Crypto buyers and consultants anticipate a bullish November after Bitcoin ended within the purple final month, for the primary time in over 6 years. Crypto market crash issues proceed as BTC value falls underneath $108K as a consequence of varied causes, together with the US Supreme Courtroom’s choice on Trump tariffs.

Hindenburg Omen Indicator Triggered, Will Crypto Market Crash?

The Hindenburg Omen technical indicator that predicted the 1987 Black Monday and the 2008 Monetary Disaster has flashed a warning signal. With the crypto market shifting in correlation with the inventory market, merchants and establishments are contemplating the excessive dangers for a Bitcoin and a broader crypto market crash additional.

The controversial indicator flashed for the second time final month. Knowledgeable Tom McClellan claimed it “tends to matter extra after we see a cluster of them.” The timing has raised extra issues amongst buyers amid spot Bitcoin and Ethereum ETFs outflow and a stoop in costs of tech shares, together with Meta, Oracle, and Microsoft.

Crypto Market Awaits Supreme Courtroom Resolution on Trump Tariffs

International markets await the U.S. Supreme Courtroom proceedings on Trump tariffs on Wednesday. Instances by companies and a gaggle of states contend that Trump’s commerce technique of elevating tariffs is prohibited and needs to be struck down.

The USA might develop into a third-world nation with out tariffs, President Donald Trump posted on Fact Social on November 3. The case on tariffs is without doubt one of the most essential in historical past, he added.

“What occurs to your financial plan if the Supreme courtroom invalidates tariffs?”@POTUS: “I feel our nation could be immeasurably damage. I feel our economic system will go to hell… I feel it is crucial topic mentioned by the Supreme Courtroom in 100 years.” pic.twitter.com/ciBJMxUncF

— Speedy Response 47 (@RapidResponse47) November 3, 2025

Trump signed a number of commerce offers throughout his Asia go to final week, together with a landmark commerce take care of China. Bitcoin and the broader crypto market rebounded as Trump lowered tariffs on China to 47% and reached a 1-year commerce deal on uncommon earths and significant minerals.

