Key Takeaways

- Cathie Wooden of ARK Make investments sees Bitcoin as a robust portfolio diversification instrument because of its low correlation with different main asset courses.

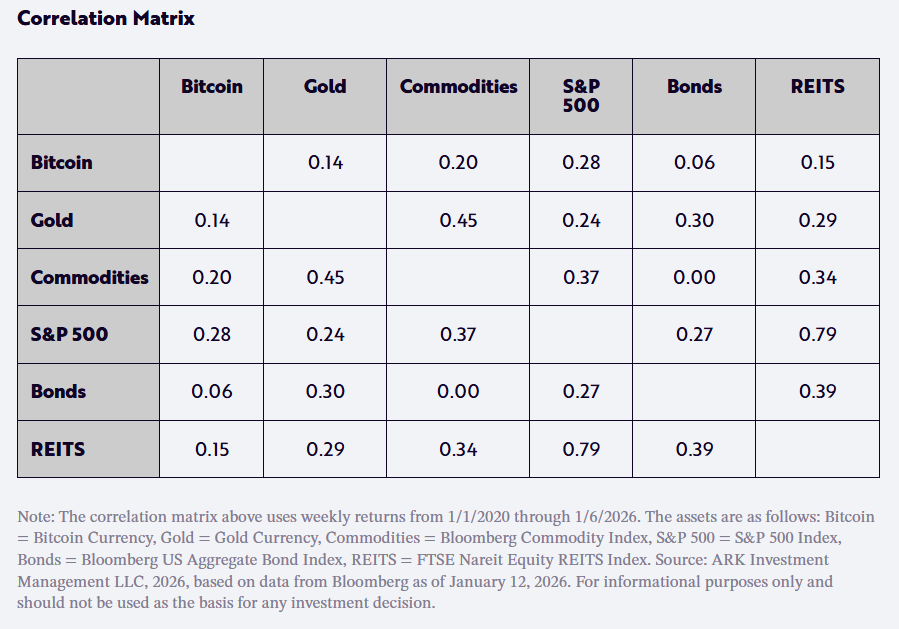

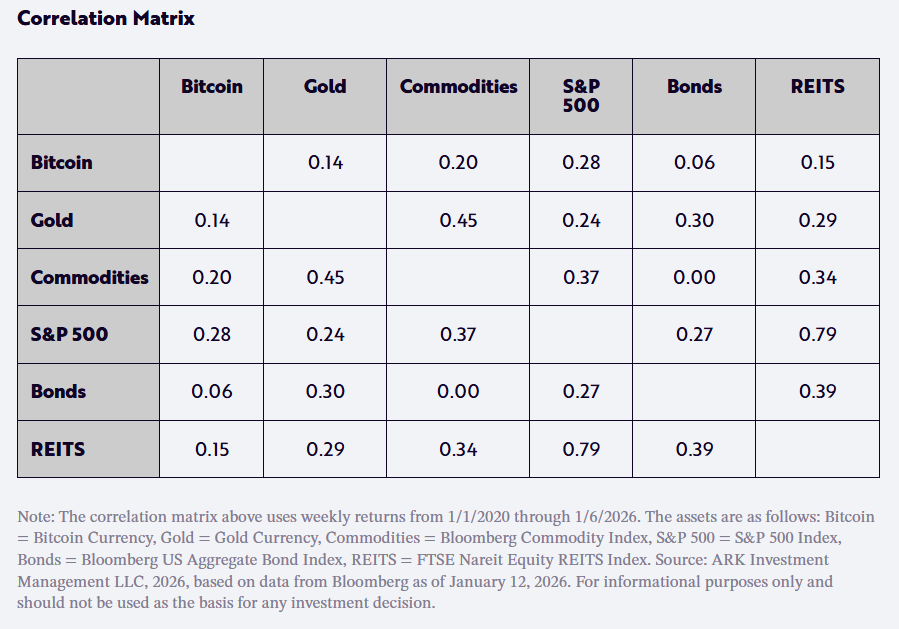

- Evaluation of weekly returns from 2020 to 2026 exhibits Bitcoin’s low correlation with gold (0.14) in comparison with the S&P 500’s correlation with bonds (0.27).

Share this text

Bitcoin’s low correlation with main asset courses like gold, shares, and bonds positions it as a robust instrument for portfolio diversification and better returns per unit of threat, stated ARK Make investments CEO Cathie Wooden in her 2026 outlook launched Thursday.

ARK’s evaluation of weekly returns from January 2020 to early January 2026 exhibits that Bitcoin has a modest correlation of 0.14 with gold, a lot decrease than the 0.27 correlation between the S&P 500 and bonds.

Bitcoin’s correlation is lowest with bonds (0.06), barely greater with gold and REITs, and highest with the S&P 500 at 0.28. Even at its peak, Bitcoin’s correlation stays far under these of conventional asset pairs, such because the S&P 500 and REITs, which correlate at 0.79.

“Bitcoin needs to be a very good supply of diversification for asset allocators searching for greater returns per unit of threat in the course of the years forward,” Wooden wrote.

On Bitcoin mining, Wooden stated that Bitcoin’s provide development is strictly restricted by protocol, with new issuance set to extend round 0.8% per yr over the subsequent two years earlier than slowing to round 0.4% yearly.

Not like gold, which miners can produce extra of in response to greater costs, Bitcoin’s provide is mathematically mounted, making it inherently scarce. She famous that this predictable provide schedule, mixed with growing demand, has contributed to a 360% worth rise since late 2022.

ARK Make investments CEO additionally outlined her outlook for the US financial system, financial coverage, and AI.

She described the financial system as a “coiled spring” poised for a rebound, highlighted decrease inflation and tax insurance policies as potential drivers of earnings and company money move development, and stated AI, robotics, vitality storage, blockchain, and multiomics might enhance productiveness and help sturdy GDP development.