Dine Manufacturers International, Inc. DIN inventory has tanked 60% previously three years, whereas its Zacks sector climbed 65% and its Retail–Eating places business climbed 12%.

The restaurant big behind Applebee’s and different chains has a tough stability sheet, and its earnings revisions have tumbled over the previous a number of years as Dine Manufacturers struggles to navigate a number of headwinds.

Ought to Traders Keep Away from DIN Inventory?

Dine Manufacturers operates eating places through subsidiaries and franchisees underneath the Applebee’s Neighborhood Grill + Bar, IHOP, and Fuzzy’s Taco Store manufacturers. The Pasadena, California-headquartered firm boasted that its portfolio consisted of roughly 3,500 eating places throughout 19 worldwide markets as of June 30.

DIN has struggled since its large post-Covid lockdown growth that benefited each space of the patron financial system. Since then, hovering inflation and slowing shopper spending have damage income and crushed its backside line.

On prime of that, shoppers have extra eating choices than ever, and extra individuals are attempting to eat more healthy.

Picture Supply: Zacks Funding Analysis

The chart above exhibits that DIN’s earnings estimates fell off a cliff over the previous a number of years. Dine Manufacturers missed our Q2 earnings estimate by 22% and offered downbeat earnings per share (EPS) steering.

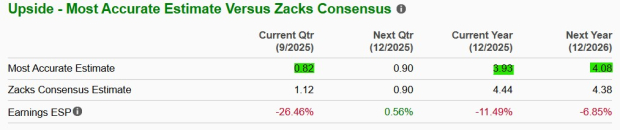

DIN’s Most Correct estimates got here in effectively under consensus for Q3, FY25, and FY26 (see under). Dine Manufacturers’ total adverse EPS revisions earn the inventory a Zacks Rank #5 (Robust Promote).

Picture Supply: Zacks Funding Analysis

Some buyers may wish to begin bottom-feeding on Dine Manufacturers inventory because it’s buying and selling close to its Covid lows whereas the broader inventory market sits close to contemporary information.

But it surely may be smart to avoid DIN because it has underperformed its business by a large margin over the previous 10 years (down -68% vs. its business’s +75% climb).

The Retail–Eating places area is within the backside 15% of roughly 240 Zacks industries. This amplifies its near-term bear case since research have proven that roughly half of a inventory’s worth motion could be attributed to its business group. And the highest 50% of Zacks Ranked Industries outperforms the underside 50% by an element of greater than 2 to 1.

On prime of that, Dine Manufacturers has extra liabilities (complete and present) than property (complete and present).

#1 Semiconductor Inventory to Purchase (Not NVDA)

The unimaginable demand for knowledge is fueling the market’s subsequent digital gold rush. As knowledge facilities proceed to be constructed and continually upgraded, the businesses that present the {hardware} for these behemoths will change into the NVIDIAs of tomorrow.

One under-the-radar chipmaker is uniquely positioned to make the most of the following progress stage of this market. It makes a speciality of semiconductor merchandise that titans like NVIDIA do not construct. It is simply starting to enter the highlight, which is strictly the place you wish to be.

See This Inventory Now for Free >>

DINE BRANDS GLOBAL, INC. (DIN) : Free Inventory Evaluation Report

This text initially printed on Zacks Funding Analysis (zacks.com).

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.