Buyers, particularly merchants, are accustomed to Reddit RDDT and have helped enhance the social media firm’s recognition by participating in its notorious community-led platforms, akin to WallStreetBets, which has been instrumental in creating the meme inventory phenomenon.

We are able to all recount a number of the most well-known meme shares that usually surge because of heightened recognition on Reddit, with GameStop GME and AMC Leisure AMC coming to thoughts.

Over time, this consideration has made Reddit one of many fastest-growing media shops, given its area of interest as a vacation spot for significant social information aggregation.

Often known as the “entrance web page of the web”, it’s no shock that Reddit inventory has been one of many hottest IPO’s since going public in March of final 12 months, with RDDT now up an exhilarating +300%.

Higher nonetheless, the decision for extra upside is beginning to be justified as Reddit’s sturdy person engagement and explosive promoting development are beginning to amplify its future earnings potential.

Picture Supply: Zacks Funding Analysis

Promoting Income Increase

Like most social media corporations, together with giants like Meta Platforms META, Reddit derives the vast majority of its income from promoting, and most not too long ago reported an 84% enhance in advert income of $465 million throughout Q2. This was attributed to a 50% enhance in energetic advertisers, with Reddit additionally posting a 47% spike in common income per person (ARPU) at $4.53.

Lifting advertiser curiosity and its inside operations has been Reddit Pixel, CAPI, and Smarty.io (AI-Powered Automation), that are advert instruments which can be boosting and integrating person conversion and monitoring information. General, Reddit’s Q2 gross sales soared over 77% to $499.63 million.

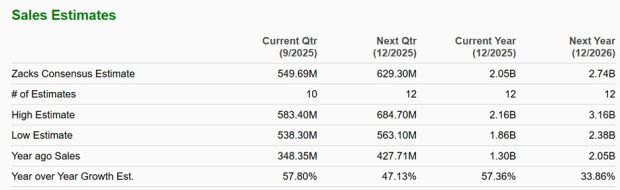

Notably, Reddit is scheduled to launch Q3 outcomes on Tuesday, November 4th, with Zacks projections calling for its prime line to increase almost 58% to $549.69 million in comparison with $348.35 million within the prior 12 months quarter (Present Qtr beneath).

Extra intriguing, Reddit’s annual gross sales at the moment are anticipated to climb over 57% in fiscal 2025 and are projected to soar one other 34% in FY26 to $2.74 billion.

Picture Supply: Zacks Funding Analysis

Sturdy Person Engagement Metrics

Most compelling about Reddit’s sturdy person engagement metrics is an increasing international base, as worldwide day by day energetic customers (DAU) elevated 32% throughout Q2 to 60.1 million. It’s noteworthy that this drove a greater than 70% surge in international income, with whole DAUs growing 21% to 110.4 million.

It’s additionally vital to level out that Reddit’s log-out customers had been at 61.1 million, and are rising sooner than its log-in customers, suggesting its attain is increasing past its core group.

Reddit Surges Previous The Profitability Line

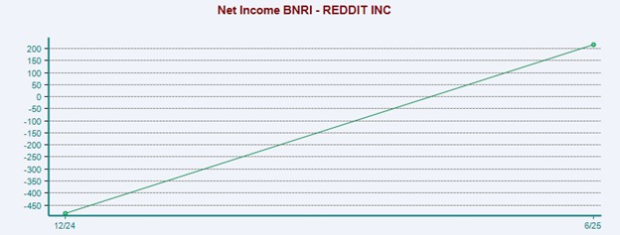

Attending to Reddit’s earnings potential, Q2 2025 marked the corporate’s first worthwhile quarter regardless of beforehand reporting optimistic earnings per share (EPS) in different quarters. Nevertheless, by way of a greenback quantity, Reddit’s adjusted internet earnings swung into the black for the primary time at $89 million from a lack of $10 million in Q2 2024.

Gross margins additionally hit a brand new peak of 90.8%, with Reddit launching a high-margin information licensing enterprise to enhance its advert income mannequin during which it sells entry to huge troves of user-generated content material for AI coaching and analytics.

Moreover, many analysts predict Reddit will flip an annual internet revenue of over $150 million this 12 months, in comparison with a internet lack of $484 million in 2024.

Picture Supply: Zacks Funding Analysis

Reddit is projected to publish high-double-digit EPS development for the foreseeable future, with Q2 earnings of $0.45 a share crushing expectations of $0.20 and skyrocketing from an adjusted lack of -$0.06 per share a 12 months in the past. Even higher is that FY25 and FY26 EPS revisions have trended noticeably increased during the last 90 days.

Picture Supply: Zacks Funding Analysis

RDDT Value Goal & Analyst Upgrades

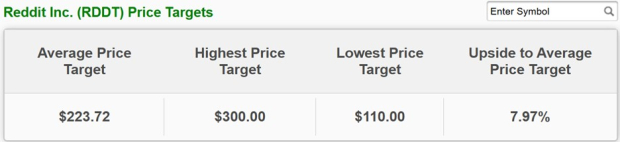

Primarily based on short-term worth targets provided by 25 analysts, the present Common Zacks Value Goal of $223.72 a share suggests 8% upside for Reddit inventory.

That mentioned, RDDT is beginning to obtain extra bullish forecasts primarily based on Reddit’s development trajectory, with JMP Securities and Piper Sandler not too long ago lifting their worth targets to street-highs of $300 and $290, respectively.

Picture Supply: Zacks Funding Analysis

Backside Line

Having an expansive person base, Reddit’s platform is able to producing profitable promoting income, which is being glorified by higher monetization per person. Protecting this in thoughts, RDDT might have extra room to run as Reddit appears to be like poised to develop into its valuation.

5 Shares Set to Double

Every was handpicked by a Zacks knowledgeable because the #1 favourite inventory to achieve +100% or extra within the coming 12 months. Whereas not all picks will be winners, earlier suggestions have soared +112%, +171%, +209% and +232%.

Many of the shares on this report are flying beneath Wall Avenue radar, which gives an awesome alternative to get in on the bottom ground.

At this time, See These 5 Potential Dwelling Runs >>

Reddit Inc. (RDDT) : Free Inventory Evaluation Report

GameStop Corp. (GME) : Free Inventory Evaluation Report

AMC Leisure Holdings, Inc. (AMC) : Free Inventory Evaluation Report

Meta Platforms, Inc. (META) : Free Inventory Evaluation Report

This text initially printed on Zacks Funding Analysis (zacks.com).

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.