Be part of Our Telegram channel to remain updated on breaking information protection

The Bitcoin worth edged up 1.5% over the previous 24 hours to commerce at $91,231 as of 11:36 a.m. EST, on buying and selling quantity that dropped 45% to $26.7 billion.

This comes as Bitcoiners celebrated “Genesis Day.” The day the primary block was mined on the Bitcoin community by pseudonymous BTC creator Satoshi Nakamoto.

Nakamoto mined the Bitcoin Genesis Block on January 3, 2009.

“Glad Bitcoin Genesis Block day,” Paolo Ardoino, the CEO of stablecoin issuer Tether, stated. On the identical time, Sam Callahan, the director of technique and analysis at BTC treasury firm OranjeBTC, echoed the message.

Glad Bitcoin Genesis Block day

— Paolo Ardoino 🤖 (@paoloardoino) January 3, 2026

The Bitcoin group usually factors to the message within the Genesis Block as a logo of Bitcoin’s core concept: a decentralized type of cash that can not be inflated or debased due to its fastened provide.

BTC is now up 4% within the final week. Can the pattern proceed, or will the bears act on the current surge?

Bitcoin Value Rebounds – Restoration Builds Inside Rising Channel

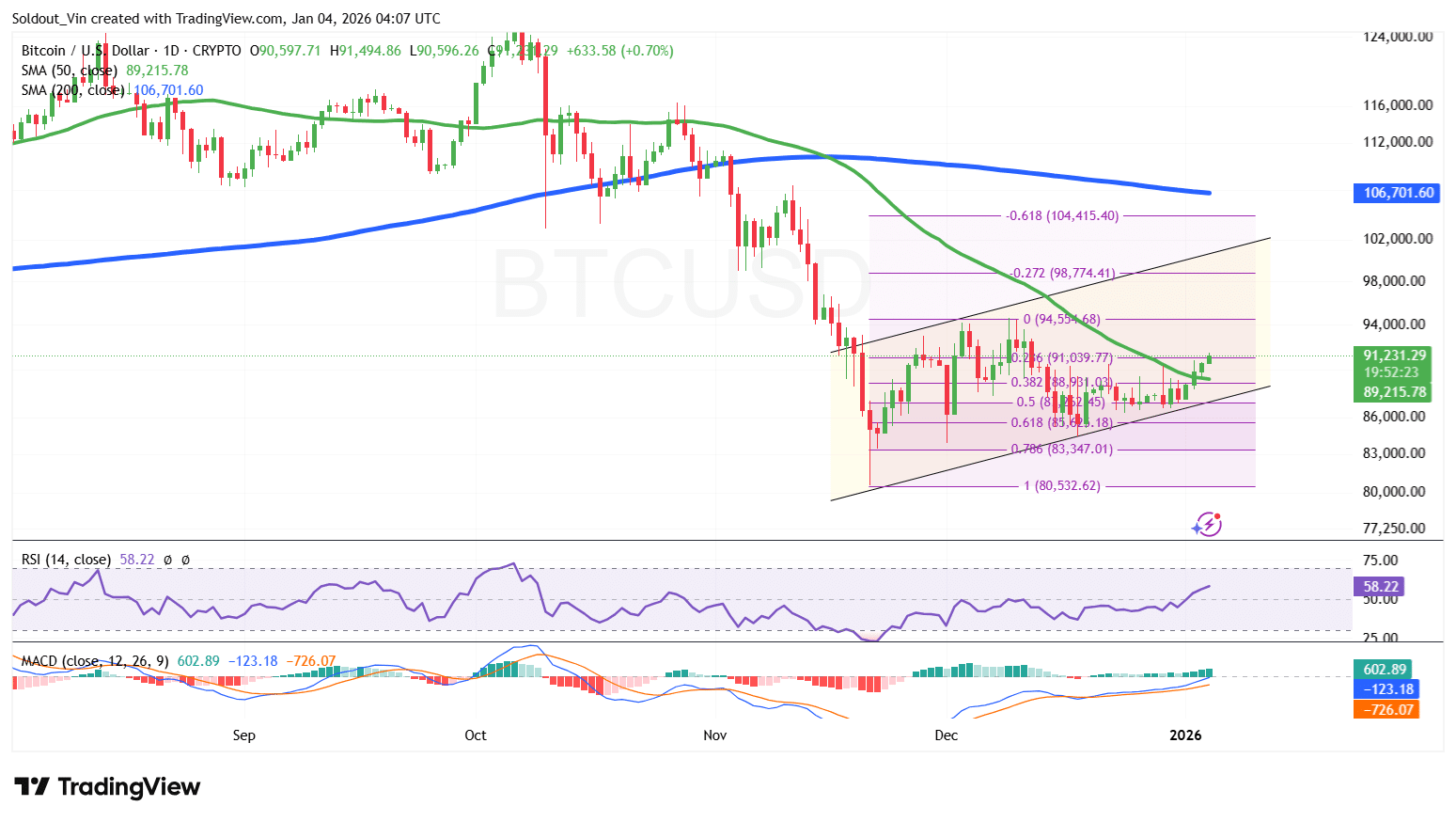

The BTC worth is exhibiting indicators of a gradual restoration after rebounding from the current swing low close to $80,500 and buying and selling above key Fibonacci assist ranges within the $85,500–$88,000 area.

This restoration comes as Bitcoin makes an attempt to stabilize following a pointy corrective transfer from the $110,000–$115,000 space, the place the flagship crypto confronted intense promoting strain after an prolonged rally.

Bitcoin’s decline accelerated as soon as the worth dropped beneath each the 50-day and 200-day Easy Shifting Averages (SMAs), confirming a bearish shift in construction because the market entered a corrective section. The failure to carry above the 200-day SMA round $106,700 marked the beginning of a deeper pullback.

The sell-off drove BTC via a number of Fibonacci retracement ranges, with the 0.618 Fib degree close to $85,500 appearing as a essential demand zone. This space attracted consumers and helped kind a better low, permitting bulls to regain short-term management.

From this assist, Bitcoin started climbing inside a rising channel, reclaiming the 50-day SMA round $89,200, which is now appearing as assist and reinforcing the short-term bullish construction.

The Shifting Common Convergence Divergence (MACD) has flipped bullish, with the MACD line crossing above the sign line and histogram bars turning constructive above the impartial degree. This indicators bettering momentum and rising purchaser participation.

In the meantime, the Relative Power Index (RSI) helps the restoration narrative, because it has pushed above the 50 midline to round 58, indicating strengthening bullish momentum with out coming into overbought situations.

BTC Value Outlook

Based mostly on the BTC/USD day by day chart evaluation, Bitcoin is positioned for a continued restoration so long as the worth holds above the 50-day SMA and stays throughout the ascending channel.

If bullish momentum persists, the BTC worth might goal key Fibonacci resistance ranges, with the subsequent upside zones round $94,500, adopted by $98,700 (-0.272 Fib). A stronger continuation might see BTC check the $104,000–$106,700 area, aligning with the −0.618 Fibonacci degree and the 200-day SMA.

On the draw back, if momentum weakens and the RSI approaches overbought territory, short-term profit-taking might push BTC again towards the $88,000–$89,000 assist zone.

A breakdown beneath this space could expose the Bitcoin worth to a deeper pullback towards the $85,500 (0.618 Fib) area, which stays a key cushion towards renewed promoting strain.

Associated Information:

Finest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be part of Our Telegram channel to remain updated on breaking information protection