The U.S. housing trade remains to be beneath strain as affordability stays a hurdle for potential patrons. Sterling Infrastructure, Inc. STRL can also be dealing with the impact of this softer housing setting inside its Constructing Options phase. Within the third quarter of 2025, phase revenues declined 1% 12 months over 12 months, and legacy residential revenues fell 17% as the corporate famous that house demand stays weak as a result of patrons proceed to wrestle with affordability challenges. The broader market acquired restricted reduction from coverage assist. On Dec. 10, 2025, the Federal Reserve reduce rates of interest by 0.25 proportion factors, however greater mortgage prices, tight provide and value pressures nonetheless maintain again demand, suggesting solely gradual enchancment heading into 2026.

Towards this backdrop, the main target shifts as to if power in E-Infrastructure can offset housing weak point in 2026. Within the third quarter of 2025, the corporate underscored the rising significance of its E-Infrastructure Options phase, which serves knowledge facilities, manufacturing amenities and different mission-critical initiatives. Revenues from this phase (representing roughly 60% of complete revenues) reached $417.1 million, reflecting roughly 58% progress from the year-ago interval, highlighting sturdy demand and the rising scale of buyer investments. Knowledge facilities stay a key progress engine, whereas semiconductor and manufacturing megaprojects are anticipated so as to add significant alternatives in 2026 and 2027.

As of Sept. 30, 2025, the corporate reported a signed backlog of $2.6 billion, up 64% from the prior 12 months, and complete potential work above $4 billion when together with awards and future phases, with E-Infrastructure representing most of this pipeline. Total, continued housing softness stays a drag. Nonetheless, the size, margin profile and visibility of E-Infrastructure exercise recommend that this power may help stability housing strain and assist efficiency heading into 2026.

STRL’s Worth Efficiency, Valuation and Estimates

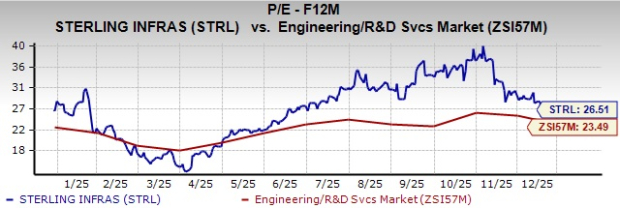

Shares of this Texas-based infrastructure companies supplier have surged 37.2% prior to now six months, outperforming the Zacks Engineering – R and D Companies trade’s 1% progress. The inventory has additional outperformed the broader Building sector and the S&P 500, which have superior 9.1% and 14.5%, respectively in the identical interval.

Picture Supply: Zacks Funding Analysis

In the identical timeframe, different trade gamers like AECOM ACM, Fluor Company FLR and KBR, Inc. KBR have declined 13.7%, 20.4% and 16.1%, respectively.

STRL inventory is at present buying and selling at a premium in contrast with its trade friends, with a ahead 12-month price-to-earnings (P/E) ratio of 26.51, as proven within the chart under.

Picture Supply: Zacks Funding Analysis

In the meantime, trade gamers, akin to AECOM, Fluor and KBR, have P/E multiples of 16.92, 18.18 and 9.65, respectively.

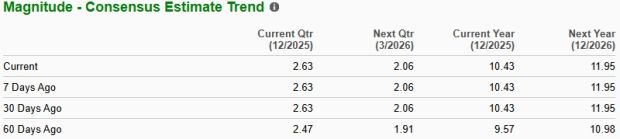

For 2026, estimates for STRL’s earnings have elevated prior to now 60 days to $11.95 from $10.98 per share. The revised estimated figures point out 14.6% year-over-year progress.

Picture Supply: Zacks Funding Analysis

The corporate at present sports activities a Zacks Rank #1 (Robust Purchase). You’ll be able to see the entire listing of in the present day’s Zacks #1 Rank shares right here.

Radical New Know-how Might Hand Buyers Large Positive aspects

Quantum Computing is the following technological revolution, and it may very well be much more superior than AI.

Whereas some believed the expertise was years away, it’s already current and transferring quick. Giant hyperscalers, akin to Microsoft, Google, Amazon, Oracle, and even Meta and Tesla, are scrambling to combine quantum computing into their infrastructure.

Senior Inventory Strategist Kevin Prepare dinner reveals 7 rigorously chosen shares poised to dominate the quantum computing panorama in his report, Past AI: The Quantum Leap in Computing Energy.

Kevin was among the many early consultants who acknowledged NVIDIA’s monumental potential again in 2016. Now, he has keyed in on what may very well be “the following huge factor” in quantum computing supremacy. Immediately, you’ve got a uncommon likelihood to place your portfolio on the forefront of this chance.

See Prime Quantum Shares Now >>

Fluor Company (FLR) : Free Inventory Evaluation Report

AECOM (ACM) : Free Inventory Evaluation Report

KBR, Inc. (KBR) : Free Inventory Evaluation Report

Sterling Infrastructure, Inc. (STRL) : Free Inventory Evaluation Report

This text initially printed on Zacks Funding Analysis (zacks.com).

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.