Bitcoin value slipped to $89K lows in Asia hours, dragging the broader crypto market decrease. The crypto market cap tumbled from $3.22 trillion to $3.06 trillion, erasing $160 billion after the Fed reduce charges by 25 bps as anticipated.

ETH value plunges practically 4% to a low of $3,170. Different prime altcoins reminiscent of XRP, Solana, BNB, Dogecoin, Cardano, and Zcash fell 4-8%. Will the crypto market crash in response to FOMC dissent, bearish indicators in derivatives markets, and adverse on-chain knowledge?

FOMC and Powell’s Hawkish Feedback Rattle Bitcoin and Crypto Market

The most recent FOMC assembly reignited considerations in regards to the Federal Reserve’s financial coverage trajectory, with some Fed officers dissenting from a 25 bps fee reduce. Furthermore, the Fed introduced it is going to buy treasury payments as much as $40 billion inside 30 days, beginning this Friday.

Furthermore, Fed Chair Jerome Powell stated the Fed would pause additional fee cuts heading into the January 2026 FOMC assembly. The FOMC financial projection confirmed expectations of just one Fed fee reduce by 25 bps in 2026, after three cuts this yr. This hawkish outlook pressured threat belongings, inflicting Bitcoin value to tumble to $89K and the crypto market to foresee a crash.

The Fed claimed the $40 billion in T-bills buy isn’t quantitative easing (QE). Nonetheless, this really exhibits stress within the cash market, which has pushed gold costs larger. As CoinGape reported earlier, the Fed is injecting billions of {dollars} into the banking system to ease liquidity considerations by repo operations. Notably, this was the second-largest liquidity injection because the COVID pandemic.

The Large Quick” Mike Burry stated the US banks are getting weaker amid the repo market volatility, signaling one other banking disaster.

So the Fed is now shopping for Treasuries once more. $40 billion of payments a month…@FTAlphaville covers it effectively. And with a humorousness – Certain John LOL. And now we have a “new” acronym to be taught RMPs – Reserve Administration Purchases. The final line of the article is notable.

“Nonetheless,… pic.twitter.com/ub7KpzkbbM

— Cassandra Unchained (@michaeljburry) December 10, 2025

Matrixport evaluation revealed Bitcoin and crypto market will stay range-bound following the Fed’s resolution. Implied volatility has been trending decrease throughout the key, reflecting declining expectations for significant near-term value swings.

Derivatives Information Alerts Crypto Market Crash

Based on CoinGlass knowledge, nearly $400 million in lengthy positions had been liquidated within the final 24 hours, with whole crypto liquidations valued at greater than $520 million. BTC, ETH, SOL, XRP, DOGE, and ZEC witnessed the vast majority of liquidations.

In the meantime, BTC choices knowledge exhibits merchants are growing bearish positioning. Open curiosity in Bitcoin choices has surged, however the put/name ratio has shifted towards places. It signifies merchants are hedging or betting on additional draw back.

Bitcoin choices of notional worth $3.56 billion to run out on Friday, with a put/name ratio of 1.09. The max ache value is at $90K, with 83% odds of BTC expiring above the $90K strike value.

Consultants have highlighted that choices flows and funding charges are skewing adverse, reinforcing the danger of continued volatility and potential additional declines.

On-Chain Alerts: Whales, Exchanges, and Revenue-Taking

The Bitcoin Bull Rating Index, a key on-chain indicator of market sentiment, indicators excessive bearish sentiment. The bull rating has dropped again to 0 after the Fed fee reduce.

Furthermore, the Bitcoin Days Bull On/Off knowledge on CryptoQuant exhibits bears dominating over bulls. Additionally, Bitcoin rebound would face a considerably bigger threat of getting liquidated, as per the Aggregated Liquidation Ranges Heatmap. Notably, Bitcoin has failed to beat the promoting strain after the October 10 crypto market crash.

