The U.S. infrastructure building panorama continues to learn from sustained private and non-private funding, as demand stays resilient throughout transportation, utilities, vitality infrastructure and mission-critical improvement. Sterling Infrastructure, Inc. STRL operates inside this supportive atmosphere, which is being additional strengthened by easing monetary circumstances following latest financial coverage shifts, enhancing the outlook for long-dated capital initiatives. As funding visibility improves, contractors with diversified publicity and robust mission pipelines are higher positioned to transform alternative into execution.

Towards this backdrop, backlog energy has turn into a central indicator of operational visibility. Sterling’s backlog and broader pipeline more and more present a transparent line of sight into exercise ranges past the close to time period, supporting confidence round execution heading into 2026. The corporate’s publicity to massive, advanced, multi-phase initiatives throughout E-Infrastructure, manufacturing, information facilities, and e-commerce has enhanced each workload sturdiness and planning effectivity.

Within the third quarter of 2025, Sterling reported a signed backlog of roughly $2.6 billion, representing a 64% year-over-year improve. Importantly, this determine understates the complete scope of visibility. When mixed with negotiated however unsigned awards and future phases tied to ongoing megaprojects, complete potential work now exceeds $4 billion. E-Infrastructure represents the vast majority of this pipeline, reflecting sustained demand for mission-critical developments that sometimes prolong over a number of years and phases.

This depth of backlog helps greater than income visibility alone. The corporate highlighted that the dimensions and complexity of present initiatives enable for improved labor planning, gear utilization and sequencing of labor, all of that are essential for constant execution. Moreover, long-term buyer planning and dedicated capital spending, significantly from massive enterprise purchasers, additional scale back uncertainty round mission timing.

The Federal Reserve’s determination to chop rates of interest by 25 foundation factors for the third time this yr on Dec. 10, 2025, bringing the benchmark price to a 3.5%-3.75% vary, may additional help infrastructure funding. With the potential for one more price lower in 2026, Sterling’s backlog-driven visibility positions the corporate to maintain momentum and execute effectively into the subsequent cycle.

STRL’s Worth Efficiency, Valuation and Estimates

Shares of this Texas-based infrastructure companies supplier have surged 37.7% previously six months, outperforming the Zacks Engineering – R and D Providers business’s 2.5% development. In the identical time-frame, different business gamers like AECOM ACM, Fluor Company FLR and KBR, Inc. KBR have declined 13%, 20.2% and 16.4%, respectively.

Picture Supply: Zacks Funding Analysis

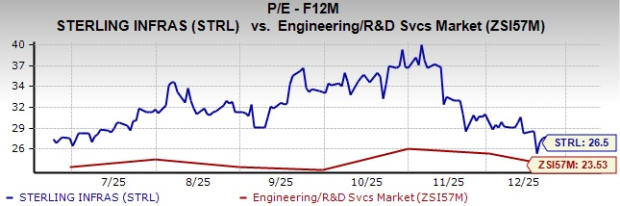

STRL inventory is presently buying and selling at a premium in contrast with its business friends, with a ahead 12-month price-to-earnings (P/E) ratio of 26.5, as proven within the chart under.

Picture Supply: Zacks Funding Analysis

Conversely, business gamers, corresponding to AECOM, Fluor and KBR, have P/E multiples of 17, 18.22 and 9.61, respectively.

For 2026, estimates for STRL’s earnings have elevated previously 60 days to $11.95 from $10.98 per share. The revised estimated figures point out 14.6% year-over-year development.

Picture Supply: Zacks Funding Analysis

The corporate presently sports activities a Zacks Rank #1 (Sturdy Purchase). You’ll be able to see the whole record of right this moment’s Zacks #1 Rank shares right here.

Zacks Naming High 10 Shares for 2026

Wish to be tipped off early to our 10 high picks for everything of 2026? Historical past suggests their efficiency could possibly be sensational.

From 2012 (when our Director of Analysis Sheraz Mian assumed duty for the portfolio) by November, 2025, the Zacks High 10 Shares gained +2,530.8%, greater than QUADRUPLING the S&P 500’s +570.3%.

Now Sheraz is combing by 4,400 corporations to handpick the very best 10 tickers to purchase and maintain in 2026. Don’t miss your probability to get in on these shares once they’re launched on January 5.

Be First to New High 10 Shares >>

Fluor Company (FLR) : Free Inventory Evaluation Report

AECOM (ACM) : Free Inventory Evaluation Report

KBR, Inc. (KBR) : Free Inventory Evaluation Report

Sterling Infrastructure, Inc. (STRL) : Free Inventory Evaluation Report

This text initially printed on Zacks Funding Analysis (zacks.com).

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.