Be a part of Our Telegram channel to remain updated on breaking information protection

BlackRock’s (BLOK) Bitcoin ETP (exchange-traded product) has began buying and selling on the London Inventory Trade in the present day after the UK’s Monetary Conduct Authority (FCA) lifted its ban on sure Bitcoin-based ETPs.

That’s the first such product supplied by the asset administration large within the UK. In its first hour of buying and selling, the IB1T ETP noticed buying and selling volumes of 1,000 shares on the London Inventory Trade.

London Inventory Trade Launch Builds On European Presence

The iShares Bitcoin ETP began buying and selling on the London Inventory Trade beneath the ticker “IB1T,” and permits traders within the UK to achieve publicity to Bitcoin via a regulated market while not having to carry the crypto straight.

BlackRock’s product was already out there to some European traders. That is after it listed on Xetra, Euronext Amsterdam and Euronext Paris in the direction of the tip of March this yr, in line with BlackRock’s web site.

The London Inventory Trade itemizing comes after the FCA opened up entry to crypto ETPs for retail traders. This rule change had come into impact on Oct. 8.

Previous to that rule change, the FCA had barred retail entry to crypto ETPs in 2021 because of issues round investor protections.

One of many necessities for retail traders within the UK to purchase into crypto ETPs is that the merchandise should be listed on acknowledged, FCA-approved UK-based exchanges. Merchandise will even must observe monetary promotion guidelines to stop deceptive promoting and inappropriate incentives.

BlackRock Seems To Cement Its Dominance In The Bitcoin ETF Market

BlackRock manages over $13 trillion in property globally, and has seen sturdy development in its crypto-focused merchandise.

Its flagship US spot Bitcoin ETF, IBIT, was launched in January final yr and has recorded probably the most cumulative inflows of all the US merchandise since their inception.

Knowledge from Farside Traders exhibits that IBIT has seen $64.981 billion in cumulative inflows to this point. That is considerably greater than the second-biggest cumulative inflows of $12.554 billion that Constancy’s FBTC has seen because it launched.

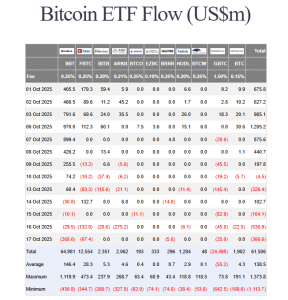

US spot BTC flows (Supply: Farside Traders)

IBIT has, nonetheless, been in a multi-day outflows streak, which it prolonged within the newest buying and selling session.

The product noticed $268.6 million depart its reserves on Oct. 17, which was the very best adverse flows seen on the day. Different funds, like Constancy’s FBTC, Valkyrie’s BRRR, and Grayscale’s GBTC noticed $67.4 million, $5.6 million, and $25 million outflows, respectively, on the identical day.

IBIT’s newest outflows got here after the product noticed $29.5 million outflows the day earlier than. On Oct. 15 and Oct. 14, the funding product noticed respective outflows of $10.1 million and $30.8 million as effectively.

Regardless of the current outflows, IBIT has been one of many high performers in each the US spot Bitcoin ETF market and amongst BlackRock’s different ETFs.

Simply 374 days after launch, IBIT crossed $80 billion in property beneath administration, changing into the quickest ETF in historical past to realize this milestone.

Its AUM then continued to develop at the beginning of October, and got here inside attain of $100 billion, in line with Bloomberg ETF analyst Eric Balchunas. Nevertheless, its AUM has since dropped to round $85.78 billion after a broader crypto market pullback, the fund’s web page exhibits.

$IBIT a hair away from $100 billion, is now probably the most worthwhile ETF for BlackRock by a very good quantity now primarily based on present aum. Try the ages of the remainder of the High 10. Absurd. pic.twitter.com/E8ZMI2wynx

— Eric Balchunas (@EricBalchunas) October 6, 2025

IBIT has additionally outperformed BlackRock’s widespread S&P 500 fund when it comes to annual charges to grow to be the asset supervisor’s most worthwhile ETF.

BlackRock’s CEO Has A Change In Stance In the direction of Crypto

A lot of BlackRock’s enlargement into the digital asset area has to do with its CEO, Larry Fink’s, change in stance.

In 2018, Fink described Bitcoin as a “speculative” asset and questioned why it “has a lot fascination for the press.”

In 2021, he then stated that BlackRock was learning cryptos like Bitcoin, however nonetheless argued that it was too early again then to say whether or not cryptos have been greater than speculative buying and selling instruments.

In October this yr, nonetheless, Fink stated that Bitcoin has the same position to gold as a portfolio diversifier, and admitted that he was flawed about his earlier anti-Bitcoin feedback.

CEO of world’s largest asset supervisor…

“We’re simply originally of the tokenization of all property.”

Sure, contains ETFs.

Larry Fink on his positively evolving perspective in the direction of crypto: “I develop & be taught.”

Good lesson right here.

And a few of you *nonetheless* assume crypto is a rip-off. pic.twitter.com/GJ8oxWF3vK

— Nate Geraci (@NateGeraci) October 15, 2025

Whereas his stance could have shifted, Fink did nonetheless warning in opposition to traders making Bitcoin a big element of their portfolios.

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be a part of Our Telegram channel to remain updated on breaking information protection