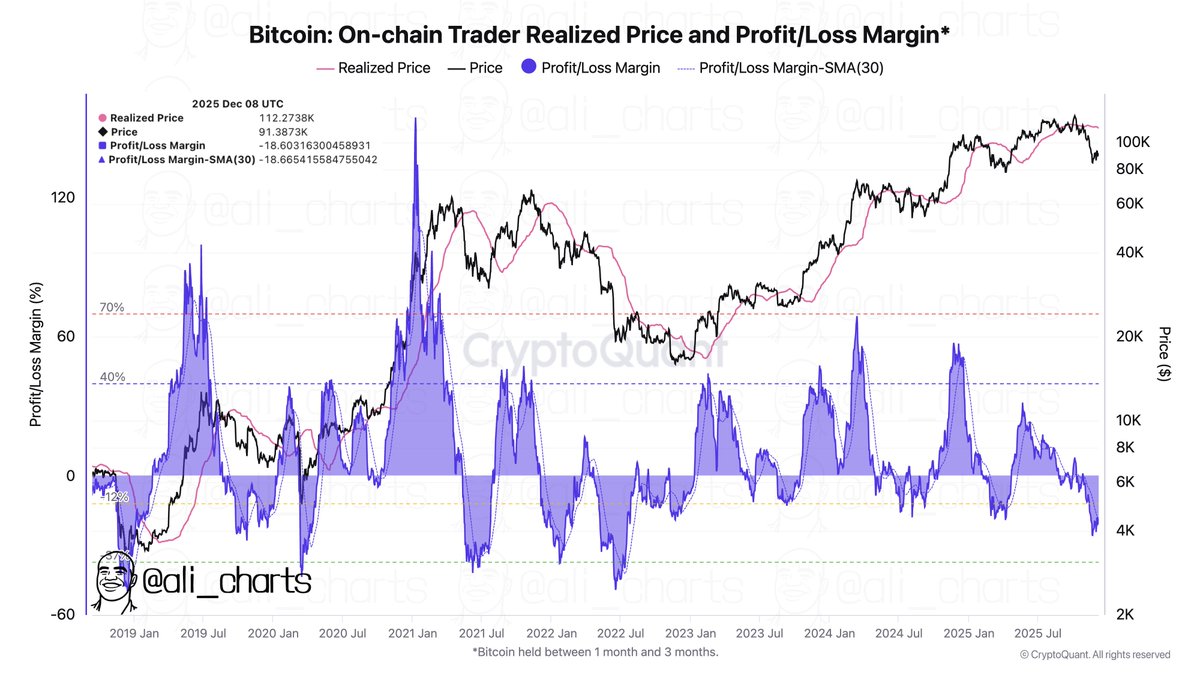

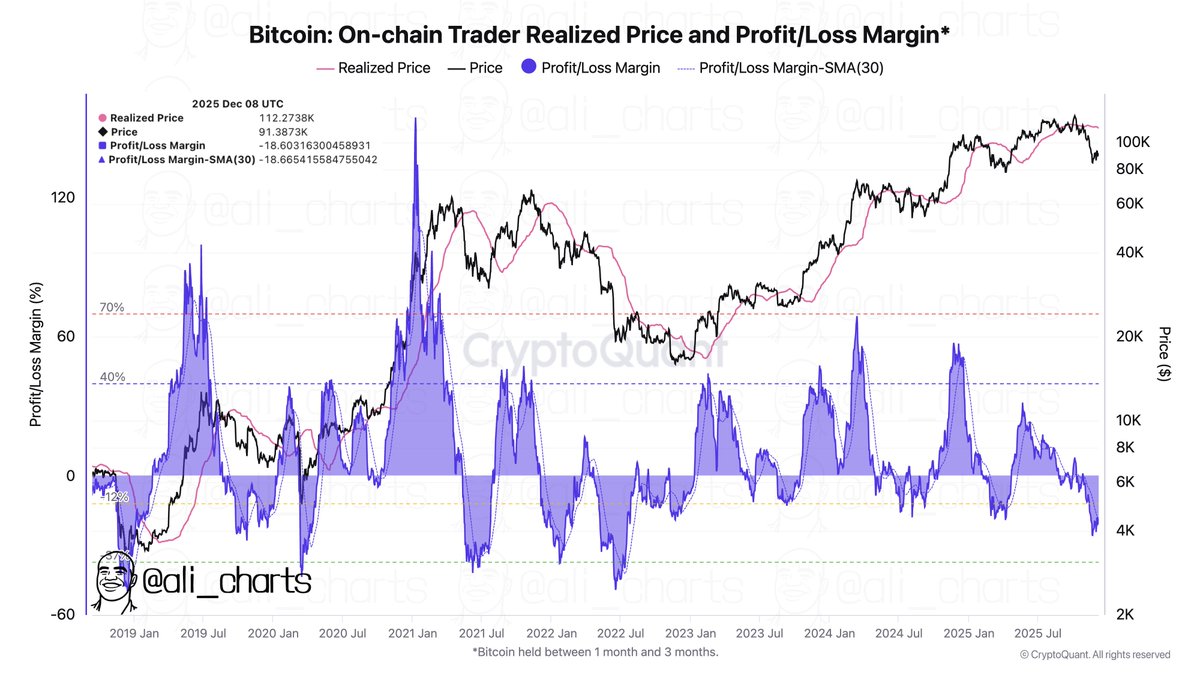

Crypto analyst Ali Martinez claimed a few of the greatest buy-the-dip alternatives have occurred when Bitcoin on-chain dealer realized loss had dropped under -37%. At present, it’s at -18% and signifies room for additional crash in Bitcoin value and the broader crypto market.

Additionally Learn: Greatest Crypto Futures Buying and selling Platforms