As AI initiatives develop, enterprises face new operational challenges relating to GPU availability throughout areas, planning capability for a number of groups and making certain predictable entry to sources. Nebius Group N.V. NBIS is addressing these wants with the launch of Nebius AI Cloud 3.1, the most recent launch of its full-stack AI cloud platform. Constructing on the Nebius AI Cloud “Aether” framework, model 3.1 infuses next-generation NVIDIA NVDA Blackwell Extremely infrastructure, clear GPU capability administration, expanded AI/ML developer instruments and improved enterprise safety and compliance options. These updates place Nebius AI Cloud as a really perfect platform for enterprises scaling AI workloads in manufacturing.

Nebius is now rolling out NVIDIA Blackwell Extremely globally, together with HGX B300 and GB300 NVL72 methods, turning into the primary cloud supplier in Europe to run each in manufacturing and the primary worldwide to deploy GB300 NVL72 with 800 Gbps NVIDIA Quantum-X800 InfiniBand. Paired with accelerated networking, storage and filesystem scaling, Nebius AI Cloud 3.1 removes AI infrastructure bottlenecks and reinforces its place with high MLPerf Coaching v5.1 outcomes. Moreover, model 3.1 introduces Capability Blocks and a real-time dashboard, offering enterprises with full visibility into reserved GPU capability throughout areas. Moreover, project-level quotas and new storage guidelines allow tighter management over sources and prices.

Past infrastructure and operations, Nebius AI Cloud 3.1 expands its ecosystem to streamline AI improvement, providing simplified entry to NVIDIA BioNeMo NIM microservices for healthcare and life sciences with out requiring NGC keys or NVDA AI Enterprise licenses. The discharge additionally enhances developer expertise with improved Slurm orchestration, FOCUS-compliant billing and a refined console, whereas strengthening enterprise safety with HIPAA-ready audit logs, granular entry controls, VPC safety teams and Microsoft Entra ID–primarily based IAM for regulated and authorities workloads.

As AI fashions develop bigger and extra complicated, platforms like Nebius AI Cloud 3.1 are poised to play a key function in enabling enterprises to innovate sooner, with out compromising on efficiency, governance, or management. Whereas capability growth helps NBIS’ income outlook, with 2025 steerage now set at $500–$550 million, up from the prior $450-$630 million, near-term dangers stay. Energy constraints, supply-chain uncertainty and intensifying competitors from high gamers like Amazon AMZN and rivals akin to CoreWeave, Inc. CRWV might restrict capability development and weigh on execution in an more and more crowded AI infrastructure market.

Rising Rivalry to Cloud NBIS’ AI Infrastructure Progress Path

CoreWeave continues to ramp up investments in information facilities and server infrastructure to maintain tempo with the continued traction in buyer demand. CRWV grew from a distinct segment GPU supplier into a number one AI cloud by shopping for massive GPU inventories and carving out relationships with AI labs and firms that want a number of H100/Blackwell-class GPUs. A serious power behind its momentum is its multi-billion-dollar agreements with NVDA. Third-quarter highlights embrace being the primary to deploy NVIDIA GB300 NVL72 methods for large-scale frontier AI workloads and the primary to supply NVIDIA RTX PRO 6000 Blackwell Server Version cases, giving CRWV an early lead in real-time AI and simulation workloads.

Amazon is quickly increasing AWS’ energy capability, doubling what it had in 2022 and on monitor to double once more by 2027. Within the fourth quarter alone, it expects so as to add one other 1 GW. The growth consists of energy, information facilities and chips like AWS’ Trainium and NVIDIA GPUs. AMZN continues to deepen partnerships with NVIDIA, AMD and Intel, putting massive chip orders and increasing these relationships over time. Backed by sturdy safety, efficiency and enterprise focus, AWS continues to dominate main enterprise and authorities cloud migrations, driving AI demand. To assist this, AWS added over 3.8 GW of capability prior to now yr, greater than another cloud supplier.

NBIS’ Worth Efficiency, Valuation and Estimates

Shares of Nebius have gained 179% prior to now yr in contrast with the Web – Software program and Providers trade’s development of 26.8%.

Picture Supply: Zacks Funding Analysis

Valuation-wise, Nebius appears overvalued, as urged by the Worth Rating of F. By way of Worth/E-book, NBIS shares are buying and selling at 3.95X, larger than the Web Software program Providers trade’s 3.74X.

Picture Supply: Zacks Funding Analysis

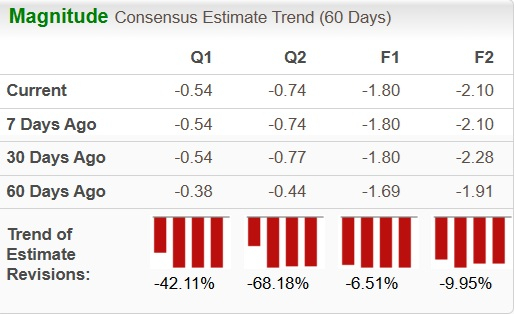

The Zacks Consensus Estimate for NBIS’ 2025 earnings has seen a downward revision over the previous 60 days.

Picture Supply: Zacks Funding Analysis

NBIS at the moment carries a Zacks Rank #4 (Promote).

You may see the entire record of in the present day’s Zacks #1 Rank (Sturdy Purchase) shares right here.

Zacks Naming High 10 Shares for 2026

Wish to be tipped off early to our 10 high picks for everything of 2026? Historical past suggests their efficiency could possibly be sensational.

From 2012 (when our Director of Analysis Sheraz Mian assumed duty for the portfolio) by means of November, 2025, the Zacks High 10 Shares gained +2,530.8%, greater than QUADRUPLING the S&P 500’s +570.3%.

Now Sheraz is combing by means of 4,400 firms to handpick the most effective 10 tickers to purchase and maintain in 2026. Don’t miss your probability to get in on these shares once they’re launched on January 5.

Be First to New High 10 Shares >>

Amazon.com, Inc. (AMZN) : Free Inventory Evaluation Report

NVIDIA Company (NVDA) : Free Inventory Evaluation Report

Nebius Group N.V. (NBIS) : Free Inventory Evaluation Report

CoreWeave Inc. (CRWV) : Free Inventory Evaluation Report

This text initially revealed on Zacks Funding Analysis (zacks.com).

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.