Since late 2025 until now, the worldwide financial and strategic panorama has been drastically altering, backed by persistent geopolitical friction and commerce tensions which are recalibrating world commerce patterns and accelerating state-led expertise agendas. A United Nations report initiatives world progress slowing to 2.7% in 2026, noting that elevated U.S. tariffs and broader coverage uncertainty have weighed on world commerce, at the same time as resilient exercise in key markets has prevented full disruption (Reuters).

Towards this backdrop, policymakers are responding by forming new coalitions centered on securing important expertise provide chains, somewhat than conventional commerce in items alone. Most just lately, Qatar and the UAE joined the U.S.-led Pax Silica initiative to strengthen cooperation in semiconductors and AI infrastructure. India can be anticipated to be invited as a full member within the coming months, reflecting broader efforts to safe world silicon provide chains.

On this shifting surroundings, the 2026 funding thesis for growth-oriented fairness buyers is more and more anchored the place superior expertise intersects with nationwide safety priorities—particularly AI, quantum applied sciences, and protection and safety. These aren’t short-term traits. As an alternative, they’re being structurally strengthened by authorities coverage, increasing public budgets, and intensifying strategic competitors amongst main economies. Three shares that we picked from these genres are NVIDIA NVDA, Lockheed Martin LMT and Worldwide Enterprise Machines IBM.

Let’s delve deeper.

Commerce to Know-how

Geopolitically, tariffs, export controls and expertise restrictions, notably round superior semiconductors, AI accelerators and protection and security-related delicate software program, have reshaped world commerce into parallel expertise blocs somewhat than open markets.

The Pax Silica initiative displays this shift. In contrast to conventional commerce offers centered on items, it targets all the semiconductor and AI worth chain, from fabrication and superior packaging to compute infrastructure and expert expertise amongst aligned international locations. Qatar and the UAE’s participation highlights the function of energy-rich nations in financing fabs and information facilities, whereas India’s anticipated inclusion underscores its rising significance as a producing hub and strategic expertise accomplice.

Towards this backdrop, AI, quantum, in addition to protection and safety, stand out as probably the most compelling fairness themes for 2026 as a result of they sit on the intersection of business scale and authorities mandate. AI is more and more embedded in protection methods, intelligence, logistics, and cybersecurity, making certain demand past enterprise use. Quantum applied sciences, notably sensing, safe communications and post-quantum cryptography, are being prioritized for his or her long-term strategic worth. Protection and safety act because the supply channel, turning geopolitical threat into sustained, government-backed spending.

In AI infrastructure, other than NVDA, AMD and Microsoft MSFT assist sovereign compute and protection workloads. In protection, different shares are Northrop Grumman, Palantir PLTR and RTX, that are increasing AI-enabled platforms and autonomous methods. In quantum, IonQ and Rigetti are additionally intently tied to government-funded analysis and safety use instances.

Shares on our Radar

NVIDIA: By means of fiscal 2026 quarters, NVIDIA has reported robust Knowledge Middle income progress, together with report $51.2 billion Knowledge Middle revenues within the third quarter of fiscal 2026, pushed by excessive demand for its AI infrastructure platforms corresponding to Blackwell. NVIDIA has additionally introduced the upcoming Rubin platform, designed to speed up large-context AI inference and reasoning workloads throughout cloud and enterprise deployments. With ongoing progress in sovereign AI cloud partnerships and broad adoption of its accelerated computing stack, NVIDIA is well-positioned on the nexus of AI infrastructure demand.

NVDA at the moment carries a Zacks Rank #3 (Maintain). In fiscal 2027 (ending January 2027), the inventory is projected to report earnings progress of 55.2% on 43.2% income enchancment.

Picture Supply: Zacks Funding Analysis

Lockheed Martin: The corporate is positioned to profit from accelerating protection spending and geopolitical demand for superior air-and-missile protection methods. In 2025, the U.S. Military awarded the corporate a $9.8 billion multiyear contract for practically 2,000 Patriot Superior Functionality-3 Missile Phase Enhancement (PAC-3 MSE) interceptors, the most important within the historical past of its Missiles and Fireplace Management unit. Lockheed can be a part of a brand new seven-year framework settlement to greater than triple PAC-3 MSE manufacturing capability, reflecting sustained world demand amid heightened air-defense wants. The corporate is integrating AI and machine studying into missile steerage and different methods, enhancing determination velocity and precision, and aligning its portfolio with nationwide safety priorities and steady government-backed revenues.

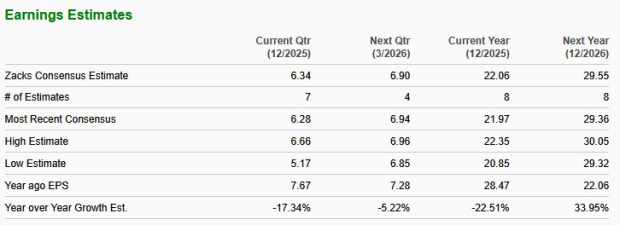

LMT at the moment carries a Zacks Rank #3. In 2026, the corporate is projected to report earnings progress of 33.9% on 4.2% income enchancment.

Picture Supply: Zacks Funding Analysis

IBM: It’s positioned to achieve from each enterprise AI transformation and the quantum computing race. Its strategic focus consists of AI methods innovation and infrastructure traits for 2026, emphasizing built-in AI options that meet enterprise and sovereign necessities. On the quantum entrance, IBM is advancing new processors and ecosystem growth geared toward attaining sensible quantum benefit by late 2026, strengthening its function in future-proof computing platforms that governments and companies are prioritizing.

IBM at the moment carries a Zacks Rank #2 (Purchase). In 2026, the corporate is projected to report earnings progress of seven.5% on 5% income enchancment. You’ll be able to see the entire listing of at the moment’s Zacks Rank #1 (Robust Purchase) shares right here.

Picture Supply: Zacks Funding Analysis

Zacks’ Analysis Chief Names “Inventory Most Prone to Double”

Our staff of specialists has simply launched the 5 shares with the best chance of gaining +100% or extra within the coming months. Of these 5, Director of Analysis Sheraz Mian highlights the one inventory set to climb highest.

This prime choose is a little-known satellite-based communications agency. House is projected to turn out to be a trillion greenback business, and this firm’s buyer base is rising quick. Analysts have forecasted a serious income breakout in 2025. In fact, all our elite picks aren’t winners however this one may far surpass earlier Zacks’ Shares Set to Double like Hims & Hers Well being, which shot up +209%.

Free: See Our High Inventory And 4 Runners Up

Lockheed Martin Company (LMT) : Free Inventory Evaluation Report

Microsoft Company (MSFT) : Free Inventory Evaluation Report

Worldwide Enterprise Machines Company (IBM) : Free Inventory Evaluation Report

NVIDIA Company (NVDA) : Free Inventory Evaluation Report

Palantir Applied sciences Inc. (PLTR) : Free Inventory Evaluation Report

This text initially revealed on Zacks Funding Analysis (zacks.com).

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.