Selloffs by Whales Spark Crypto Market Crash Considerations

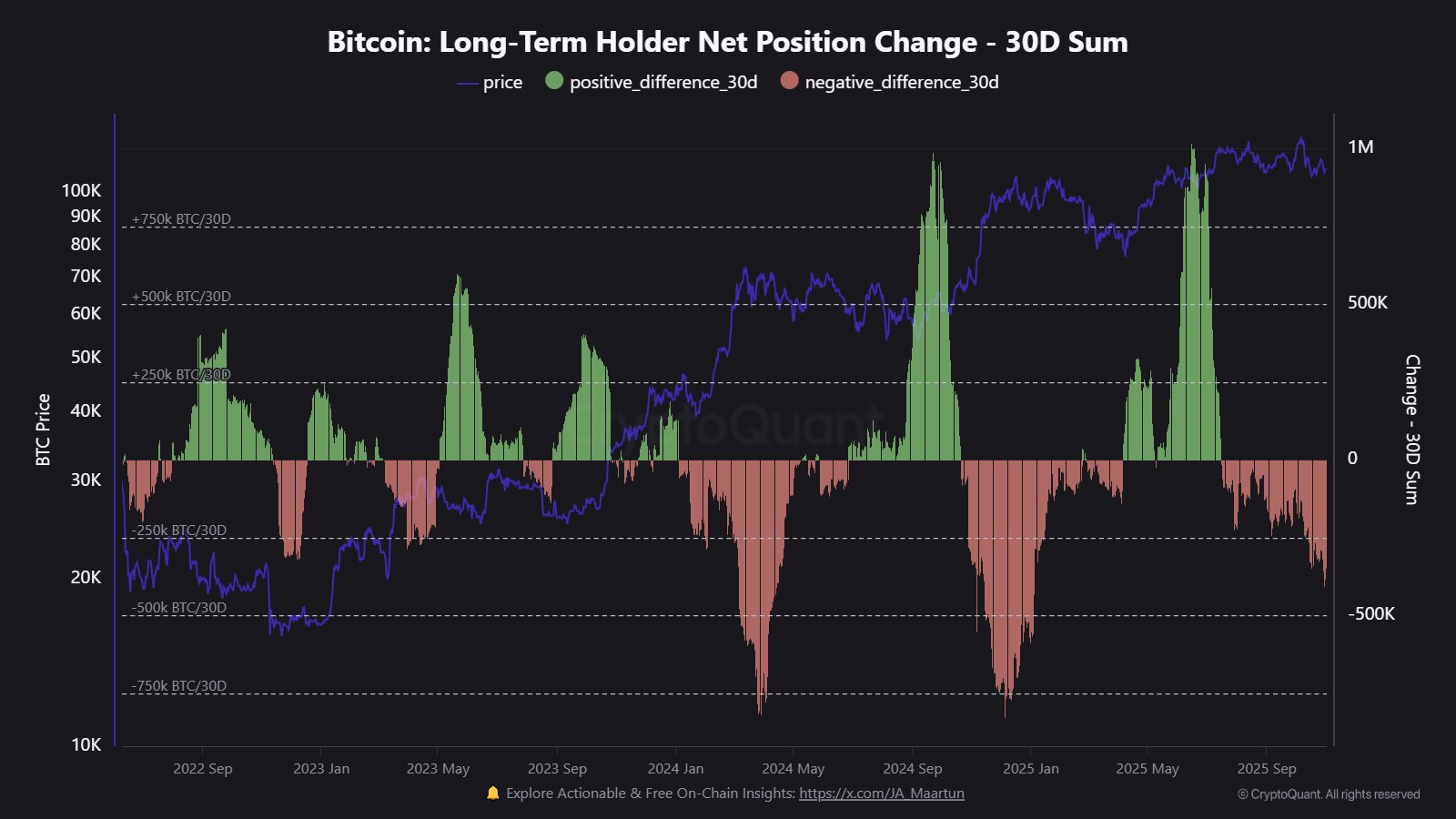

Whales and long-term holders have been promoting their crypto holdings. As per on-chain knowledge, long-term holders have offloaded 405,000 BTC up to now 30 days. The crypto market noticed almost $450 million in liquidations up to now 24 hours, with $250 million liquidated in simply 4 hours.

Lookonchain identified that Bitcoin OGs are dumping BTC in the previous couple of weeks. A whale deposited 13K BTC price $1.48 billion to Kraken, Binance, Coinbase, and Hyperliquid in October. Additionally, Owen Gunden has deposited 483.3 BTC price $53 million as we speak, increasing selloffs to $364.5 million within the final 2 weeks.

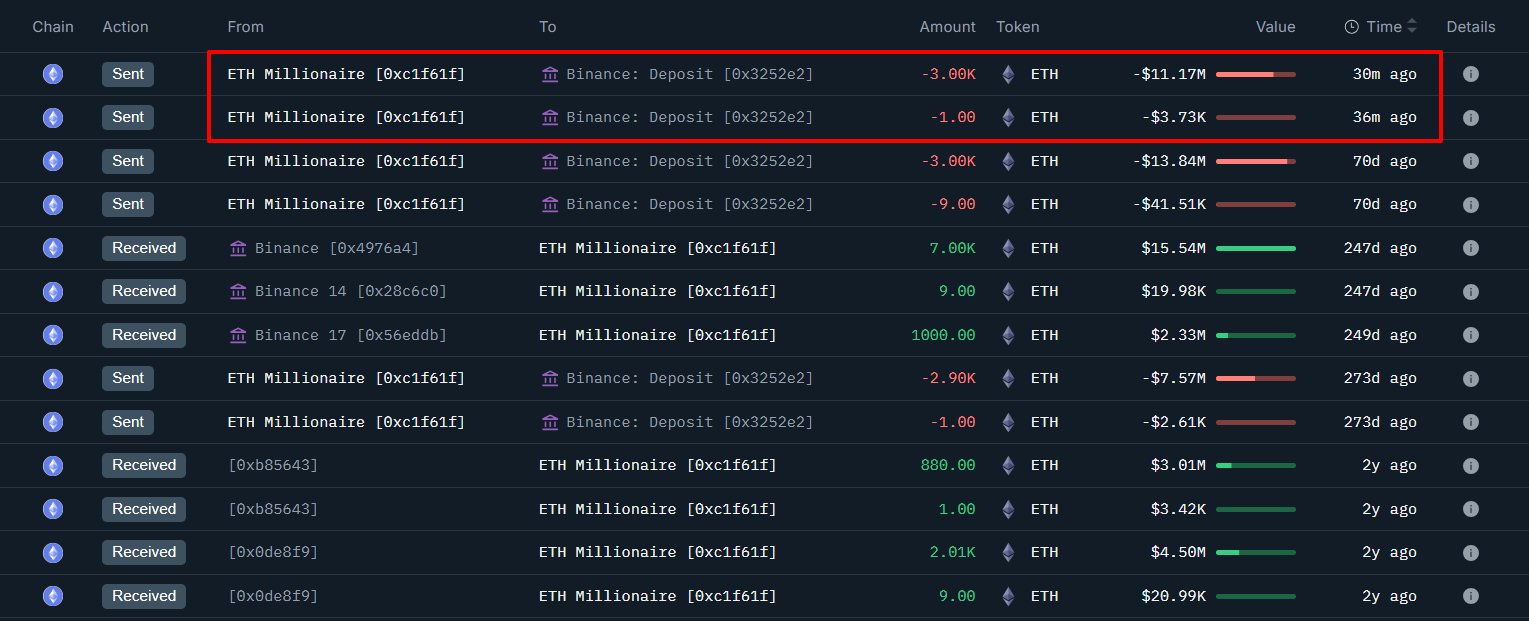

Onchain Lens additionally reported {that a} whale deposited 3,000 ETH price $11.17 million to Binance, making a revenue of $14.76 million. The whale nonetheless holds 2,000 ETH price $7.48 million.

10x Analysis predicts a crypto market crash, with Bitcoin value breaking under the help at $107,000. The agency cited cooling ETF demand, shifting miner economics towards AI, and weakening Ethereum patterns amid a thinning purchaser base as key causes.

The declining worth of Bitcoin treasury shares and regular promoting by mega whales have additional added promoting stress. Whereas many see it as a wholesome correction, a shift in market psychology can’t be prevented. “This week’s tape will inform us whether or not capital steps again in or whether or not this rotation is barely simply starting,” 10x Analysis famous.

Bitcoin would break this help line at $107,000 pic.twitter.com/ieByNXR8hu

— 10x Analysis (@10x_Research) November 3, 2025