David Tepper Nails China Commerce

Appaloosa Administration’s David Tepper is a generational expertise and one of the profitable traders of all time. Tepper has amassed a multi-billion-dollar fortune and accrued a lot wealth that he was capable of buy the Carolina Panthers NFL crew. How did Tepper turn out to be so rich? Tepper has made his fortune with an investing method that bets in opposition to the group, takes high-conviction bets, and locations giant bets. As an example, within the fallout of the destruction of the World Monetary Disaster of 2008, Tepper guess huge on beaten-down banks like Financial institution of America (BAC) in 2009, shopping for them when nobody needed them for pennies and promoting them for multi-bag positive factors, resulting in a $7 billion annual windfall for his fund.

Picture Supply: Zacks Funding Analysis

In February, I wrote a chunk titled “David Tepper’s Huge Bets: China and AI” about Tepper’s latest, “all-in” excessive conviction guess: China. On the time, China had been recovering from one of many worst actual property collapses in historical past, a heavy-handed regulatory authorities, and a weak financial system plagued with rampant inflation:

David Tepper’s Genius Lies in His Simplicity

Once I consider David Tepper’s success, I consider the quote “simplicity is the final word sophistication.” Not like many outstanding Wall Road corporations, Tepper doesn’t generate his returns by way of high-frequency buying and selling or advanced quant methods. As a substitute, Tepper leverages a ‘first ideas’ investing framework the place he hyper-focuses on what would possibly in any other case appear apparent to seek out high-probability, funding alternatives with uneven reward-to-risk.

Why Did David Tepper Purchase Banks in 2009?

David Tepper purchased banks in 2009 for 2 easy, but highly effective causes. Banks have been criminally undervalued, and Tepper knew that the US authorities wouldn’t permit most main US banks to fail.

David Tepper’s “Purchase All the things China Declaration”

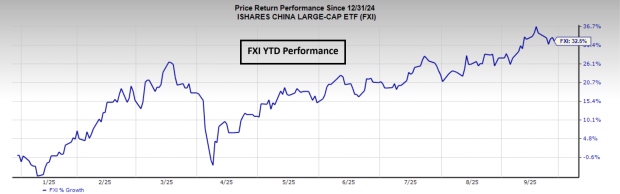

Quick-forward to February, and Tepper purchased Chinese language shares for a equally easy cause. Tepper realized that authorities officers in Beijing have been intent on stimulating the market, saying, “When China desires to spice up their inventory market, the federal government will cease at nothing.” Whereas it’s been a bumpy, headline-driven journey, the iShares China Massive-Cap ETF (FXI) has gained a sturdy 35% year-to-date, once more proving the ability of easy pondering and excessive conviction bets.

Picture Supply: Zacks Funding Analysis

Can Chinese language Shares Proceed to Run?

Authorities Stimulus, De-regulation, Quick Development

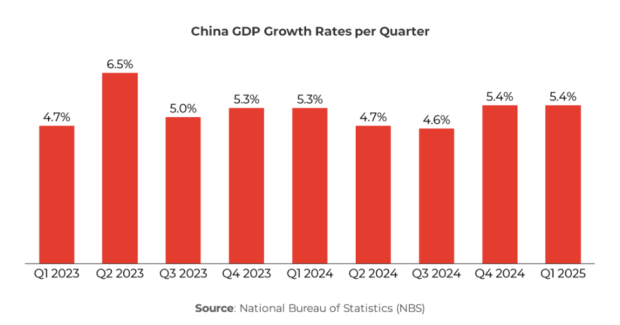

In essentially the most wide-ranging motion because the world monetary disaster, the Chinese language authorities continues to implement stimulus measures, like rate of interest cuts, fiscal stimulus, and help for the actual property market. Keep in mind, liquidity is the one most important market-moving issue, and China at the moment enjoys a plethora of it. Moreover, the Chinese language authorities has turn out to be extra lenient with enterprise rules. In the meantime, China is rising quickly, with the first-half 2025 GDP progress clocking in at a sturdy 5.3%.

Picture Supply: Arc Group, Nationwide Bureau of Statistics

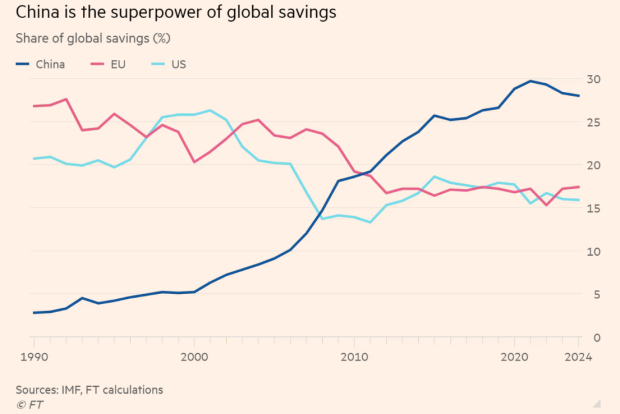

Chinese language Households have Extra Financial savings from Covid-19

Stringent COVID-19 lockdowns and government-driven concern surrounding the virus have led to Chinese language residents saving much more cash than a lot of the world. This extra financial savings ought to result in a sturdy Chinese language financial system and a powerful client.

