- Bitcoin Prints Contemporary All-Time Highs

- Bitcoin Overtakes Amazon in Market Cap

- Bitcoin’s Lengthy-term Returns are Spectacular

- Bitcoin Enters Its Seasonally Strongest Interval

- The Variety of Bitcoins on Exchanges Reaches 6-year Lows

- Bitcoin’s Hash Fee Reaches Highs

- Regardless of New Highs, Bitcoin Curiosity is Close to 5-year Lows

- The World M2 vs. Bitcoin Correlation

- Bitcoin Technical Evaluation

- Acquire Perspective by Altering Your Unit of Account

- #1 Semiconductor Inventory to Purchase (Not NVDA)

Bitcoin Prints Contemporary All-Time Highs

Over the weekend, Bitcoin, the world’s largest crypto asset, notched an all-time excessive of ~$125k per coin. Not too long ago, I wrote a Bitcoin commentary about Coinbase World (COIN) CEO Brian Armstrong’s daring prediction that Bitcoin will attain $1 million per coin by 2030. You may learn it right here:

“Is Brian Armstrong’s $1 million BTC Prediction by 2030 Unrealistic?”

Through the Fox Enterprise interview the place Armstrong made the prediction, he emphasised the importance and energy of long-term pondering in relation to Bitcoin. Whereas I agree with a lot of Armstrong’s bullish Bitcoin thesis and can take it into consideration, as an intermediate-term speculator, I additionally discover worth in dissecting what the present information units are telling buyers. Beneath are 5 of crucial Bitcoin charts.

Bitcoin Overtakes Amazon in Market Cap

Because of its fame as ‘digital gold’ and the emergence of Bitcoin ETFs, such because the iShares Bitcoin ETF (IBIT) and the ARK 21Shares Bitcoin ETF (ARKB), 2025 is the 12 months when Bitcoin formally reworked into an institutional-sized asset class. With a market cap of ~2.45 trillion, Bitcoin’s market cap has surpassed Amazon’s (AMZN) market cap and sits slightly below silver because the world’s seventh-largest asset.

Picture Supply: companiesmarketcap

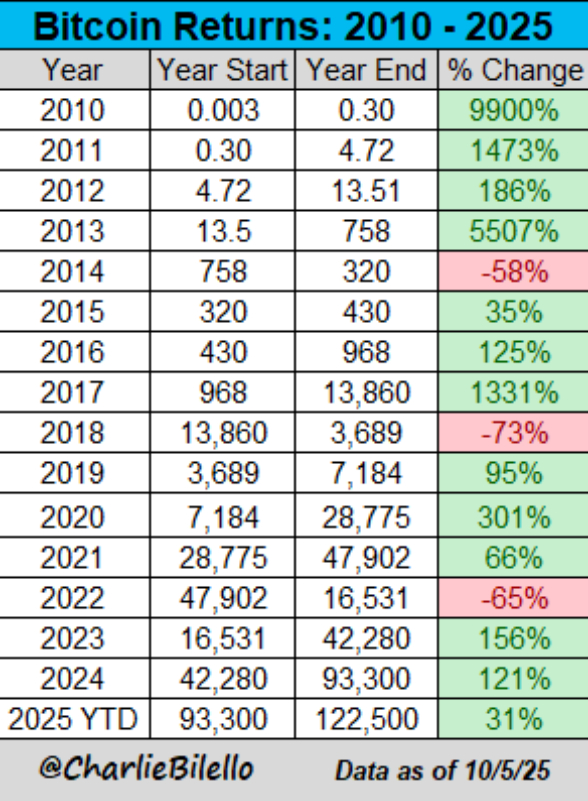

Bitcoin’s Lengthy-term Returns are Spectacular

Assuming 2025 finishes inexperienced, Bitcoin has produced constructive annualized returns in 13 of the previous 15 years, with triple-digit (or extra) proportion returns in 9 of these years.

Picture Supply: @charliebilello

Bitcoin Enters Its Seasonally Strongest Interval

Traditionally, September and October are the most effective months to personal Bitcoin. Bitcoin has been inexperienced in October 73% of the time whereas averaging a strong 29.23% return. In the meantime, with a median return of 37.64%, Bitcoin returns in November have been unmatched. You may learn extra about ‘Uptober’ right here.

Picture Supply: Zacks Funding Analysis

The Variety of Bitcoins on Exchanges Reaches 6-year Lows

Bitcoin that lives on exchanges, akin to Coinbase, tends to vary arms extra often than Bitcoin held in chilly storage. As Bitcoin demand will increase, provide shocks can happen because the variety of Bitcoins on exchanges is restricted. Moreover, Bitcoin that’s moved off exchanges is way extra prone to be held by buyers within the long-term, suggesting bullish conviction in Bitcoin’s future.

Picture Supply: glassnode

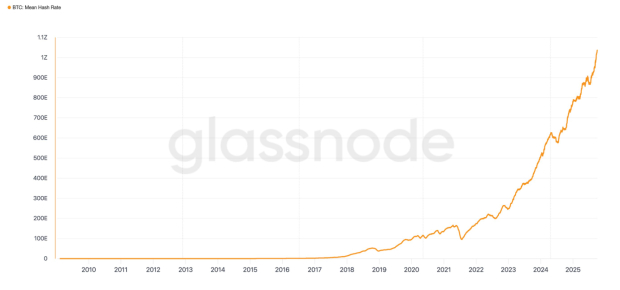

Bitcoin’s Hash Fee Reaches Highs

The Bitcoin hash price measures the whole computational energy dedicated to securing the Bitcoin blockchain. An elevated hash price signifies that Bitcoin miners, like Riot Platforms (RIOT) and CleanSpark (CLSK), are investing extra capital within the {hardware} and vitality infrastructure required to mine Bitcoin. The elevated funding means that, although their prices are have elevated, these Bitcoin miners see greater Bitcoin costs sooner or later, and thus, their investments are justified.

