Be part of Our Telegram channel to remain updated on breaking information protection

US crypto trade Coinbase has sued the states of Michigan, Connecticut, and Illinois in a bid to lock in federal safety for its deliberate prediction markets.

In its Thursday filings, the trade is asking federal judges to declare that prediction markets listed on a platform regulated by the US Commodity Futures Buying and selling Fee (CFTC) fall below the Commodity Alternate Act (CEA) and the CFTC’s unique jurisdiction.

“Right this moment, Coinbase filed lawsuits in CT, MI, and IL to substantiate what is evident: prediction markets fall squarely below the jurisdiction of the CFTC, not any particular person state gaming regulator (not to mention 50),” the trade’s Chief Authorized Officer Paul Grewal wrote on X.

The filings had been made only a day after Coinbase unveiled that it’s going to broaden into the prediction markets house as a part of its effort to create an “all the pieces trade.” This growth shall be made doable via a partnership with Kalshi, which is a CFTC-regulated platform.

Coinbase’s filings look like pre-emptive measures in anticipation of pushback from state regulators, who’ve focused prediction markets platforms in latest months.

States Have No Authority To Intervene In Prediction Markets, Argues Coinbase

The prediction markets house has flourished this 12 months as customers rush to wager on the outcomes of quite a lot of real-world occasions spanning throughout politics, sports activities, and extra.

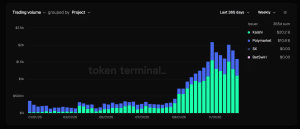

Polymarket and Kalshi are the most well-liked platforms available in the market. Up to now few months, each platforms have seen file buying and selling volumes, information from Token Terminal reveals.

Prediction markets volumes (Supply: Token Terminal)

Each Polymarket and Kalshi have introduced a collection of strategic partnerships this 12 months as nicely with corporations equivalent to Google, the UFC, and others.

Nevertheless, that development has attracted pushback from state authorities.

A number of states have taken enforcement motion towards prediction market operators, arguing that event-based contracts represent unlawful playing except licensed below state legislation.

Particularly, regulators have mentioned that prediction markets fall out of the CFTC’s jurisdiction once they relate to sports activities.

Coinbase argued that Congress has already designated the CFTC as the only real regulator for prediction markets, leaving states with out authority to intervene.

Grewal mentioned on X that state regulators’ efforts to manage or outright block prediction markets “stifle innovation and violate the legislation.”

“Prediction markets are basically completely different from sportsbooks,” Coinbase’s authorized chief added.

Prediction markets are basically completely different from sportsbooks. Casinos win provided that you lose and set odds to maximise their income. Prediction markets are impartial exchanges, detached to cost, that match patrons and sellers. 3/4

— paulgrewal.eth (@iampaulgrewal) December 19, 2025

“Casinos win provided that you lose and set odds to maximise their income. Prediction markets are impartial exchanges, detached to cost, that match patrons and sellers.”

The trade mentioned that treating casinos and prediction markets platforms as the identical factor wouldn’t solely misinterpret how Congress defines “commodity” within the CEA, however would additionally smother a federally regulated product that’s speculated to reside contained in the derivatives framework, with CFTC surveillance and place limits.

Kalshi Has Been Getting Combined Outcomes Utilizing The Similar Arguments

Kalshi has been attempting to make use of the identical arguments introduced by Coinbase in courtroom for practically a 12 months now, and has achieved combined outcomes.

Kalshi has both sued or been sued in a minimum of six states concerning whether or not its sports activities and occasion markets could be thought-about unlicensed playing or are CFTC-regulated derivatives.

In Nevada and Maryland, judges have maintained that Kalshi is topic to state gaming oversight regardless of it being regulated by the CFTC. In the meantime, federal courts in New Jersey, and Connecticut have granted the corporate momentary safety from enforcement whereas broader injunctions are weighed.

Massachusetts has sued to dam Kalshi’s sports activities merchandise. An injunction choice just isn’t anticipated on this occasion till early 2026.

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be part of Our Telegram channel to remain updated on breaking information protection