This week’s quarterly reviews from Pepsi PEP, Delta Airways DAL, and two different S&P 500 members for his or her respective fiscal quarters ending in August will get counted as a part of our September-quarter tally. Now we have already seen such fiscal August-quarter outcomes from 19 S&P 500 members, together with outcomes from FedEx, Common Mills, Oracle, and others.

We are going to focus on present expectations for Pepsi and Delta somewhat later on this notice, however we are going to first overview combination Q3 expectations for the S&P 500 index as a complete.

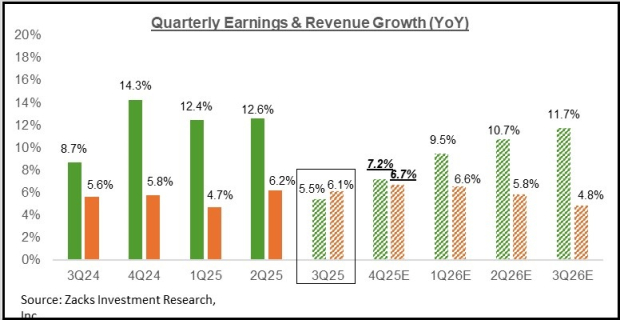

The expectation is for Q3 earnings to extend by +5.4% from the identical interval final 12 months on +6.1% larger revenues. This may comply with earnings progress charges of +12.6% and +12.4% in 2025 Q2 and Q1, respectively.

Within the unlikely occasion that precise Q3 earnings progress for the S&P 500 index seems to be +5.3% as presently anticipated, this would be the lowest earnings progress tempo for the index since 2023 Q3.

Common readers of our earnings commentary are conversant in us constantly flagging the favorable shift within the revisions pattern that has been in place for the previous few months. Now we have often featured how Q3 estimates moved larger after the beginning of the interval, marking a shift from the tendencies noticed within the first two quarters of the 12 months.

The optimistic revisions pattern has not been restricted to Q3 alone, as estimates for This fall have additionally elevated lately, because the chart under exhibits.

Picture Supply: Zacks Funding Analysis

For the reason that begin of July, This fall estimates have elevated for 7 of the 16 Zacks sectors, which embrace the Tech, Finance, and Vitality sectors. Different sectors having fun with optimistic estimate revisions for This fall embrace Retail, Utilities, Transportation, and Enterprise Companies.

On the unfavourable aspect, This fall estimates stay beneath strain for 8 of the 16 Zacks sectors, with notable strain on the Client Discretionary, Medical, Autos, Industrial Merchandise, and Building sectors.

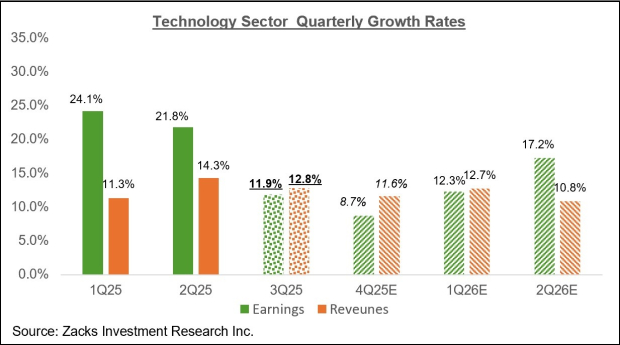

Getting again to Q3 expectations, the Tech sector is anticipated to proceed enjoying the main progress driver position within the coming durations as effectively. For 2025 Q3, Tech sector earnings are anticipated to extend +11.9% on +12.8% larger revenues, with This fall earnings presently anticipated to be up +8.7% on +11.6% income progress.

The chart under exhibits the Tech sector’s earnings and income progress image on a quarterly foundation, with expectations for 2025 Q3 contrasted with precise progress for the previous two durations and expectations for the next three quarters.

Picture Supply: Zacks Funding Analysis

Key Earnings Stories This week

Now we have greater than 25 firms on deck to report outcomes this week, together with 4 S&P 500 members. Along with Pepsi and Delta Air Strains, notable firms reporting this week embrace Constellation Manufacturers, McCormick & Firm, Levi Strauss & Co., and others.

Pepsi will likely be reporting outcomes earlier than the market’s open on Thursday, October 9th, with the corporate anticipated to report earnings of $2.27 per share on $23.88 billion in revenues, representing year-over-year adjustments of -1.7% and +2.4%, respectively. The revisions pattern has been optimistic, with estimates modestly up over the past two months. Pepsi shares had responded positively to the earlier quarterly report on July 17th, however the positive aspects finally dissipated.

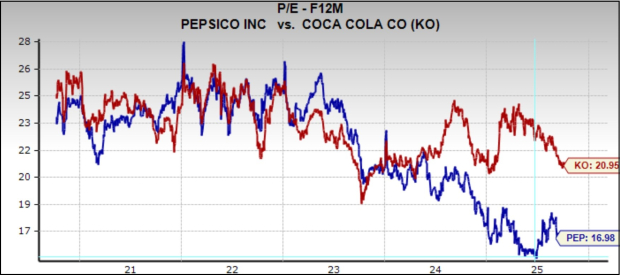

Pepsi shares have been big-time laggards within the year-to-date interval, with the inventory down -6.1% this 12 months, lagging the S&P 500 index’s +15.3% acquire and rival Coca-Cola’s +7.4% acquire. The inventory has carried out higher recently, with Pepsi shares modestly outperforming Coca-Cola shares over the previous three- and six-month durations.

