- CCJ’s Efficiency vs. Business, Sector & S&P500

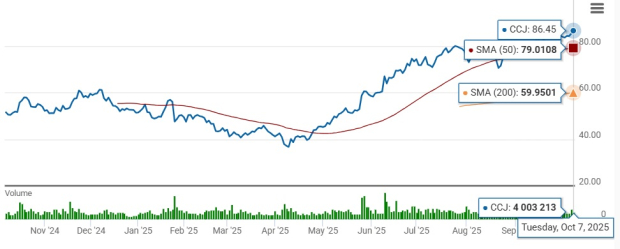

- Cameco’s Inventory Trades Above 50-Day & 200-Day SMAs

- CCJ’s Efficiency vs. Vitality Fuels, Ur Vitality & Uranium Vitality

- Cameco Delivers Upbeat Outcomes Regardless of Weak Uranium Costs

- Cameco Expands Market Attain With Slovenské elektrárne Deal

- Cameco Trims 2025 Outlook for McArthur River Mine

- Cameco’s Earnings Estimates Witness Downward Revisions

- CCJ Presents Lofty Inventory Valuation

- Cameco’s Debt Ranges are Greater Than Friends

- CCJ’s Lengthy-Time period Fundamentals Stay Robust

- Our Closing Tackle CCJ Inventory

- Past Nvidia: AI’s Second Wave Is Right here

Cameco CCJ has surged 115.9% prior to now six months, outpacing the business’s 27.9% development, the Zacks Fundamental Supplies sector’s 25.3% acquire and the S&P 500’s 25.3% rise.

CCJ’s Efficiency vs. Business, Sector & S&P500

Picture Supply: Zacks Funding Analysis

Cameco has been buying and selling above the 200-day easy shifting common (SMA) and the 50-day SMA, indicating a bullish development.

Cameco’s Inventory Trades Above 50-Day & 200-Day SMAs

Picture Supply: Zacks Funding Analysis

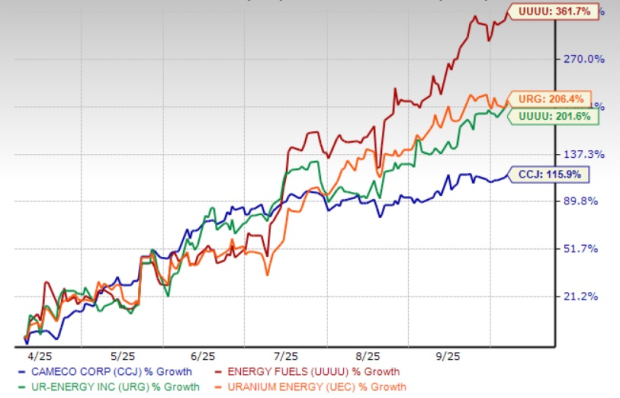

Nevertheless, different uranium friends Vitality Fuels Inc. UUUU, Ur-Vitality Inc. URG and Uranium Vitality Corp. UEC have delivered even stronger returns on this timeframe, as proven on this chart beneath.

CCJ’s Efficiency vs. Vitality Fuels, Ur Vitality & Uranium Vitality

Picture Supply: Zacks Funding Analysis

Traders could also be keen to affix the rally, nevertheless it’s important to first perceive what’s fueling the surge, assess Cameco’s development prospects and weigh the potential dangers.

Cameco Delivers Upbeat Outcomes Regardless of Weak Uranium Costs

Cameco’s complete revenues within the first half of 2025 elevated 35% yr over yr to CAD 1,666 million ($1,184 million). Uranium revenues have been up 27% to CAD 1,324 million ($941 million), aided by a 16% increased gross sales quantity and a rise of 10% within the Canadian greenback common realized worth, benefiting from fixed-price contracts, although U.S. greenback spot costs fell 24%.

Gasoline providers’ revenues surged 56% yr over yr to CAD297 million ($211 million) on account of a 2% enhance in common realized worth and a 55% enhance in gross sales quantity.

Cameco’s adjusted earnings per share soared 248% yr over yr to CAD 0.87 ($0.62) within the first half of 2025. The earnings enchancment was additionally attributed to stronger fairness earnings reflecting Cameco’s 49% funding in Westinghouse Electrical Firm within the second quarter.

Cameco Expands Market Attain With Slovenské elektrárne Deal

In September, Cameco signed a long-term settlement to produce pure uranium hexafluoride (UF6) to Slovenské elektrárne (“SE”), Slovakia’s largest electrical energy producer. This settlement, working by way of 2036, marks Cameco’s entry into the Slovakia market.

Cameco will present each uranium and conversion providers to SE. The fabric will assist operations at SE’s Bohunice and Mochovce nuclear amenities, beginning in 2028.

Cameco Trims 2025 Outlook for McArthur River Mine

Cameco has two working mines, Cigar Lake (through which it holds a 54.547% stake) and McArthur River (69.805%), together with a mill at Key Lake (83.33%).

Cameco just lately revised its share of manufacturing expectation for 2025 at 9.8-10.5 million kilos from the McArthur River mine, from the 12.6 million kilos anticipated earlier. This displays growth delays in transitioning the mine to new mining areas, in addition to slower-than-anticipated floor freezing. The anticipated share from the Cigar Lake mine is maintained at 9.8 million kilos. Backed by Cigar Lake’s upbeat efficiency within the first half, Cameco expects it’s going to probably assist set off as much as 1 million kilos (100% foundation) of the manufacturing shortfall on the McArthur River.

