Touchdown the Bear of the Day, AptarGroup ATR is a inventory to keep away from within the Zacks Containers-Paper and Packaging Trade, which is at present within the backside 7% of over 240 Zacks industries.

With the revolutionary packaging options firm beginning to exemplify a number of the trade’s struggles, ATR shares are down greater than +20% in 2025 to noticeably underperform the broader indexes.

Sadly, there could possibly be extra draw back danger forward, whilst Aptar has persistently exceeded its quarterly expectations, however has confronted numerous headwinds which have weighed on investor sentiment.

Picture Supply: Zacks Funding Analysis

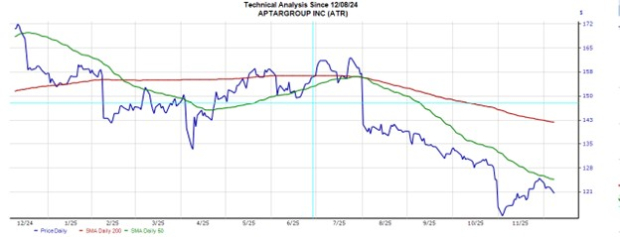

Current Headwinds & ATR Technical Evaluation

Notably, Aptar’s inventory has been falling as a result of a mixture of authorized prices, stock challenges, analyst downgrades, and weaker demand in sure healthcare markets. Concerning authorized bills, Aptar is dealing with mental property litigation, elevating considerations about short-term profitability.

Moreover, destocking in its Client Healthcare phase has pressured margins and created uncertainty about demand restoration, whereas challenges within the European chilly/cough packaging market have added to investor worries about long-term development as properly.

The technical tape for Aptar inventory is indicative of those fears, with ATR buying and selling under its 50-day (inexperienced line) and 200-day (crimson line) easy transferring averages, signaling brief and long-term weak spot and an general bearish downtrend since July.

Picture Supply: Zacks Funding Analysis

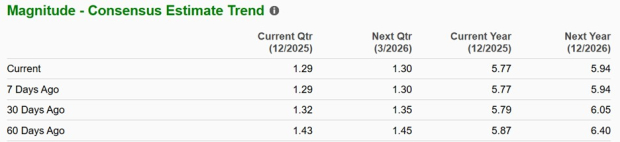

Declining EPS Revisions

Correlating with current headwinds and taking away from Aptar’s modest development projections is that over the past 60 days, fiscal 2025 and FY26 EPS estimates have dipped 2% and seven%, respectively.

Picture Supply: Zacks Funding Analysis

Aptar’s “F” Worth Rating

Extra regarding to the declining EPS revisions is that at 21X ahead earnings, Aptar’s inventory continues to be buying and selling at a little bit of a stretch to its trade common of 14X, with some noteworthy friends being Avery Dennison AVY, Packaging Company of America PKG, and Sonoco SON.

By way of value to ahead gross sales, ATR can also be at an elevated however not as noticeable P/S a number of of 2X in comparison with the trade common of 1X.

Picture Supply: Zacks Funding Analysis

Backside Line

On the floor, Aptar’s constant operational efficiency and nice reductions to the benchmark S&P 500’s valuation metrics could also be enticing. Nevertheless, at over $100 a share, buyers are understandably involved concerning the premium they’re paying for ATR relative to its friends, particularly given the packaging trade’s challenges in the intervening time.

Radical New Expertise Might Hand Traders Large Positive factors

Quantum Computing is the subsequent technological revolution, and it could possibly be much more superior than AI.

Whereas some believed the know-how was years away, it’s already current and transferring quick. Giant hyperscalers, corresponding to Microsoft, Google, Amazon, Oracle, and even Meta and Tesla, are scrambling to combine quantum computing into their infrastructure.

Senior Inventory Strategist Kevin Prepare dinner reveals 7 fastidiously chosen shares poised to dominate the quantum computing panorama in his report, Past AI: The Quantum Leap in Computing Energy.

Kevin was among the many early consultants who acknowledged NVIDIA’s monumental potential again in 2016. Now, he has keyed in on what could possibly be “the subsequent huge factor” in quantum computing supremacy. Right this moment, you will have a uncommon likelihood to place your portfolio on the forefront of this chance.

See High Quantum Shares Now >>

AptarGroup, Inc. (ATR) : Free Inventory Evaluation Report

Sonoco Merchandise Firm (SON) : Free Inventory Evaluation Report

Avery Dennison Company (AVY) : Free Inventory Evaluation Report

Packaging Company of America (PKG) : Free Inventory Evaluation Report

This text initially printed on Zacks Funding Analysis (zacks.com).

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.