $ETH, price $80.37M, to its Strategic $ETH reserve.

They now maintain 859,395 $ETH, price $3.58B.

Handle: 0x5e3b62e38808fc9582c23bc05e8a19a091d979c9

Information @nansen_ai pic.twitter.com/HPPEW1SYpm

— Onchain Lens (@OnchainLens) October 26, 2025

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be part of Our Telegram channel to remain updated on breaking information protection