The worth of Bitcoin seems to have cooled off after displaying nice energy in recovering the $90,000 degree over the previous week. Based on the most recent worth motion knowledge, this worth bounce will solely be transient, because the premier cryptocurrency is seemingly nonetheless caught in a bearish construction.

BTC Worth Momentum Continues To Gradual Down

On November 29, market analyst Axel Adler Jr. shared a recent outlook on the worth of BTC on the social media platform X. The crypto pundit revealed that the market chief is likely to be getting into a zone of “elevated threat for a chronic correction.”

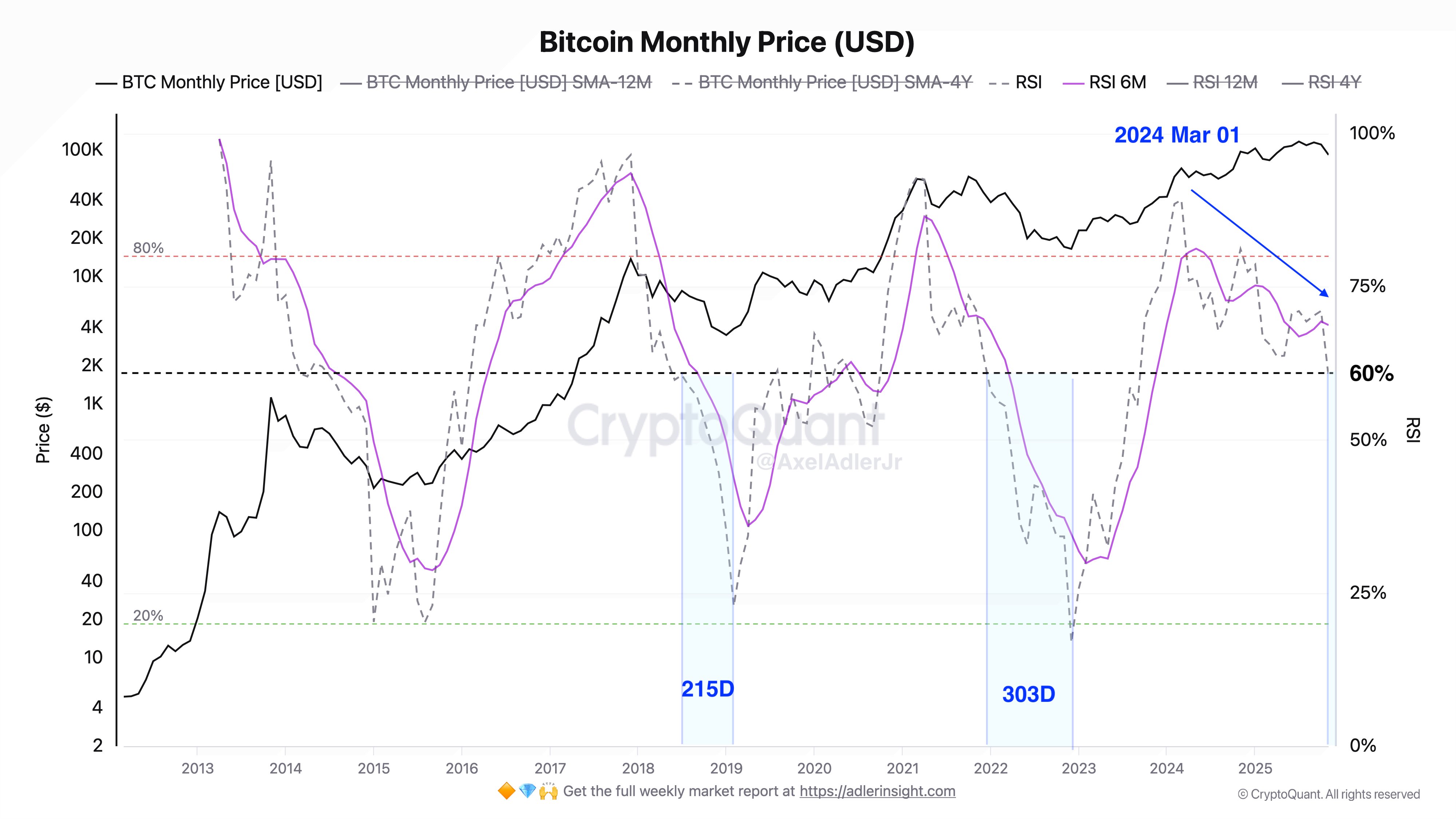

Based on Adler Jr., the worth momentum of Bitcoin has been witnessing a cool-off since March 2024. This commentary relies on adjustments within the month-to-month Relative Power Index, an indicator that measures the pace and magnitude at which an asset’s worth adjustments.

Associated Studying: Bitcoin Traders Are Not ‘Remotely Bullish Sufficient’ — Bitwise Researcher

Information from CryptoQuant reveals that the month-to-month Bitcoin RSI has fallen from overheated ranges right down to 60% since March 2024, a interval marked by important worth surges. From a historic perspective, this decline may spell additional hassle for the worth of BTC.

Supply: @AxelAdlerJr on X

As Adler Jr. highlighted on X, the flagship cryptocurrency took between 200 to 300 days to start a brand new bullish wave after an RSI decline of that magnitude within the earlier two cycles. Utilizing this historic sample, the Bitcoin worth won’t attain its subsequent backside till between June and October 2026.