Cameco’s share of manufacturing (Cigar Lake and McArthur River) was at 10.6 million kilos of uranium within the first half of 2025, reflecting an 18% drop from the year-ago quarter. The corporate has to supply 9-9.7 million kilos from each operations within the second half to satisfy its revised steerage of 19.6-20.3 million kilos in 2025.

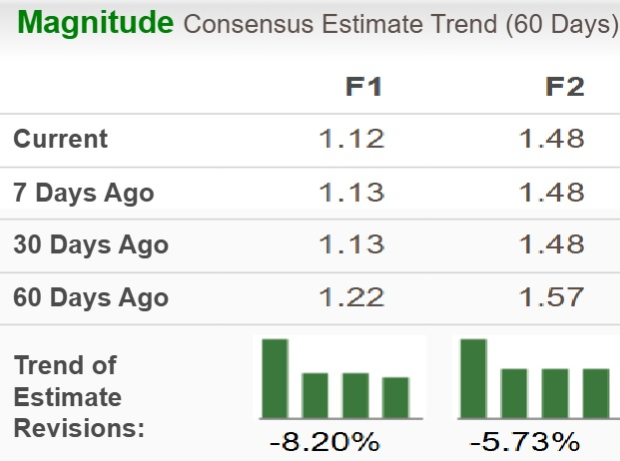

Cameco’s Earnings Estimates Witness Downward Revisions

The Zacks Consensus Estimate for CCJ’s 2025 earnings is pegged at $1.12 per share, indicating 128.6% year-over-year development. The identical for 2026 is $1.48, implying 31.7% development.

Picture Supply: Zacks Funding Analysis

Picture Supply: Zacks Funding Analysis

Nevertheless, each the estimates for fiscal 2025 and 2026 have moved down, as proven within the chart beneath.

Picture Supply: Zacks Funding Analysis

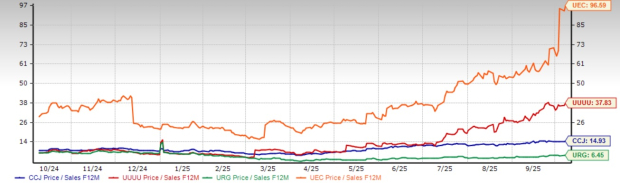

CCJ Presents Lofty Inventory Valuation

Cameco’s inventory is buying and selling at a ahead price-to-sales ratio of 14.93 in contrast with the business’s 1.46. It’s above its five-year median of 6.78. The corporate’s Worth Rating of F means that the inventory isn’t so low cost and signifies a stretched valuation at this second.

Picture Supply: Zacks Funding Analysis

Ur-Vitality is buying and selling a lot decrease than Cameco, at 4.66X. In the meantime, Vitality Fuels and Uranium Vitality are at present buying and selling increased at 37.83X and 96.59X, respectively.

Picture Supply: Zacks Funding Analysis

Cameco’s Debt Ranges are Greater Than Friends

CCJ had a complete debt-to-total capital ratio of 0.13% as of June 30, 2025. In the meantime, Vitality Fuels and Uranium Vitality have debt-free stability sheets. Ur-Vitality’s complete debt-to-total capital ratio is 0.01%.

CCJ’s Lengthy-Time period Fundamentals Stay Robust

The nuclear energy sector is experiencing a robust upswing, pushed by world occasions, the urgency of vitality safety and a surge in low-carbon vitality demand ensuing from the local weather disaster. Cameco is uniquely positioned to capitalize on this growth, because of its high-quality, low-cost asset base and its strategic involvement throughout all the nuclear gasoline provide chain.

CCJ continues to put money into rising manufacturing and capitalizing on market alternatives. Work is underway to increase the mine life at Cigar Lake to 2036. Cameco can also be rising manufacturing at McArthur River and Key Lake from 18 million kilos to its licensed annual capability of 25 million kilos (100% foundation).

Our Closing Tackle CCJ Inventory

Supported by a robust stability sheet, the corporate is making investments to spice up its capability to capitalize on the anticipated surge in uranium demand. Nevertheless, new traders can anticipate a greater entry level, contemplating the premium valuation, lowered manufacturing outlook and the downward estimate revision exercise. The inventory at present carries a Zacks Rank #3 (Maintain).

You possibly can see the entire checklist of right now’s Zacks #1 Rank (Robust Purchase) shares right here.

Past Nvidia: AI’s Second Wave Is Right here

The AI revolution has already minted millionaires. However the shares everybody is aware of about aren’t more likely to preserve delivering the largest income. Little-known AI companies tackling the world’s largest issues could also be extra profitable within the coming months and years.

See “2nd Wave” AI shares now >>

Cameco Company (CCJ) : Free Inventory Evaluation Report

Ur Vitality Inc (URG) : Free Inventory Evaluation Report

Vitality Fuels Inc (UUUU) : Free Inventory Evaluation Report

Uranium Vitality Corp. (UEC) : Free Inventory Evaluation Report

This text initially revealed on Zacks Funding Analysis (zacks.com).

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.