Bitcoin continues to commerce under the $100,000 mark, struggling to search out course amid rising indecision and chronic promoting strain. After briefly dipping towards $95,000, the market is trying to carry this key help stage as sentiment stays fragile. Merchants and buyers are carefully watching whether or not Bitcoin can stabilize right here or if additional draw back is imminent.

In keeping with high analyst Darkfost, the scenario has turn out to be more and more difficult for short-term holders (STHs) — those that acquired Bitcoin throughout the previous few months. Their common value foundation now sits close to $110,500, that means that almost all of this cohort has been underwater for a few month. This indicators widespread unrealized losses amongst newer market individuals, typically a precursor to emotional or panic-driven promoting.

For context, in the course of the March correction, short-term holders confronted related circumstances for roughly two months earlier than the market finally recovered. Whether or not historical past will repeat itself stays to be seen, however the extended strain on STHs is contributing to heightened volatility. As whales and long-term buyers stay extra steady, market resilience will probably depend upon how this reactive section behaves across the $95K–$100K vary within the coming days.

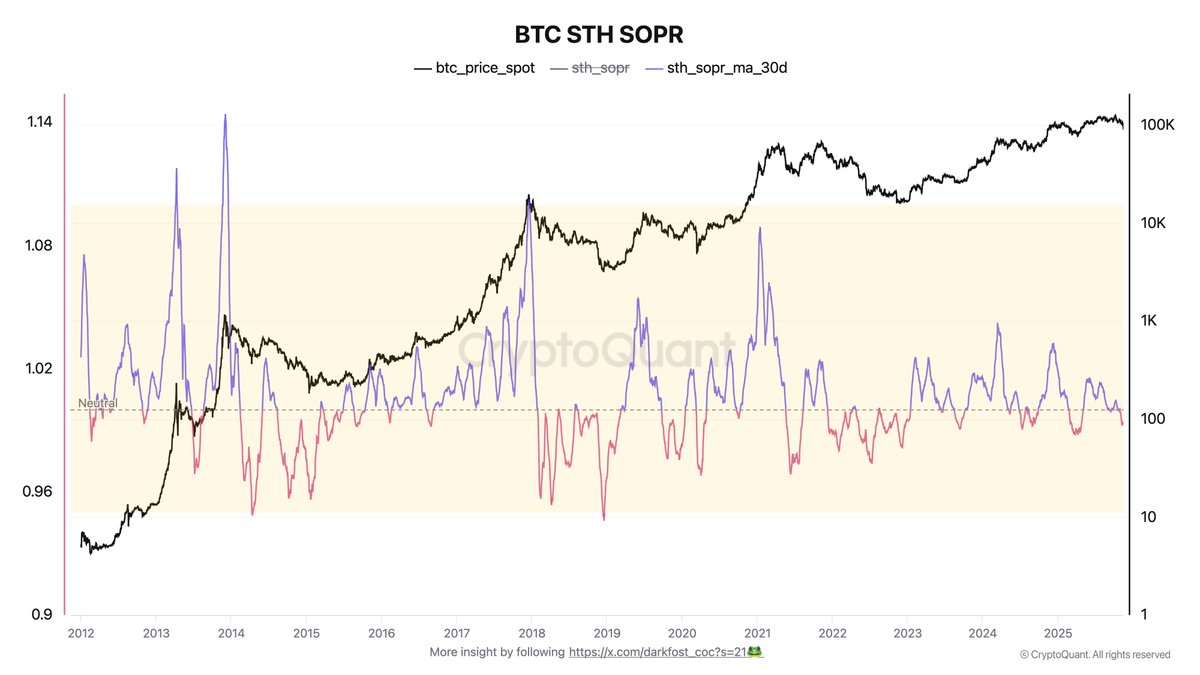

Brief-Time period Holders Present Indicators of Capitulation as Losses Mount

Brief-term holders (STHs) are dealing with intense stress as promoting strain accelerates throughout the market. The STH Spent Output Revenue Ratio (SOPR) on a 30-day shifting common has remained under 1, presently sitting at 0.993, which signifies that on common, STHs are realizing losses of round 7% after they transfer their cash. Traditionally, the sort of habits has coincided with the ultimate stage of market corrections, as weak fingers capitulate and stronger gamers quietly accumulate.

Darkfost notes that STHs are notably reactive to cost swings, typically exiting positions in panic as soon as losses deepen. This has been evident in current weeks — on November 15, over 65,000 BTC have been despatched to exchanges at a loss, creating an estimated $6 billion in promote strain. Earlier within the month, realized losses peaked at $812 million on November 9, confirming sustained capitulation exercise.

Regardless of the adverse sentiment, this dynamic has traditionally signaled market exhaustion slightly than continuation. Every spike in realized losses all through this cycle has marked the top of a correction, suggesting that whereas the present setting stays risky, Bitcoin may very well be approaching the late levels of this downturn earlier than rebounding.

Bitcoin Makes an attempt to Stabilize Close to $95K After Steep Promote-Off

Bitcoin’s current value motion reveals a transparent try to stabilize close to $95,000 following a pointy decline that pushed it under the psychological $100,000 stage. The chart illustrates that BTC has damaged under each its 50-day and 100-day shifting averages, signaling that short-term momentum stays bearish. Nonetheless, the worth is now discovering non permanent help across the $93,000–$95,000 zone — an space that coincides with prior consolidation in Could and June.

The promoting strain that dominated final week has began to ease, as indicated by the marginally decrease quantity on current candles. This implies that sellers could also be getting exhausted after a major drawdown. Nonetheless, bulls are struggling to regain management, and a decisive shut above $100,000 could be wanted to reestablish confidence.

If the $95K stage fails to carry, the following potential help sits close to $90,000, aligning with the 200-day shifting common — a traditionally essential line separating bullish from bearish phases. On the upside, reclaiming the 100K–105K zone might set off renewed momentum towards $110K. For now, Bitcoin stays in a consolidation section, with buyers watching carefully to see whether or not this space turns into a bottoming zone or the prelude to a deeper correction.

Featured picture from ChatGPT, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our group of high know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.