Bitcoin is coming into a decisive second as promoting stress intensifies and uncertainty continues to grip the market. Bulls are struggling to reclaim larger ranges, and every failed rebound reinforces the prevailing downtrend. With momentum weakening throughout spot and derivatives markets, traders are more and more questioning whether or not BTC can stabilize earlier than extra critical structural harm happens.

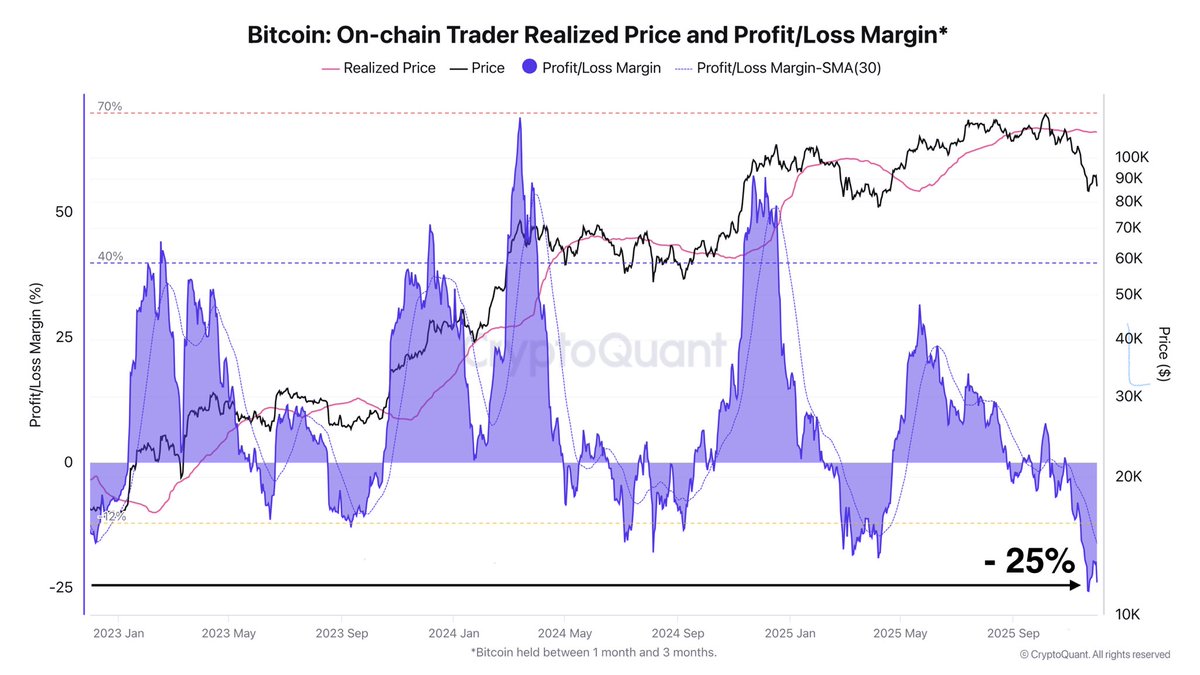

In line with a report by Darkfost, the state of affairs is particularly troublesome for short-term members. With a realized value of $113,692, the BTC 1–3 month cohort is now experiencing the biggest proportion lack of this complete cycle.

This evaluation focuses solely on the spot market, isolating a gaggle of traders identified for extra speculative habits and sooner response instances. As a result of these holders sometimes enter throughout sturdy momentum phases, their capitulation or continued holding typically indicators pivotal shifts in market construction.

The deep losses inside this cohort reveal how aggressively the market has reversed and underscore the mounting stress on shorter-term gamers. As Bitcoin approaches important help ranges, the habits of those traders might decide whether or not the present correction stabilizes — or accelerates right into a broader downturn.

Brief-Time period Holder Capitulation Usually Alerts Backside Formation

Darkfost highlights that the 1–3 month Bitcoin holder cohort has now spent almost two weeks sitting on common unrealized losses between 20% and 25%. Traditionally, such a drawdown amongst short-term members has tended to happen close to cyclical backside formation.

These merchants sometimes react rapidly to volatility, and when their losses attain this depth, they’re pushed right into a important resolution level: promote and exit the market, or maintain and endure additional draw back.

All through this cycle, comparable phases of elevated losses have preceded main inflection factors. As soon as a big portion of those speculative holders capitulates — a course of that seems to have been unfolding in latest weeks — promoting stress normally begins to exhaust. This shift typically creates an surroundings the place accumulation turns into way more engaging for affected person traders who observe sentiment and realized-price dynamics.

Nonetheless, Darkfost emphasizes that this sample solely holds if the long-term bullish development stays intact. Structural on-chain indicators, broader demand tendencies, and long-horizon holder habits proceed to help the concept Bitcoin’s macro development has not been invalidated.

Whereas volatility might persist within the quick time period, the alignment of capitulation indicators with a still-intact long-term construction means that present ranges might turn out to be a chance for strategic accumulation.

Bitcoin Assessments Weekly Degree as Market Searches for Increased-Timeframe Help

Bitcoin’s weekly chart reveals essentially the most important corrective section for the reason that early levels of the cycle, with value falling sharply from the $120,000 area and now making an attempt to stabilize across the 100 SMA close to $84,000–$85,000. This transferring common has traditionally acted as a serious structural help throughout bull markets, and BTC’s present interplay with it marks a important juncture for the broader development.

The breakdown under the 50 SMA was a transparent signal of weakening momentum, signaling that sellers have gained management of the higher-timeframe construction. Nonetheless, the wick fashioned beneath the 100 SMA means that patrons are starting to step in, making an attempt to defend this important zone. The response to date is constructive however not but decisive — BTC wants a stronger weekly shut above $90,000 to substantiate stability.

Quantity has elevated in the course of the decline, indicating compelled promoting and capitulation quite than natural development reversal. Traditionally, pullbacks into the 100 SMA typically precede medium-term bottoms inside a long-term bullish market, however continuation relies on whether or not BTC can keep away from a sustained weekly shut under this degree.

Featured picture from ChatGPT, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our group of high know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.