Consistent with Pepsi’s progress challenges, the inventory’s valuation a number of has notably compressed, with present valuation within the neighborhood of its 5-year low, because the chart under exhibits.

Picture Supply: Zacks Funding Analysis

Delta will likely be reporting the identical morning as Pepsi, with the air provider anticipated to report $1.60 per share in earnings on $15.93 billion in revenues, representing year-over-year adjustments of +6.7% and +1.6%, respectively. The inventory surged following the final quarterly launch, which included favorable steering and administration commentary. Whereas the inventory value has fluctuated within the wake of the earlier quarterly report on July tenth, the revisions pattern has sustainably remained optimistic since then.

With This fall being a seasonally robust interval for Delta, in addition to the broader airline group, administration steering will likely be key in figuring out how the inventory reacts to this quarterly report. Yr-to-date, Delta shares are down -5.2% this 12 months, lagging the broader market’s +15.2% acquire and rival United Airways’ -1.8% decline.

Q3 Earnings Season Scorecard

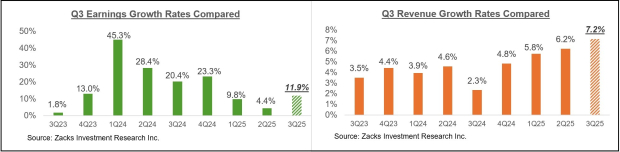

As famous earlier, we’ve got already seen outcomes for fiscal quarters ending in August from 19 S&P 500 members, which we embrace in our September-quarter tally. Complete earnings for these 19 index members are up +11.9% from the identical interval final 12 months on +7.2% larger revenues, with 73.7% beating EPS estimates and 78.9% beating income estimates.

The comparability charts under put the Q3 earnings and income progress charges from these firms in a historic context.

Picture Supply: Zacks Funding Analysis

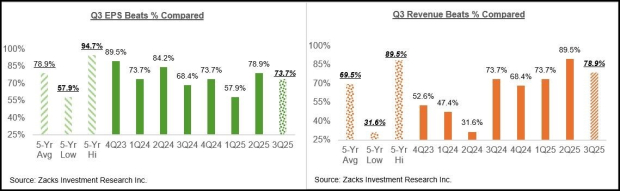

The comparability charts under put the Q3 EPS and income beats percentages in a historic context.

Picture Supply: Zacks Funding Analysis

The Earnings Massive Image

The chart under exhibits present Q3 earnings and income progress expectations for the S&P 500 index within the context of the previous 4 quarters and the approaching 4 quarters.

Picture Supply: Zacks Funding Analysis

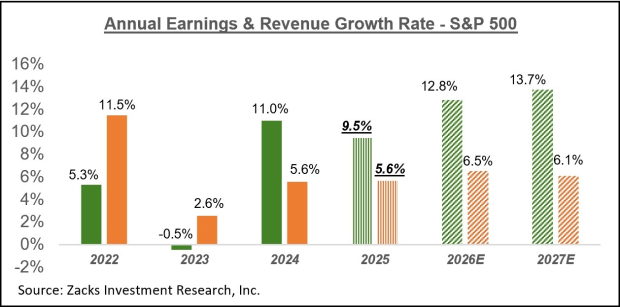

The chart under exhibits the general earnings image on a calendar-year foundation.

Picture Supply: Zacks Funding Analysis

By way of S&P 500 index ‘EPS’, these progress charges approximate to $258.12 for 2025 and $290.98 for 2026.

For an in depth view of the evolving earnings image, please try our weekly Earnings Tendencies report right here >>>>Financial institution Earnings in Focus as Q3 EarningsSeason Takes Middle Stage

Radical New Know-how May Hand Traders Large Features

Quantum Computing is the following technological revolution, and it could possibly be much more superior than AI.

Whereas some believed the expertise was years away, it’s already current and shifting quick. Massive hyperscalers, similar to Microsoft, Google, Amazon, Oracle, and even Meta and Tesla, are scrambling to combine quantum computing into their infrastructure.

Senior Inventory Strategist Kevin Prepare dinner reveals 7 fastidiously chosen shares poised to dominate the quantum computing panorama in his report, Past AI: The Quantum Leap in Computing Energy.

Kevin was among the many early specialists who acknowledged NVIDIA’s huge potential again in 2016. Now, he has keyed in on what could possibly be “the following large factor” in quantum computing supremacy. In the present day, you have got a uncommon probability to place your portfolio on the forefront of this chance.

See High Quantum Shares Now >>

Delta Air Strains, Inc. (DAL) : Free Inventory Evaluation Report

PepsiCo, Inc. (PEP) : Free Inventory Evaluation Report

This text initially printed on Zacks Funding Analysis (zacks.com).

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.