- Highlights of Q3 Earnings

- CPA’s Capability Growth Continues Submit Q3

- Sturdy Outlook Given by CPA

- CPA’s Robust Value Efficiency

- Wall Avenue Common Goal Value for CPA Suggests an Upside

- Engaging Valuation Image Provides to CPA’s Luster

- Headwinds Confronting CPA Inventory

- Ultimate Ideas

- Analysis Chief Names “Single Greatest Choose to Double”

On Nov. 19, Copa Holdings CPA reported its third-quarter 2025 monetary outcomes, highlighting robust demand, stable income progress and strong operational excellence. The corporate continued to increase its fleet, preserve best-in-class on-time efficiency and ship worth to shareholders by means of wholesome profitability and dividends.

Highlights of Q3 Earnings

Copa Holdings reported third-quarter 2025 earnings per share (EPS) of $4.20, which surpassed the Zacks Consensus Estimate of $4.03 and improved 20% yr over yr. Revenues of $913.1 million missed the Zacks Consensus Estimate of $915 million, however elevated 6.8% yr over yr.

Web revenue rose 18.7% to $173.4 million, with working and internet margins reaching 23.2% and 19.0%, respectively. To satisfy rising demand, CPA is increasing capability. CPA ended the quarter with $1.3 billion in liquidity and a low adjusted internet debt-to-EBITDA ratio of 0.7x. Fleet enlargement continued with new Boeing 737 MAX 8 deliveries, whereas on-time efficiency and flight completion remained among the many greatest within the business. Supported by robust operational metrics, CPA, together with LATAM Airways Group LTM, Ryanair Holdings RYAAY and Allegiant ALGT, demonstrated resilience in capturing market demand and sustaining profitability in a aggressive panorama.

CPA’s Capability Growth Continues Submit Q3

In October, out there seat miles (ASM: a measure of capability) had been up 9.6% yr over yr, and income passenger miles (RPM) elevated 9.3%. The load issue got here in at 87.2%, as visitors progress barely lagged capability enlargement.

Different carriers additionally noticed robust demand in October. LATAM Airways Group reported a consolidated load issue of 85.5% and a 7.4% year-over-year enhance in capability. Ryanair Holdings transported 19.2 million passengers in October 2025, reflecting a 5% year-over-year enhance, with a load issue of 93%. Allegiant carried 27.6% extra passengers than a yr in the past, attaining a load issue of 81.9%, whereas system-wide capability rose 20.2%. LATAM Airways Group, Ryanair Holdings and Allegiant benefited from the identical demand swell that supported CPA’s visitors progress, highlighting the broad energy of the market.

Sturdy Outlook Given by CPA

CPA’s administration expects consolidated capability to develop 8% (prior view: up 7-8%) yr over yr, and the working margin is anticipated to be within the vary of 22-23% (prior view: 21-23%). The gas value is anticipated to be $2.47 per gallon (prior view: $2.45).

RASM remains to be anticipated to be 11.2 cents. The load issue for the present yr is anticipated to be 87%. Non-fuel unit prices are anticipated to be 5.8 cents.

Preliminarily, for 2026, CPA at present anticipates its capability to develop by virtually 11-13% on a year-over-year foundation, with unit prices excluding gas (Ex-Gas CASM) anticipated to be within the vary of 5.7 to five.8 cents.

Copa Holdings expects to finish 2025 with 124 plane (prior view: 125 plane) and 2026 with 132 plane (prior view: 131 plane).

CPA’s Robust Value Efficiency

Shares of Copa Holdings have carried out handsomely submit third-quarter 2025 earnings beat, outperforming the Zacks Transportation – Airline business and the S&P 500 index.

Picture Supply: Zacks Funding Analysis

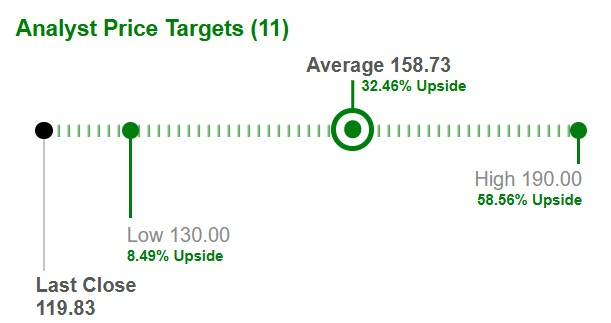

Wall Avenue Common Goal Value for CPA Suggests an Upside

Primarily based on short-term worth targets supplied by 11 analysts, the Wall Avenue common worth goal is at $158.73 per share, suggesting a 32.5% upside from present ranges.

