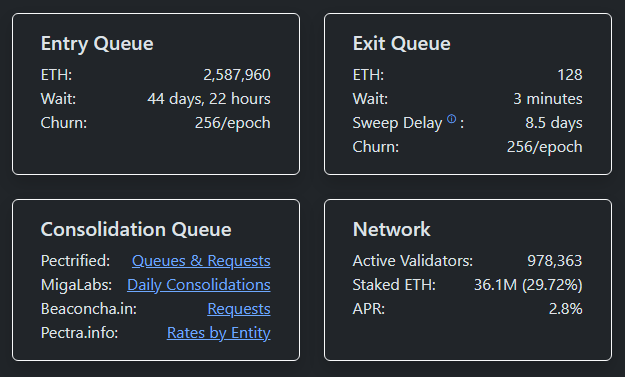

Ethereum’s validator exit queue has dropped to zero, a shift that on-chain watchers say might change how the market views promote stress. In keeping with on-chain metrics and up to date experiences, validators who as soon as waited weeks to withdraw are not lining up. That alone removes a big, seen supply of potential ETH flowing again into markets.

Ethereum Exit Queue Clears

The queue as soon as held thousands and thousands of ETH. Now it’s empty, information from Ethereum Validator Queue exhibits. This implies validators who select to exit will be processed nearly instantly, relatively than being pressured to attend. The backlog that apprehensive merchants in late 2025 has gone.

A change this clear removes an apparent provide overhang and it shifts the stability between how a lot ETH stays locked versus how a lot will be spent.

Provide Tightening And Market Noise

Primarily based on experiences, staking inflows have been sturdy sufficient to drag an enormous share of circulating ETH out of lively markets. With fewer validators lined as much as go away, sudden massive dumps tied to emergency exits grow to be much less doubtless.

Ethereum staking registry and exit queue numbers. Supply: Ethereum Validator Queue

That doesn’t make costs sure, but it surely lowers one type of draw back danger. Merchants monitoring on-chain flows now weigh staking habits alongside spot and derivatives exercise when forming short-term views.

Staking Demand Grows

Entry requests to stake ETH are rising quick. Stories notice that the entry queue — ETH ready to grow to be lively validators — has climbed to excessive ranges as soon as seen solely in huge onboarding durations.

Wait instances for brand new activations have stretched into many weeks in locations. Establishments and staking providers are a part of this push, in accordance with market observers, and their strikes are likely to lock up bigger sums for longer.

BTCUSD buying and selling at $3,317 on the 24-hour chart: TradingView

Safety, Yield, And Actual Results

Extra ETH locked for staking helps the community’s safety as a result of extra validators are actively taking part. It additionally creates yield alternatives for holders preferring regular returns over buying and selling.

That mentioned, the presence of enormous staking swimming pools and providers means some dangers are concentrated. If one huge supplier faces bother, the consequences might be felt extensively. Stories say regulators and product issuers are watching intently as staking turns into simpler to entry by mainstream channels.

What Merchants Are Watching

Worth motion will depend upon many issues past exit queues. Derivatives positions, ETF flows, and macro headlines nonetheless matter. Nonetheless, analysts level out that when a visual outlet for mass withdrawals disappears, the narrative round “pressured promoting” weakens.

Liquidity situations can shift quietly — after which quickly — if any of these different levers transfer. Market individuals are subsequently watching withdrawal metrics alongside change balances and futures open curiosity.

Featured picture from Gemini, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our group of high expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.