Airline shares have been on a tear going into 2026, with Delta Air Strains DAL and United Airways UAL standing out specifically.

As two of essentially the most environment friendly airways, United and Delta have led the rally, which coincided with information that air journey was at record-breaking ranges throughout Thanksgiving and Christmas.

Air journey demand has continued to hit new peaks for the reason that Covid-19 pandemic, together with Delta and United’s income, making it a worthwhile subject of which airline inventory would be the higher funding.

Picture Supply: Zacks Funding Analysis

Profitability & Liquidity Comparability

Delta and United inventory are often the go-to choices in a high-cost, extremely aggressive trade that may be cyclical and economically delicate.

The Zacks Transportation-Airline Business has a low trailing twelve-month (TTM) internet margin common of 4.85%, with Delta’s 7.36% being the best among the many main home carriers, adopted by United’s 5.64%. Notably, American Airways AAL and Southwest Airways LUV have TTM internet margins which are barely above 1%.

Picture Supply: Zacks Funding Analysis

Whereas it is more durable for airways to supply income in comparison with different industires, Delta and United are very efficient in the case of turning a big portion of their working income into precise free money stream (FCF) regardless of being in a capital-intensive trade that consistently requires enormous investments for plane purchases and upkeep.

Airliners are likely to have a decrease return on invested capital (ROIC) as effectively, and capital expenditures devour an enormous portion of their working money stream. Nevertheless, Delta and United have surprisingly excessive FCF conversion charges which are above the popular threshold of 80%.

United has the sting right here with a really spectacular FCF conversion charge of 130% as proven under. Notably, analysts view the excessive FCF conversion as an indication of earnings high quality and that an organization is best positioned to deal with financial downturns. To that time, extra cash is accessible for debt compensation, acquisitions, reinvestment, or to reward shareholders, as Delta and United often accomplish that by share buybacks.

Picture Supply: Zacks Funding Analysis

Monitoring Delta and United’s Outlook

Delta is now thought to have ended fiscal 2025 with annual earnings dipping to $5.82 per share in comparison with EPS of $6.16 in 2024. That mentioned, Delta’s FY26 EPS is projected to rebound and soar 23% to what can be a brand new file of $7.17. Delta’s gross sales are anticipated to be up 2% for FY25 and are projected to extend one other 3% this 12 months to $65.19 billion. Delta will likely be reporting its This fall 2025 outcomes subsequent Tuesday, January 13.

As for United, FY25 EPS is anticipated at $10.48 versus file earnings of $10.61 per share in 2024. United’s FY26 EPS is projected to spike 25% to a brand new peak of $13.15. Annual gross sales are anticipated to be up 3% for FY25 and are projected to extend one other 9% in FY26 to $64.26 billion. United experiences This fall 2025 outcomes on Tuesday, January 20.

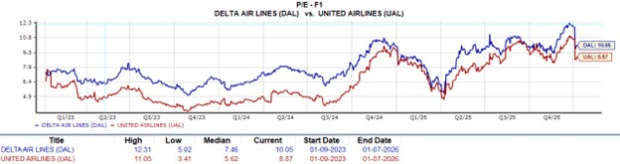

DAL & UAL Valuation Comparability

Making their favorable outlook extra enticing is that Delta and United inventory commerce roughly on par with the trade common of 9X ahead earnings and fewer than 1X ahead gross sales regardless of being clear-cut leaders within the area. At over $100 a share, United nonetheless has a barely decrease P/E valuation than Delta inventory, which trades at round $70.

Picture Supply: Zacks Funding Analysis

Conclusion & Strategic Ideas

It’s nonetheless very intriguing to purchase Delta and United inventory, however favorable This fall experiences and steerage will likely be essential in regard to the probability of extra upside, as DAL and UAL have spiked almost 10% within the final month. Each shares presently land a Zacks Rank #3 (Maintain) and nonetheless supply long-term worth at their present ranges, even with airline operators being vulnerable to suppressed margins.

United’s inventory checks extra bins and usually delivers the stronger value efficiency, however for traders or hedge fund managers preferring a smaller monetary dedication, Delta shares could supply a extra accessible method to pursue significant positions and compound returns.

Radical New Know-how May Hand Buyers Large Good points

Quantum Computing is the following technological revolution, and it might be much more superior than AI.

Whereas some believed the expertise was years away, it’s already current and shifting quick. Giant hyperscalers, similar to Microsoft, Google, Amazon, Oracle, and even Meta and Tesla, are scrambling to combine quantum computing into their infrastructure.

Senior Inventory Strategist Kevin Prepare dinner reveals 7 fastidiously chosen shares poised to dominate the quantum computing panorama in his report, Past AI: The Quantum Leap in Computing Energy.

Kevin was among the many early consultants who acknowledged NVIDIA’s monumental potential again in 2016. Now, he has keyed in on what might be “the following massive factor” in quantum computing supremacy. At this time, you’ve a uncommon likelihood to place your portfolio on the forefront of this chance.

See Prime Quantum Shares Now >>

Delta Air Strains, Inc. (DAL) : Free Inventory Evaluation Report

United Airways Holdings Inc (UAL) : Free Inventory Evaluation Report

Southwest Airways Co. (LUV) : Free Inventory Evaluation Report

American Airways Group Inc. (AAL) : Free Inventory Evaluation Report

This text initially printed on Zacks Funding Analysis (zacks.com).

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.