Be part of Our Telegram channel to remain updated on breaking information protection

The Ethereum value has slid under $3k to commerce at $2,950 as Tom Lee’s crypto agency, Bitmine, stepped up its accumulation through the current market pullback.

Whereas ETH has struggled to carry key psychological help, institutional consumers look like utilizing the weak spot as a long-term entry alternative. Bitmine not too long ago elevated its Ethereum holdings by including 44,463 ETH in a transaction valued at roughly $130 million.

This newest buy lifted the corporate’s whole ETH reserves to round 4.11 million tokens, giving it management of roughly 3.41% of Ethereum’s whole provide. The transfer additional strengthens Bitmine’s place as one of many largest institutional holders of ETH.

⚡ Flash Information

🐳 Bitmine Immersion expands Ethereum publicity@Bitmine Immersion added 44,463 $ETH over the previous week, bringing whole holdings to 4,110,525 $ETH and strengthening its place throughout the @Ethereum provide. pic.twitter.com/tKaM8zlRG2

— Crypto Financial system Information (@CryptoEconomyEN) December 29, 2025

The agency is actively positioning itself to develop into the world’s largest Ethereum treasury. As a part of this technique, Bitmine has already staked 408,627 ETH, permitting it to earn yield whereas supporting the Ethereum community. Trying forward, the corporate plans to increase its staking operations by adopting the MAVAN validator community beginning in 2026.

In response to Tom Lee, Bitmine has been the most important supply of recent ETH shopping for through the current interval of market weak spot. He defined that year-end circumstances, together with seasonal tax-loss promoting, positioned strain on crypto costs and created engaging accumulation home windows. Bitmine took benefit of this surroundings to construct its place at scale.

Bitmine’s long-term technique mirrors a broader pattern of institutional accumulation additionally seen amongst Ethereum-focused treasury companies equivalent to Development Analysis. The corporate’s final objective, described because the “alchemy of 5%,” is to ultimately personal 5% of Ethereum’s whole provide, elevating questions on how sustained institutional demand may have an effect on ETH liquidity and circulation over time.

Ethereum Dangers Deeper Drop as Bearish Chart Sample Takes Form

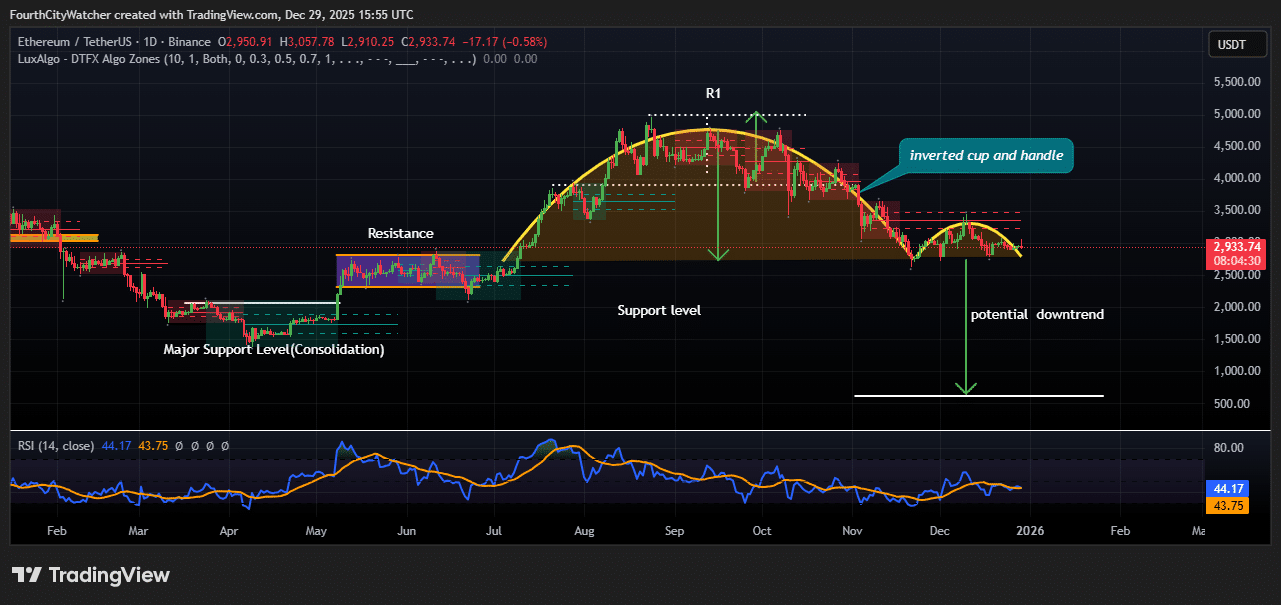

The Ethereum value stays below strain after failing to carry above the $4,500–$5,000 area earlier within the yr. On the day by day chart, value motion now reveals a transparent inverted cup and deal with formation, a sample that usually indicators continuation to the draw back.

ETH is presently buying and selling round $2,950, sitting simply above a key help zone that would determine the following main transfer. Earlier, Ethereum spent a number of months consolidating across the $1,500–$1,600 space, which acted as a robust base for the rally that adopted, ultimately peaking close to the $5,000 mark.

Nonetheless, after reaching that top, bullish momentum pale. The value started forming decrease highs and decrease lows, confirming a shift right into a broader downtrend.

ETHUSDT Chart Evaluation Supply: Tradingview

The $2,900–$3,000 space is now performing as an necessary help degree. This zone beforehand served as each resistance and help, making it technically vital. A day by day shut under this degree would strengthen the bearish case and will open the door for a deeper decline.

Primarily based on the inverted cup and deal with construction, a breakdown may expose ETH to a transfer towards the following main help zone close to $1,000–$1,200 over the medium time period. The Relative Energy Index (RSI) is presently round 44, under the impartial 50 degree. This reveals that consumers are dropping management, and promoting strain stays dominant.

Whereas ETH will not be but oversold, the weak RSI suggests restricted upside except sturdy shopping for returns. On the upside, Ethereum would wish to reclaim $3,200 first to sign short-term aid. A stronger restoration would require a break above the $3,500–$3,600 resistance space, the place earlier promoting strain was heavy. With out such a transfer, any bounce is prone to stay corrective moderately than trend-changing.

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be part of Our Telegram channel to remain updated on breaking information protection