Bitcoin Whales Present Diminished Conviction: Alphractal CEO

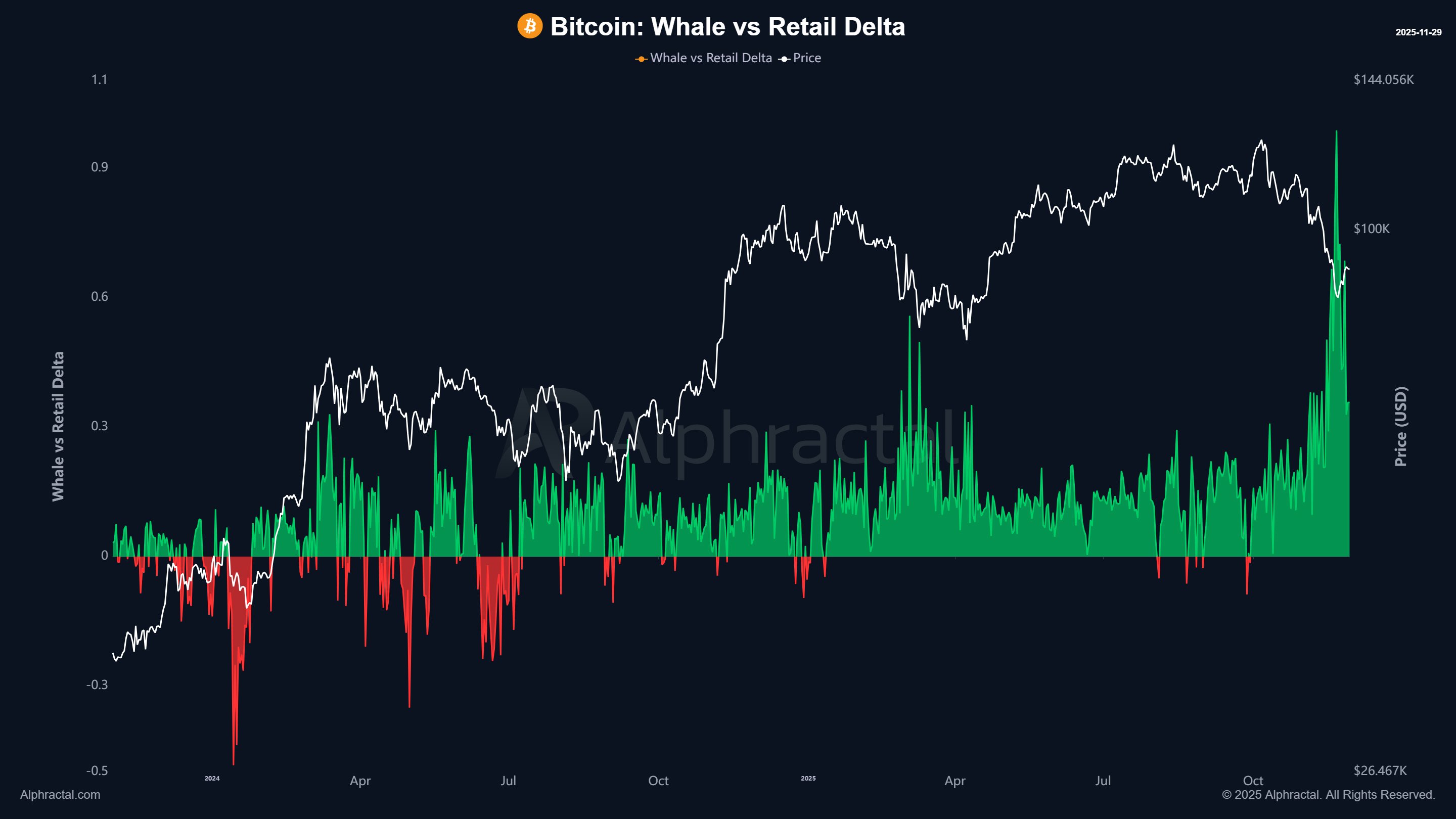

From a special on-chain standpoint, Alphractal CEO and founder Joao Wedson additionally has an identical not-so-optimistic stance on the worth of Bitcoin within the close to time period. This analysis relies on the positions of the biggest traders (whales) in comparison with retail traders.

Based on Wedson, BTC whales are both closing their lengthy positions or barely rising their BTC shorts in comparison with retail traders. Sometimes, this pattern results in a interval of sideways worth motion — as seen between March and April 2025.

Supply: @joao_wedson on X

Wedson additionally famous that some bears are most likely trying to push the BTC worth towards the $80,000 degree earlier than happening an accumulation spree. In the end, the mixture of the falling momentum and whales’ lack of conviction paints a considerably pessimistic image for Bitcoin.

As of this writing, the worth of BTC stands at round $90,979, reflecting no important adjustments prior to now 24 hours. In the meantime, the market chief is up by greater than 7% on the weekly timeframe, in keeping with knowledge from CoinGecko.

The worth of BTC on the every day timeframe | Supply: BTCUSDT chart on TradingView

Featured picture from iStock, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our crew of high expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.