Bitcoin, Ethereum, XRP and different altcoins pare features because the crypto market braces for an additional potential selloff. New macro jitters are unlocking forward of key occasions comparable to Nvidia earnings, FOMC minutes launch, and Nonfarm payroll jobs information this week.

Bitcoin, Crypto Market Falter as Japan’s Bond Yields Hit New Excessive

Japan’s long-term authorities bond yields surge to document highs for the primary time in historical past amid financial considerations. This has precipitated Bitcoin and the broader crypto market to drop amid alerts of worldwide liquidity tightening and potential unwinding of the Yen carry trades.

Right now, Japan’s 40Y Authorities Bond Yield surged to its highest stage in historical past at 3.697%, as markets put together for Prime Minister Sanae Takaichi’s stimulus plan.

BREAKING: Japan’s 40Y Authorities Bond Yield surges to three.697%, its highest stage in historical past, as markets put together for extra stimulus. pic.twitter.com/NgyJKRdDva

— The Kobeissi Letter (@KobeissiLetter) November 19, 2025

The macro jitters sparked reactions throughout the crypto market. Bitwise Make investments CIO Jeff Park stated “Japan’s 30Y bond yield has by no means been increased in historical past than it’s now. The worldwide carry machine is on life help.”

In the meantime, Financial institution of Japan (BOJ) Governor Kazuo Ueda advised Prime Minister Takaichi that the central financial institution will hike charges to curb inflation in step with its 2% goal.

Nevertheless, an additional rise in bond yields might set off unwinding of Yen carry trades. World yen carry commerce publicity accounts for $20 trillion, which may shake markets, together with Bitcoin, as seen throughout an earlier crypto market crashes.

Crypto Market Braces for Nvidia and FOMC Assembly

Bitcoin, Ethereum, XRP and the broader crypto market rebounded after the newest information confirmed an increase in jobless claims in the US. The weakening labor market fueled December’s Fed fee minimize odds.

Nevertheless, BTC value has once more dropped beneath $90K after rebounding above $93K, signaling uncertainty rising forward of key occasions comparable to Nvidia earnings and FOMC minutes launch right now.

Nvidia to report its Q3 earnings after market hours on Wednesday, amid AI bubble fears. Nvidia earnings will decide the sustainability of Wall Avenue’s huge AI-driven investments. NDVA inventory closed 2.81% decrease at $181.36 on Tuesday, extending the autumn to 7.26% in every week.

The crypto market individuals face the FOMC minutes launch later right now. Markets trimmed bets on a Fed fee minimize in December amid hawkish outlook. The CME FedWatch device now exhibits beneath 49% odds of one other 25 bps Fed fee minimize because the Fed officers reimportant divided.

In the meantime, US President Donald Trump goals to interchange Fed Chair earlier than Christmas as Jerome Powell sticks to his hawkish stance. Fed considerations might elevate short-term crash considerations within the international markets.

Key Jobs Knowledge to Watch

Thursday’s Nonfarm payroll and unemployment fee information for September is key due to first jobs information launch submit authorities shutdown. Furthermore, the White Home confirmed that no October CPI and jobs information will probably be launched.

On the time of writing, ETH value wavers above $3,000 after a serious crash, with buying and selling quantity dropping 30% over the previous 24 hours.

In the meantime, XRP value holds close to $2.15, however analysts see whale distributions on this early bear market might end in an extra value drop.

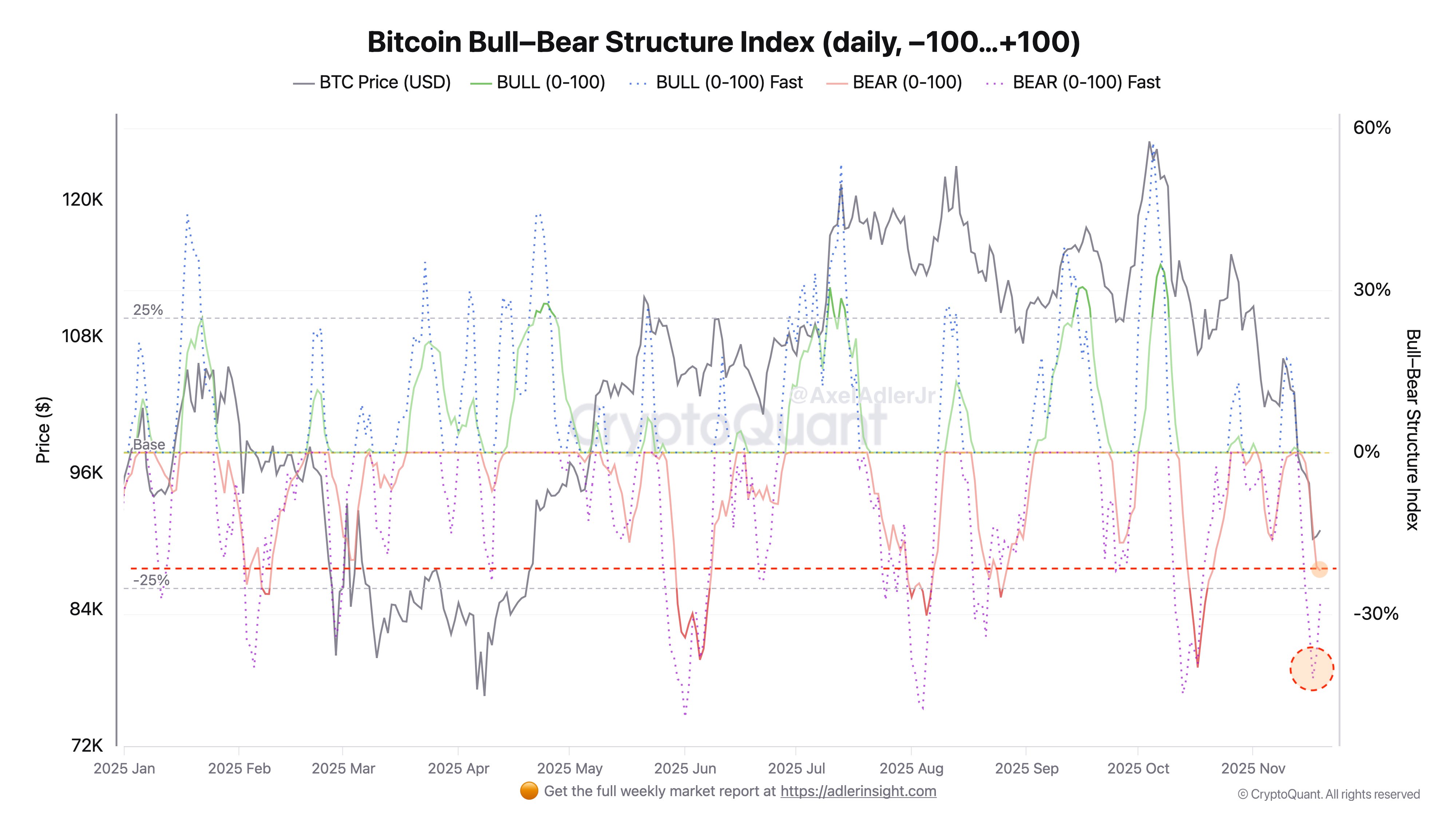

The Bull-Bear Construction Index alerts the continued dominance of bearish components. These embrace unfavourable taker circulation, persistent derivatives strain, and ongoing ETF outflows.