If there’s one factor that continues to be sure for 2026, it’s that the AI frenzy will proceed to dominate market headlines and total commentary. It’s not unsurprising, given a few of the lofty forecasts we’ve obtained, although the contemporary 12 months will probably weed out just a few of the ‘pretenders’ from the true winners.

And the headlines simply maintain flowing in, with Alphabet GOOGL saying a multi-year collaboration with fellow expertise titan Apple AAPL. Extra particularly, Apple and Google have entered right into a multi-year collaboration beneath which the subsequent era of Apple Basis Fashions will probably be based mostly on Google’s Gemini fashions and cloud expertise.

Apple & Gemini

In a joint assertion, the businesses stated, ‘After cautious analysis, Apple decided that Google’s Al expertise gives essentially the most succesful basis for Apple Basis Fashions and is worked up concerning the revolutionary new experiences it should unlock for Apple customers. Apple Intelligence will proceed to run on Apple units and Non-public Cloud Compute, whereas sustaining Apple’s industry-leading privateness requirements.’

It is an thrilling improvement within the ever-expanding AI house, notably following rising sentiment that Apple is being ‘left behind’ within the race. Notably, AAPL has not had its massive AI second, however at the moment’s announcement helps alleviate a few of the considerations.

Remember the fact that the response to Apple Intelligence to this point has been combined, with a number of extremely anticipated options, like an improved Siri, delayed through the preliminary rollout. After just a few years of remaining quiet about AI usually, the less-than-ideal rollout of the introduced options actually amplified the considerations.

There’s been an enormous efficiency disparity between the 2 over the previous 12 months, as proven under. The weaker beneficial properties in AAPL might partly replicate much less pleasure about its AI trajectory relative to GOOGL, although the lately introduced deal ought to assist flip sentiment.

Picture Supply: Zacks Funding Analysis

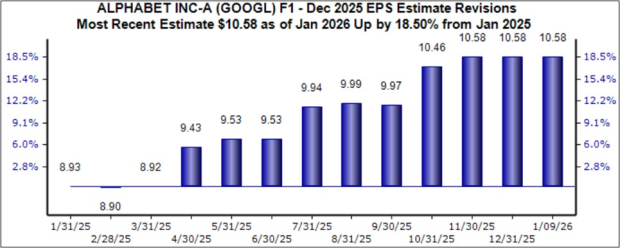

Each shares proceed to sport rosy outlooks regarding their present fiscal years, with analysts bullishly revising their expectations greater. GOOGL’s $10.58 Zacks Consensus EPS estimate is up 18% over the past 12 months, as proven under.

Picture Supply: Zacks Funding Analysis

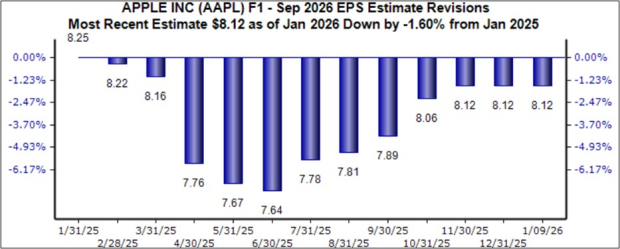

EPS expectations for Apple bottomed out in July of final 12 months, on a notably bullish trajectory since.

Picture Supply: Zacks Funding Analysis

Placing The whole lot Collectively

Total, it’s a transparent win-win state of affairs for each Apple AAPL and Alphabet GOOGL, with Apple securing its AI spine and Google additional cementing Gemini as a core part of AI infrastructure for the world’s largest shopper ecosystem.

5 Shares Set to Double

Every was handpicked by a Zacks professional as the favourite inventory to realize +100% or extra within the months forward. They embrace

Inventory #1: A Disruptive Power with Notable Development and Resilience

Inventory #2: Bullish Indicators Signaling to Purchase the Dip

Inventory #3: One of many Most Compelling Investments within the Market

Inventory #4: Chief In a Crimson-Sizzling Trade Poised for Development

Inventory #5: Trendy Omni-Channel Platform Coiled to Spring

A lot of the shares on this report are flying beneath Wall Road radar, which gives an awesome alternative to get in on the bottom flooring. Whereas not all picks will be winners, earlier suggestions have soared +171%, +209% and +232%.

Obtain Atomic Alternative: Nuclear Power’s Comeback free at the moment.

Apple Inc. (AAPL) : Free Inventory Evaluation Report

Alphabet Inc. (GOOGL) : Free Inventory Evaluation Report

This text initially printed on Zacks Funding Analysis (zacks.com).

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.