TLDR

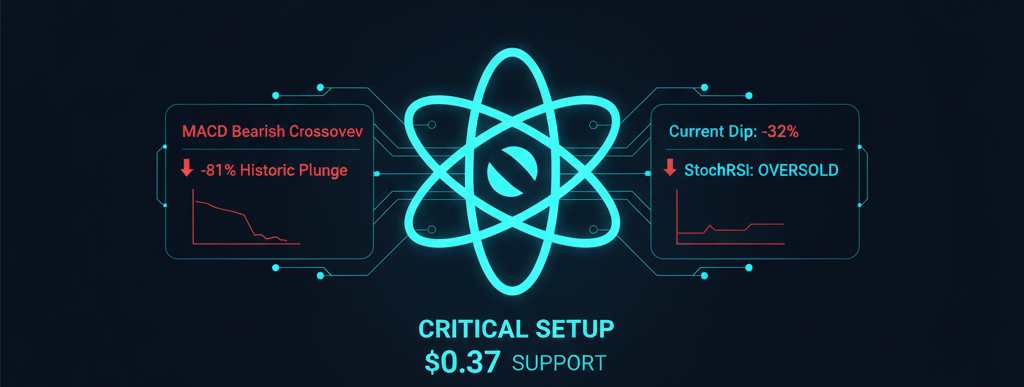

- The MACD indicator has crossed into bearish territory, a transfer that beforehand preceded an 81% plunge.

- The ADA token has already recorded a 32% retracement following Bitcoin’s drop to the $85,000 zone.

- StochRSI exhibits excessive oversold circumstances, suggesting the asset is perhaps undervalued.

Analysts are on excessive alert as Ali Martinez just lately identified that the Cardano (ADA) worth is repeating an especially harmful market construction. The first cause is the Transferring Common Convergence Divergence (MACD) crossing into the bearish zone—a sign that previously triggered a large 81% correction for the asset.

At present, the asset has already skilled a 32% pullback, largely influenced by common market weak spot and Bitcoin’s decline. Nevertheless, different technical indicators reinforce the case for warning: the Exponential Transferring Common (EMA) sits at $0.38, slightly below the present worth, whereas the Bull Bear Energy (BBP) stays in damaging territory, confirming vendor dominance.

Whales and On-chain Indicators: Between Mistrust and Alternative

Regardless of the grim situation, not all information is damaging for the Cardano (ADA) worth. Though the Chaikin Cash Circulate (CMF) exhibits that whales aren’t but satisfied of an instantaneous rebound, there’s a technical signal of hope. The Stochastic RSI (StochRSI) is in huge oversold ranges, indicating that Cardano could also be undervalued in comparison with its direct rivals.

The likelihood of a bounce for the bulls lies within the energy of the $0.37 assist stage and the success of Midnight (NIGHT), the ecosystem’s new token whose sidechain has just lately generated important optimism.

If whale shopping for urge for food returns at this vital assist stage, the Cardano (ADA) worth may invalidate the large crash principle and start a crucial accumulation section for a future rally. For now, monitoring the $0.38 stage is important to figuring out the altcoin’s destiny within the coming weeks.