Picture Supply: Zacks Funding Analysis

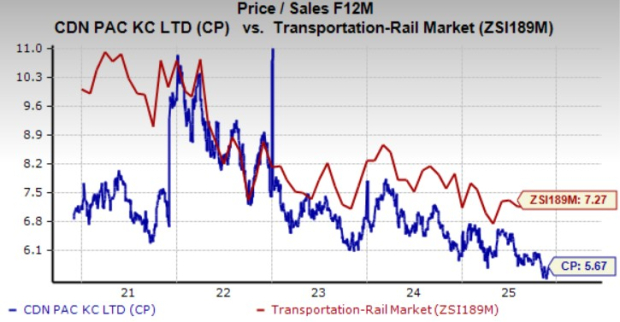

Engaging Valuation Image Provides to CPA’s Luster

From a valuation perspective, CPA is buying and selling at a reduction in contrast with the business, going by the ahead 12-month price-to-sales ratio. The corporate has a Worth Rating of A.

Picture Supply: Zacks Funding Analysis

Headwinds Confronting CPA Inventory

The uptick in complete working bills—rising 2.9% yr over yr to $700.84 million within the third quarter of 2025 —regardless of tailwinds from decrease gas and upkeep prices. It underscores mounting inflationary stress throughout the associated fee base. Labor-related bills climbed 5.4%, gross sales and distribution outlays superior 6.6%, passenger servicing prices elevated 4.8%, and airport amenities and dealing with costs surged 8.8%. These will increase spotlight the corporate’s restricted operational leverage and the structural rigidity of its expense profile, whilst capability expands.

The uptick throughout these key value facilities additionally casts doubt on the corporate’s margin resilience within the coming quarters. Different working and administrative bills rose 3.5% from the third quarter of 2024, additional reinforcing the persistent upward value drift. Though capability progress could assist income technology, the disproportionate escalation in personnel, distribution and airport-related prices threatens to compress working margins with out extra strong cost-containment measures. General, the sustained uptick throughout important expense classes creates a difficult value structure that would impede future profitability.

Ultimate Ideas

For long-term buyers, a single quarter’s efficiency is much less essential than the corporate’s underlying fundamentals. Whereas Copa Holdings delivered spectacular third-quarter outcomes, potential buyers ought to train warning and keep away from dashing to purchase, given the challenges the corporate faces. It’s advisable to watch CPA’s progress and anticipate a extra favorable entry level. Present shareholders, nevertheless, can think about sustaining their positions, because the inventory’s long-term prospects stay stable. The Zacks Rank #3 (Maintain) additional reinforces this cautious outlook.

You possibly can see the whole checklist of at present’s Zacks #1 Rank (Robust Purchase) shares right here.

Analysis Chief Names “Single Greatest Choose to Double”

From hundreds of shares, 5 Zacks consultants every have chosen their favourite to skyrocket +100% or extra in months to return. From these 5, Director of Analysis Sheraz Mian hand-picks one to have probably the most explosive upside of all.

This firm targets millennial and Gen Z audiences, producing practically $1 billion in income final quarter alone. A latest pullback makes now a really perfect time to leap aboard. In fact, all our elite picks aren’t winners however this one may far surpass earlier Zacks’ Shares Set to Double like Nano-X Imaging which shot up +129.6% in little greater than 9 months.

Free: See Our High Inventory And 4 Runners Up

Ryanair Holdings PLC (RYAAY) : Free Inventory Evaluation Report

Copa Holdings, S.A. (CPA) : Free Inventory Evaluation Report

Allegiant Journey Firm (ALGT) : Free Inventory Evaluation Report

LATAM Airways Group S.A. (LTM) : Free Inventory Evaluation Report

This text initially printed on Zacks Funding Analysis (zacks.com).

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.