Elliott Wave concept is a technique of technical evaluation that Bitcoin merchants search for recurrent long-term Bitcoin (BTC) value patterns. The Elliott wave concept says {that a} crypto asset resembling Bitcoin (BTC) value actions could be predicted as they transfer in repeating up-and-down patterns referred to as waves created by investor psychology.

Be aware that Elliott wave or patterns don’t present any form of certainty about Bitcoin (BTC) future value motion, however slightly, serve in serving to to seek out the chances for BTC future market motion.

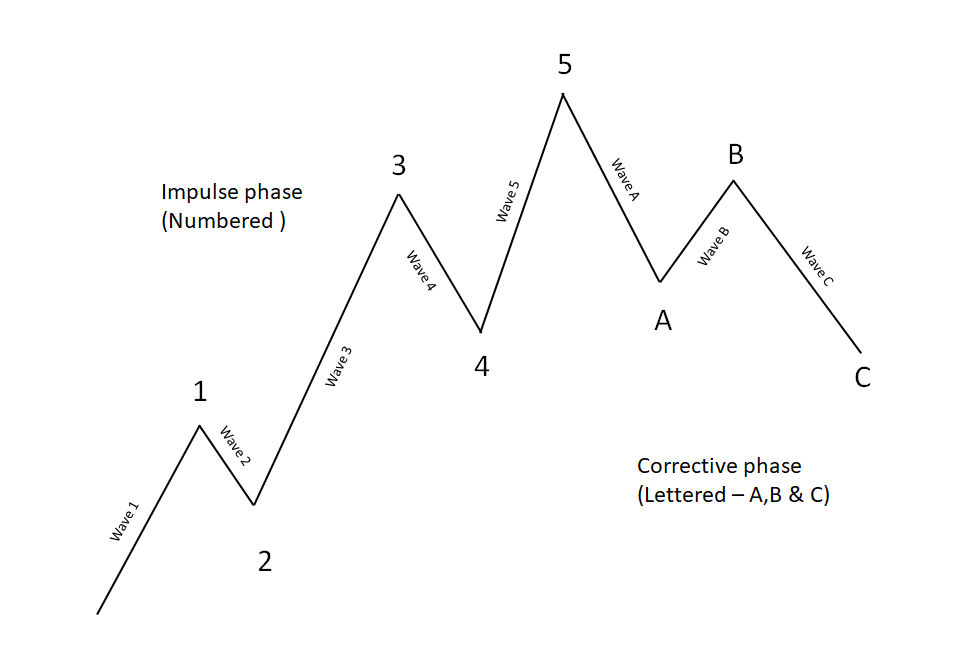

The speculation identifies two various kinds of waves – impulse waves, and corrective waves.

Impulse wave:

Impulse waves consist of 5 sub-waves that make internet Bitcoin (BTC) motion in the identical path. Nevertheless, it has three guidelines that outline its formation. These guidelines are unbreakable. If the sample violates considered one of these guidelines, then the construction is just not an impulse wave. The three guidelines are:

- Wave two can’t retrace greater than 100% of wave one;

- Wave three can by no means be the shortest of waves one, three, and 5.

Corrective waves:

Within the Elliott wave mannequin, the Corrective wave consists of three, or a mixture of three, sub-waves that make internet Bitcoin (BTC) motion within the path reverse to the development. Similar as an impulse wave, every sub-wave of the diagonal by no means totally retraces the earlier sub-wave, and sub-wave three of the diagonal will not be the shortest wave.

Merely put, motion within the path of the development is unfolding in 5 waves referred to as Impulse wave. Whereas any correction in opposition to the development is in three waves often called the corrective wave.

And the three-wave correction is labeled as a, b, and c.

