Be part of Our Telegram channel to remain updated on breaking information protection

Coinbase CEO Brian Armstrong has predicted that banks will begin lobbying for yields on stablecoins in a couple of years.

“My prediction is the banks will truly flip and be lobbying FOR the flexibility to pay curiosity and yield on stablecoins in a couple of years, as soon as they understand how large the chance is for them,” Armstrong wrote in a Dec. 27 X submit.

Coinbase Gained’t Let Banks Reopen Discussions Round The GENIUS Act

Amrstrong’s submit was a response to a submit by Digital Ascension Group chief enterprise improvement officer Max Avery, who stated that the banking foyer desires to reopen discussions across the GENIUS Act.

Specifically, banks proceed to specific issues that present wording round stablecoin yields poses a threat to financial institution deposits, Avery stated.

The GENIUS Act, which is the primary regulatory framework for stablecoins and which was signed into regulation by US President Donald Trump in July, prohibits stablecoin issuers from providing yields on to token holders. Nonetheless, it doesn’t lengthen this ban to third-party service suppliers, that means that stablecoin issuers might provide yields through these platforms.

Coinbase, as an illustration, presents merchants and traders on its platforms yields on USDC, which is issued by the stablecoin agency Circle.

Issues over that means to probably provide yields by third-party platforms have been voiced by the banking foyer a number of instances this 12 months, famous Avery.

Whatever the banking foyer’s ongoing issues, Armstrong stated in his reply that he and Coinbase “received’t let anybody reopen GENIUS,” including that it’s a “purple line” for them.

Following his prediction that banks will finally begin to foyer for stablecoin yields, he stated that the present pushback in opposition to the GENIUS Act is “100% wasted effort on their half.”

Stablecoin Market Anticipated To Soar To $500B By The Finish Of 2026

The regulatory readability provided by the GENIUS Act served as a catalyst for the stablecoin market’s progress this 12 months.

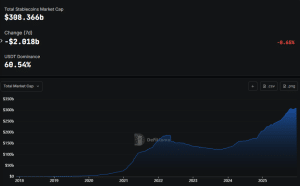

In 2025, the mixed capitalization for stablecoins has soared to above $300 billion for the primary time and presently stands at over $308.36 billion, information from DefiLlama exhibits.

Stablecoin market cap (Supply: DefiLlama)

Tether’s USDT token maintains a dominant share of the market with its capitalization of about $186.7 billion. USDC is available in at second with a market cap of roughly $76.38 billion, whereas Ethena’s USDe is ranked because the third-biggest stablecoin with a capitalization of $6.29 billion.

Following what has been a powerful 12 months for stablecoins, business specialists imagine the expansion for these tokens is predicted to proceed in 2026.

Amongst these specialists is SharpLink co-CEO Joseph Chalom, who stated that the stablecoin market cap will attain $500 billion by the top of 2026.

“World stablecoin use circumstances, together with cross-border remittances, retail funds, and institutional transactions, will proceed to extend with Ethereum establishing itself because the foundational settlement layer for the motion of worth,” he stated on X.

1/ The stablecoin market will hit $500B by the top of subsequent 12 months.

World stablecoin use circumstances, together with cross-border remittances, retail funds, and institutional transactions, will proceed to extend with Ethereum establishing itself because the foundational settlement layer for…

— Joseph Chalom (@joechalom) December 26, 2025

He additionally stated that large gamers will enter the stablecoin market subsequent 12 months, highlighting latest strikes by JP Morgan, PayPal, Japan, South Korea, and EU banks.

Chalom added that the adoption of stablecoins lays the groundwork for broader crypto adoption at establishments.

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be part of Our Telegram channel to remain updated on breaking information protection