Be part of Our Telegram channel to remain updated on breaking information protection

Kraken CEO Dave Ripley has fired again towards a senior government of the American Bankers Affiliation (ABA) who argued that stablecoin yields are a “detriment” to banks who’re attempting to help their neighborhood.

“That is about guaranteeing banks proceed to be ready to help their communities and energy the financial system,” mentioned ABA’s senior vp of innovation and technique, Brook Ybarra.

She added that “a detriment to that will be permitting the likes of Coinbase and Kraken to pay curiosity on fee stablecoins.”

Ybarra then mentioned that doing so would “fly within the face” of the notion round a fee stablecoin “that it must be a method of fee and never a retailer of worth.”

ABA senior vp and government director Jess Sharp was on stage with Ybarra and agreed along with her feedback, including that the difficulty just isn’t “about what’s good for banks,” however somewhat “what’s good for communities.”

“Banks take the deposits and convert them into loans,” he mentioned. “Fewer deposits imply fewer loans, and most members of Congress perceive that that’s not factor.”

He added that these members of Congress will “not wish to do harm to the communities that they serve.”

“Detriment To Who?” Asks Ripley

Whereas the ABA senior executives argue that stablecoin yields might negatively influence banks’ capability to help communities, Ripley questioned if there’s an ulterior motive behind their remarks.

He mentioned on X that stablecoins will result in wholesome competitors within the monetary area, including that “wholesome competitors is the bedrock of a free market and free markets profit precise shoppers and companies.”

This panel hosted by the American Bankers Affiliation mentioned permitting firms like @krakenfx or @coinbase to pay curiosity on stablecoins can be “a detriment.”

A detriment to who?

Wholesome competitors is the bedrock of a free market and free markets profit precise shoppers…

— Dave Ripley (@DavidLRipley) October 21, 2025

“Shoppers ought to have the liberty to decide on the place they maintain worth and probably the most environment friendly solution to ship that worth,” he added.

He acknowledged that there are “regulatory moats” that had been constructed to “enrich the businesses that kind them,” and added that he isn’t stunned that the ABAis attempting to forestall stablecoin issuers from providing yields to token holders.

“Banks wish to protect their place and hold incomes charges on consumer belongings with out passing the profit again to the individuals who personal them,” he mentioned.

Stablecoin Issuers At the moment Prohibited From Providing Direct Yields To Holders

Stablecoin issuers are presently not allowed to supply their token holders yields immediately below the GENIUS Act, which was signed into legislation in July by US President Donald Trump.

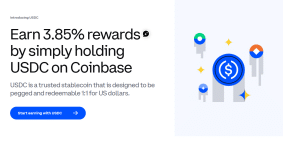

Nonetheless, the ban just isn’t prolonged to 3rd social gathering service suppliers or associates. For instance, Coinbase presently provides yields of three.85% on Circle’s USD Coin (USDC).

Coinbase provides 3.85% on USDC holdings (Supply: Coinbase)

The yield on stablecoins supplied by Coinbase and different crypto exchanges is far larger than the 0.6% common supplied by US nationwide financial savings accounts.

Banking commerce associations such because the American Bankers Affiliation (ABA), Financial institution Coverage Institute (BPI) and the Shopper Bankers Affiliation are due to this fact lobbying Congress and regulators to shut what they name a “loophole” that enables stablecoin corporations to get round providing yields to token holders.

Their issues comply with an estimate by the US Treasury Division that stablecoin adoption might result in as a lot as $6.6 trillion in deposits shifting out of banks.

Stablecoin Issuers May Quickly Plug Into The Fed’s Infrastructure

Amid the issues that stablecoins might set off huge outflows from banks, the US Federal Reserve just lately signaled its intention to embrace revolutionary applied sciences corresponding to stablecoins and AI within the funds area.

Talking on the central financial institution’s inaugural Funds Innovation Convention, Governor Christopher Waller mentioned the Fed is contemplating giving “eligible” stablecoin corporations entry to its funds infrastructure.

He pitched the thought of a “skinny” grasp account, which might give the corporations restricted entry to the Fed’s infrastructure.

“The thought is to tailor the companies of those new accounts to the wants of those corporations and the dangers they current to the Federal Reserve Banks and the fee system,” Waller defined throughout his speech.”

“Accordingly, and importantly, these lower-risk fee accounts would have a streamlined timeline for evaluate,” he added.

That would speed up the approval course of for crypto-native corporations corresponding to Ripple, Kraken and Custodia Financial institution, who’re all pursuing Fed grasp accounts by prolonged authorized processes.

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be part of Our Telegram channel to remain updated on breaking information protection