Bitcoin has formally misplaced the important $85,000 stage, triggering a wave of panic throughout the market as worth briefly tagged the $81,000 zone. This breakdown has pushed the whole crypto ecosystem right into a deep corrective section, with concern escalating and liquidity quickly evaporating. Analysts warn that the market is now getting into full capitulation territory — a stage the place short-term holders (STHs) are pressured to appreciate heavy losses, usually accelerating downward momentum.

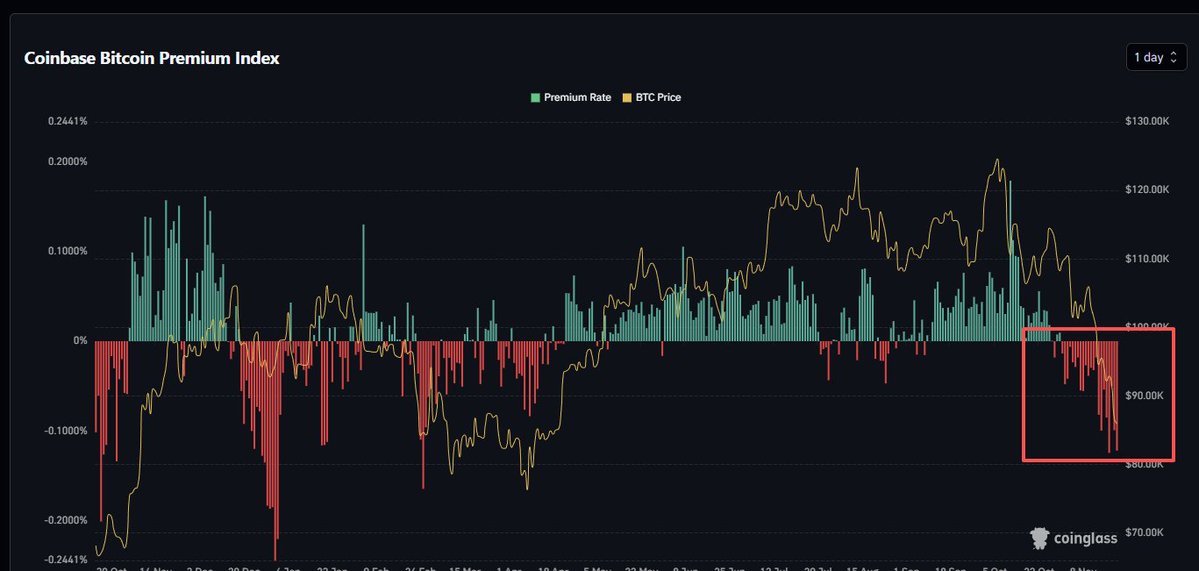

On-chain knowledge confirms the severity of the transfer. In keeping with CoinGlass, the Coinbase Bitcoin Premium Index has remained adverse for 21 consecutive days, marking the longest sustained promote streak of this cycle. A adverse premium means US spot-based merchants — traditionally among the many strongest demand segments — are promoting extra aggressively than world markets. This persistent stress confirms that sentiment amongst US buyers has flipped decisively bearish.

With STHs capitulating and main spot venues displaying sustained promote dominance, the market construction displays a basic late-stage correction. Traditionally, related circumstances have appeared throughout vital macro washouts — moments that both precede deeper breakdowns or set the muse for highly effective recoveries. For now, Bitcoin should reclaim larger ranges shortly to keep away from sliding into a protracted bear section.

Understanding the 21-Day Adverse Coinbase Premium

A 21-day streak of adverse Coinbase Premium is not only one other datapoint — it’s a clear sign that US-based spot demand has flipped aggressively bearish. The premium compares Bitcoin’s worth on Coinbase to world exchanges; when it turns adverse for this lengthy, it means American buyers are constantly promoting at a reduction, exerting persistent downward stress.

Traditionally, extended adverse readings have coincided with market stress, liquidity withdrawals, and risk-off habits — all of which match the present setting.

This development additionally displays how deeply short-term holders have capitulated. With many sitting on losses, even small worth drops set off panic promoting, reinforcing a suggestions loop that pushes costs decrease. Below these circumstances, Bitcoin should maintain present ranges to keep away from a deeper structural breakdown. If the value fails to stabilize, the market may enter a protracted bear section as confidence erodes and liquidity thins additional.

Nonetheless, not everybody agrees on the bearish final result. Some analysts argue that capitulation occasions like this — particularly when aligned with excessive adverse premiums — usually mark late-cycle cleanses somewhat than beginnings of a bear market. They imagine that if Bitcoin manages a quick restoration, the broader bull cycle may stay intact. However for now, the burden is on BTC to reclaim larger ranges earlier than sentiment deteriorates past restore.

Weekly Chart Indicators a Vital Breakdown

Bitcoin’s weekly chart reveals a pointy and decisive breakdown, with BTC falling to $82,571 after shedding the $85K stage. This transfer marks one of many strongest weekly sell-offs of the cycle, with the most recent candle dropping greater than 12% and shutting properly under the 50-week shifting common. The rejection from the $110K–$120K zone has now escalated right into a full breakdown, and momentum has flipped aggressively bearish.

Quantity confirms the shift. The previous two weeks present clear promoting dominance, with pink candles increasing as the value accelerates downward. This implies distribution somewhat than a short lived shakeout. The 100-week shifting common — presently close to $80K — now turns into the following main line of protection. A weekly shut under this space may open the door to a deeper flush towards the 200-week shifting common, a traditionally highly effective assist stage.

Structurally, BTC has damaged under a year-long uptrend construction, invalidating higher-timeframe bullish setups and signaling that consumers have misplaced management. Nonetheless, this space additionally aligns with the prior consolidation zone from late 2024, which means it may change into a key battleground for a possible backside.

To regain energy, Bitcoin must reclaim $90K shortly. In any other case, sentiment could deteriorate additional as extra holders transfer into loss and capitulation deepens.

Featured picture from ChatGPT, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our staff of high know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.