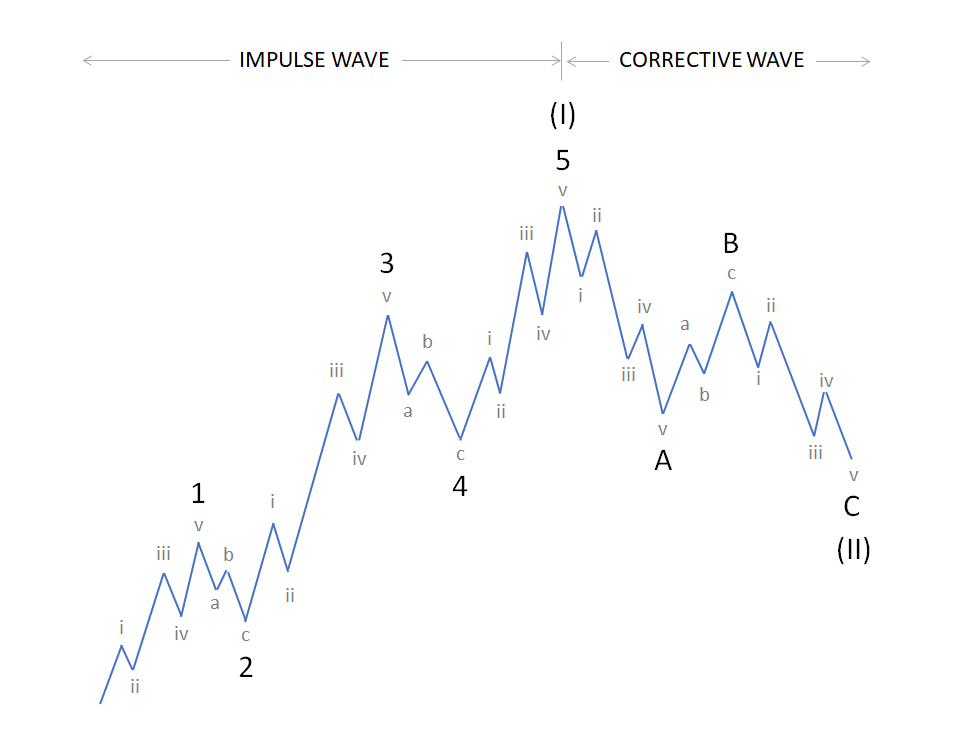

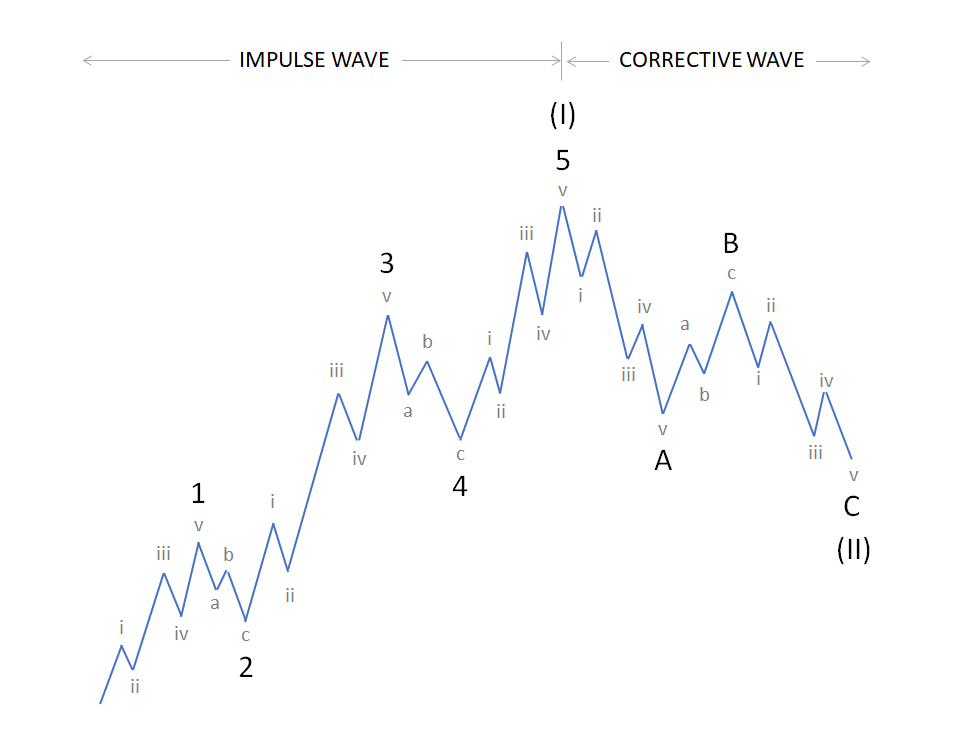

The Elliott wave mannequin means that an asset resembling Bitcoin (BTC) market value can alternate between an impulse and a corrective section on all time scales of the development. These impulse and corrective waves are nested in a self-similar fractal to create bigger patterns. That means, smaller patterns could be recognized inside greater patterns.

These patterns could be seen in the long run in addition to quick time period charts. For instance, a one-year chart could also be within the midst of a corrective wave, however a 30-day chart might present a growing impulse wave. A dealer thus may need a long-term bearish outlook with a short-term bullish outlook.

Within the above picture, wave 1, 3 and 5 are subdivided into 5 smaller diploma impulses labelled as i, ii, iii, iv, and v. Wave 2 and 4 are corrective waves and they’re subdivided into 3 smaller diploma waves labelled as a, b, and c. The 5 waves transfer in waves 1, 2, 3, 4, and 5 make up a bigger diploma Impulse wave (I).

Corrective waves subdivide into 3 smaller-degree waves, denoted as ABC. Corrective waves begin with a 5 wave counter-trend impulse (wave A), a retrace (wave B), and one other impulse (wave C). The three waves A, B, and C make up a bigger diploma corrective wave (II).