Picture Supply: IMF, PT calculations, FT

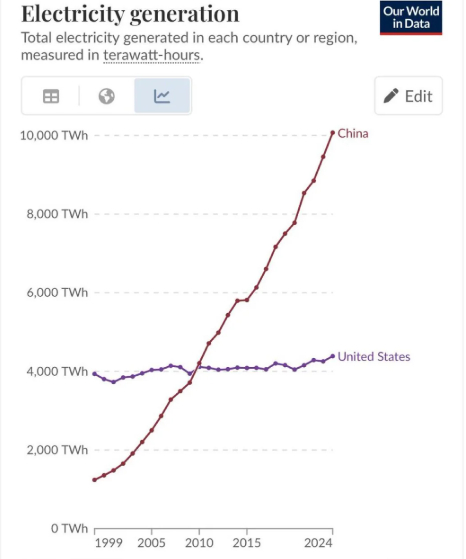

AI: China Leads the Power Battle

Though Wall Road thinks of the US because the chief within the red-hot AI trade, China is sizzling on its heels and is main the AI race in some important areas. One such space is vitality. AI coaching requires a whole lot of energy-hungry knowledge facilities. With out ample vitality, the AI race is misplaced. From this attitude, China is main the AI vitality race considerably. Actually, China produces greater than twice the vitality that the US produces, and this hole is predicted to widen over time.

Picture Supply: Our World in Information

In the meantime, in a latest interview on the “All in Podcast,” former Google CEO Eric Schmidt identified that China is focusing extra of its AI efforts on sensible purposes of AI (which is able to produce income) as a substitute of aiming for synthetic basic intelligence (AGI) like a lot of America’s huge tech juggernauts.

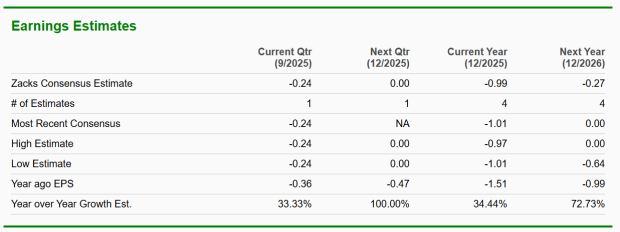

China: Bettering Fundamentals, EPS Estimates, & Cheap Valuations

Wall Road analysts anticipate that Chinese language corporations equivalent to Tencent Music (TME), Baidu (BIDU), and Nio (NIO) will generate sturdy earnings progress by way of 2026.

Picture Supply: Zacks Funding Analysis

Regardless of vital value advances in 2025, Chinese language tech juggernauts like Alibaba (BABA) stay low-cost.

Picture Supply: Zacks Funding Analysis

Backside Line

David Tepper’s newest success along with his China commerce is a testomony to his constant, ‘first ideas’ funding philosophy: guess in opposition to the group, concentrate on easy but highly effective fundamentals, and exude excessive conviction.

5 Shares Set to Double

Every was handpicked by a Zacks professional as the favourite inventory to realize +100% or extra within the months forward. They embrace

Inventory #1: A Disruptive Drive with Notable Development and Resilience

Inventory #2: Bullish Indicators Signaling to Purchase the Dip

Inventory #3: One of many Most Compelling Investments within the Market

Inventory #4: Chief In a Crimson-Scorching Business Poised for Development

Inventory #5: Fashionable Omni-Channel Platform Coiled to Spring

A lot of the shares on this report are flying underneath Wall Road radar, which gives an important alternative to get in on the bottom ground. Whereas not all picks will be winners, earlier suggestions have soared +171%, +209% and +232%.

Obtain Atomic Alternative: Nuclear Power’s Comeback free at present.

Financial institution of America Company (BAC) : Free Inventory Evaluation Report

Baidu, Inc. (BIDU) : Free Inventory Evaluation Report

iShares China Massive-Cap ETF (FXI): ETF Analysis Experiences

Alibaba Group Holding Restricted (BABA) : Free Inventory Evaluation Report

NIO Inc. (NIO) : Free Inventory Evaluation Report

Tencent Music Leisure Group Sponsored ADR (TME) : Free Inventory Evaluation Report

This text initially revealed on Zacks Funding Analysis (zacks.com).

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.