Though many AI shares completed 2025 on a bitter observe, 2026 is beginning the alternative method. A number of bullish alerts are showing for AI shares, together with:

AI Valuations Are Cheap

Quite a few main AI shares, resembling Nvidia (NVDA) have been consolidating for a number of months. Nvidia shares peaked in October (as of now) and have moved sideways. Nonetheless, the corporate’s fundamentals have solely change into stronger. The end result? Nvidia’s valuation metrics, resembling its price-to-sales ratio have retreated dramatically, making the inventory engaging to a wider swath of Wall Avenue establishments, together with these that target valuations. NVDA, which had a P/S of 200x in 2023, now has a P/S of simply ~24x.

Picture Supply: Zacks Funding Analysis

Taiwan Semi: A Good Barometer of the AI Business

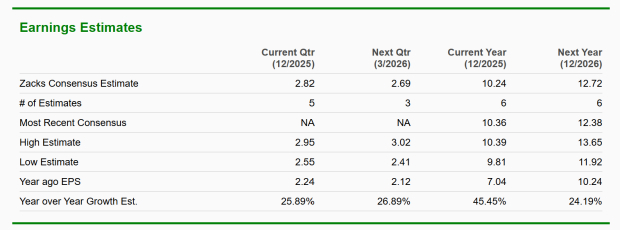

Taiwan Semiconductor (TSM) is arguably an important AI barometer out there. The corporate is a pure-play producer who provides components which might be indispensable to corporations like Superior Micro Units (AMD) and Nvidia. Thursday, TSM shares rallied on information that the corporate beat earnings and raised ahead steering. Most notably, TSM’s administration workforce made some extent of dispelling AI bubble fears. Zacks Consensus Estimates recommend double-digit EPS development in 2026.

Picture Supply: Zacks Funding Analysis

Google Search Cannibalization Fears are Unfounded

A number of Wall Avenue analysts expressed considerations that Alphabet’s (GOOGL) AI enterprise might eat into its dominant, profitable search enterprise. Nonetheless, the info reveals that not solely has Google’s ‘Gemini’ search integration not negatively impacted its search enterprise, it’s strengthened it.

Deregulation will Spur AI development

President Trump has issued quite a few government orders that scale back regulatory pink tape. AI corporations will profit dramatically from the administration’s concentrate on procuring innovation and lowering stringent oversight.

Worth and Quantity Motion Offers Clues

On Thursday, a number of AI shares moved greater on heavy quantity turnover. For example, CoreWeave (CRWV) gained practically 10% on Thursday as quantity turnover surged. Heavy quantity on sturdy inexperienced days is a trademark of accumulation.

Backside Line

The narrative surrounding synthetic intelligence is shifting from speculative hype to disciplined development. Cheap valuations, sturdy earnings, and a supportive regulatory panorama recommend AI shares have room to run.

Zacks Names #1 Semiconductor Inventory

This under-the-radar firm makes a speciality of semiconductor merchandise that titans like NVIDIA do not construct. It is uniquely positioned to make the most of the following development stage of this market. And it is simply starting to enter the highlight, which is strictly the place you need to be.

With sturdy earnings development and an increasing buyer base, it is positioned to feed the rampant demand for Synthetic Intelligence, Machine Studying, and Web of Issues. World semiconductor manufacturing is projected to blow up from $452 billion in 2021 to $971 billion by 2028.

See This Inventory Now for Free >>

Superior Micro Units, Inc. (AMD) : Free Inventory Evaluation Report

NVIDIA Company (NVDA) : Free Inventory Evaluation Report

Taiwan Semiconductor Manufacturing Firm Ltd. (TSM) : Free Inventory Evaluation Report

Alphabet Inc. (GOOGL) : Free Inventory Evaluation Report

CoreWeave Inc. (CRWV) : Free Inventory Evaluation Report

This text initially printed on Zacks Funding Analysis (zacks.com).

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.