Picture Supply: glassnode

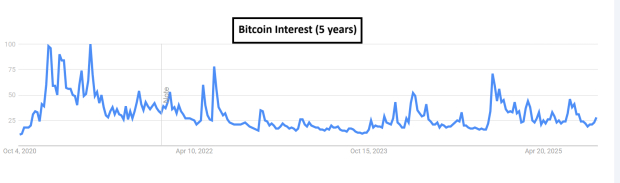

Regardless of New Highs, Bitcoin Curiosity is Close to 5-year Lows

Though Bitcoin notched contemporary all-time highs final weekend, sentiment is muted. In reality, in line with Google ‘Developments’ information, internet surfers looked for Bitcoin 4 occasions extra in 2020 than at present. An absence of pleasure at highs suggests a bullish contrarian image for the world’s dominant crypto asset.

Picture Supply: Google Developments

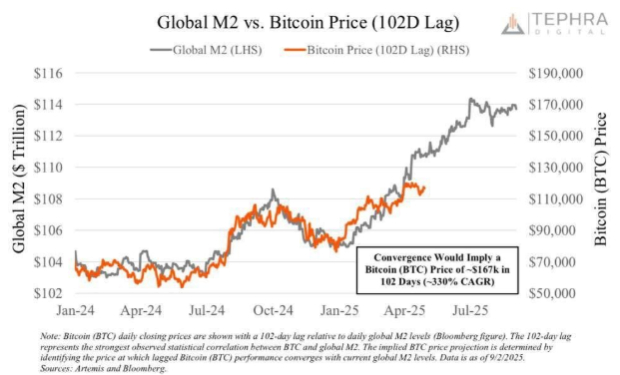

The World M2 vs. Bitcoin Correlation

World M2 measures the cash provide of central banks such because the US Federal Reserve. Greater world M2 means deeper liquidity. Traditionally, elevated liquidity results in elevated bullish hypothesis, displaying a correlation with and driving up the worth of Bitcoin.

Picture Supply: Tephra Digital

Bitcoin Technical Evaluation

The value of Bitcoin has been range-bound since late July. Nonetheless, it’s at present making an attempt to interrupt out. Ought to the breakout stick, the Fibonacci extensions counsel that Bitcoin might attain $134k by year-end. Including to the breakout’s attractiveness was the quantity that the IBIT ETF clocked on Friday. Quantity turnover soared 89% above the 50-day common, signaling heavy bullish accumulation.

Picture Supply: TradingView

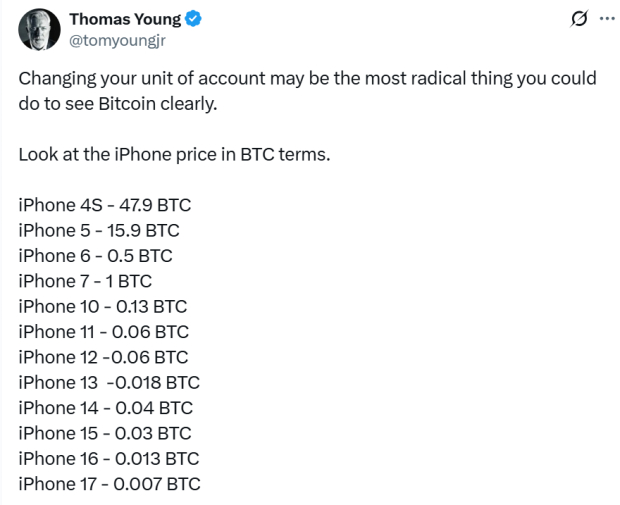

Acquire Perspective by Altering Your Unit of Account

Bitcoin’s meteoric ascent may be put into eye-opening perspective when pricing on a regular basis objects such because the Apple (AAPL) iPhone in BTC phrases.

Picture Supply: @tomyoungjr

Backside Line

Bitcoin’s long-term bullish narrative stays powerfully intact, supported by a scarce provide, seasonal energy, and chronic liquidity. The highway to the following main milestone seems well-supported by the metrics that matter most.

#1 Semiconductor Inventory to Purchase (Not NVDA)

The unimaginable demand for information is fueling the market’s subsequent digital gold rush. As information facilities proceed to be constructed and continually upgraded, the businesses that present the {hardware} for these behemoths will develop into the NVIDIAs of tomorrow.

One under-the-radar chipmaker is uniquely positioned to benefit from the following development stage of this market. It makes a speciality of semiconductor merchandise that titans like NVIDIA do not construct. It is simply starting to enter the highlight, which is strictly the place you need to be.

See This Inventory Now for Free >>

Apple Inc. (AAPL) : Free Inventory Evaluation Report

Riot Platforms, Inc. (RIOT) : Free Inventory Evaluation Report

Cleanspark, Inc. (CLSK) : Free Inventory Evaluation Report

Coinbase World, Inc. (COIN) : Free Inventory Evaluation Report

This text initially printed on Zacks Funding Analysis (zacks.com).

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.

![SPDR S&P 500 (SPY)’s path to report peaks [Video] SPDR S&P 500 (SPY)’s path to report peaks [Video]](https://editorial.fxsstatic.com/images/i/SP500-bearish-withoutbear_Large.jpg)