TL;DR

- Ethereum community progress is now pushed by new, first-time customers.

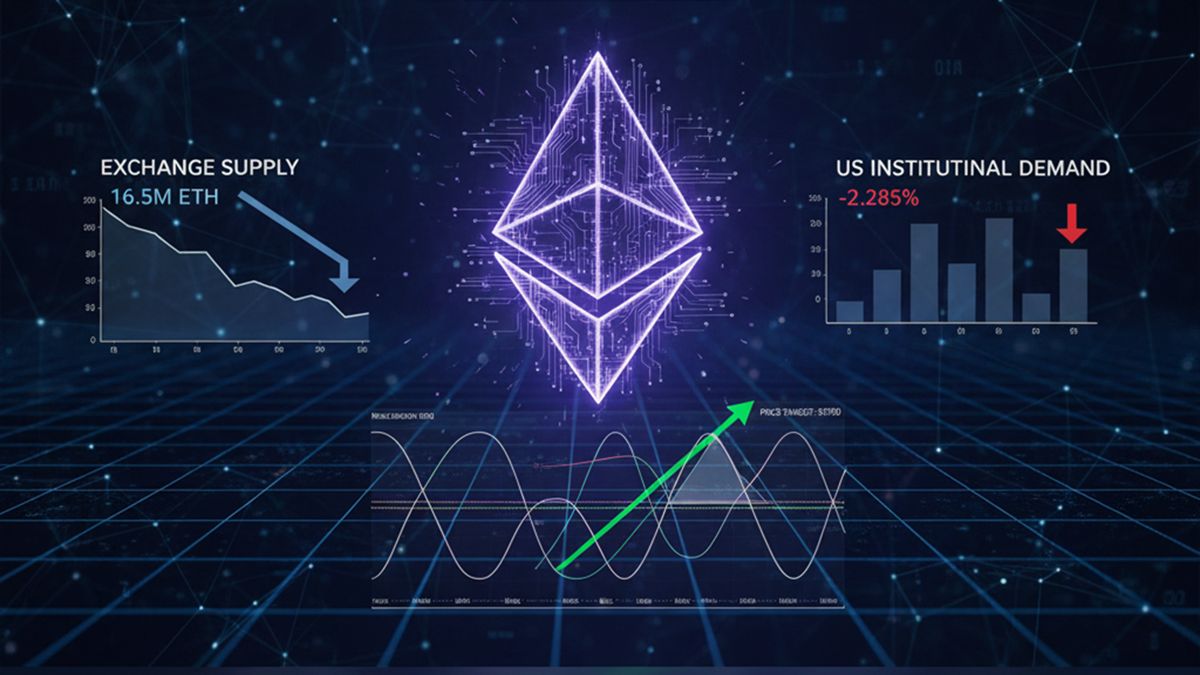

- The worth is consolidating round $3,300 after a latest upward transfer.

- This sample of latest person progress differs from earlier bullish cycles.

Exercise on the Ethereum blockchain accelerated during the last month. New knowledge exhibits progress is now primarily pushed by first-time contributors. Exercise from current wallets has decreased compared.

Analytics from Glassnode point out the variety of new addresses interacting with the community practically doubled in comparison with 2025 ranges. This alteration alerts a structural growth completely different from earlier cycles. Traditionally, peaks in Ethereum utilization coincided with bullish cycles like 2017 and 2021, the place retained and returning customers dominated exercise.

Ethereum’s Month-over-Month Exercise Retention exhibits a pointy spike within the “New” cohort, indicating a surge in first-time interacting addresses over the previous 30 days.

This displays a notable inflow of latest wallets partaking with the Ethereum community, fairly than exercise being… pic.twitter.com/h8Zw7hXOSX— glassnode (@glassnode) January 15, 2026

The 12 months 2026 exhibits a widening base of latest wallets forming the muse of community utilization. This progress in new contributors happens whereas the asset’s value exhibits sideways conduct. From a technical perspective, Ethereum is buying and selling in a comparatively tight vary round $3,300.

This motion follows a pronounced upward impulse earlier within the week

The chart exhibits that after a bullish breakout, value motion shifted into sideways consolidation. This conduct suggests the market is digesting latest positive factors fairly than extending them instantly.

Moderated quantity reinforces the view of a pause fairly than a reversal. Such consolidations usually precede continuation strikes or deeper pullbacks, relying on how momentum resolves.

Momentum indicators assist the consolidation narrative. The Relative Energy Index stays within the low 50s, impartial territory. This implies Ether is neither overbought nor oversold, leaving room for motion in both route.

The Transferring Common Convergence Divergence stays barely destructive, with its sign and MACD traces shut collectively. This configuration sometimes displays weakening momentum fairly than sturdy bearish strain. In previous cycles, comparable setups usually acted as a reset section earlier than the subsequent directional transfer.

The technical image mirrors the on-chain knowledge

Ethereum seems to be in a transitional section. Whereas person progress accelerates beneath the floor, value motion is consolidating. This dynamic might be laying the groundwork for a bigger transfer as soon as sentiment and momentum realign.