Out of doors-focused clothes firm Columbia Sportswear Firm’s COLM earnings have tanked over the past a number of years after an enormous Covid-period surge.

Columbia is struggling in opposition to a number of headwinds from slowing client spending, made worse by lingering inflation, to tariffs and more durable competitors.

Keep Away from COLM Inventory for Now?

Columbia has been on the forefront of outside clothes, attire, and footwear for many years. The Portland, Oregon-headquartered agency owns a number of outdoor-focused manufacturers, together with its namesake, in addition to boot standout Sorel and higher-end attire maker Mountain Exhausting Put on.

The corporate additionally owns prAna, which makes every thing from mountaineering garments to yoga gear, and is a part of a gaggle of manufacturers competing alongside Lululemon.

Picture Supply: Zacks Funding Analysis

The diversification and portfolio enlargement have helped Columbia. Nonetheless, its namesake model is by far the biggest income contributor, bringing in round 80% to 85% of complete gross sales in most quarters.

Columbia competes in opposition to The North Face, Patagonia, and tons of digital-native upstarts which are thriving within the direct-to-consumer age.

Columbia posted enormous income progress in 2021 and 2022. But it surely hasn’t been in a position to maintain its momentum because it faces inflation, slowing general client spending, and different setbacks.

The historic out of doors clothes firm introduced a multi-year revenue enchancment program in 2024 after its earnings tanked in 2023. COLM’s adjusted and GAAP earnings per share fell once more in 2024 regardless of efforts to develop its backside line.

Picture Supply: Zacks Funding Analysis

Columbia’s state of affairs hasn’t enhance in 2025. It reported an working lack of $23.6 million in Q2 and an adjusted lack of -$0.19 a share. “The attire and footwear business is going through growing tariffs, on prime of already excessive current duties… For the upcoming Fall 2025 season, our focus is delivering distinctive worth to shoppers, who’re pressured by greater costs for a lot of client items,” CEO Tim Boyle stated in ready Q2 remarks.

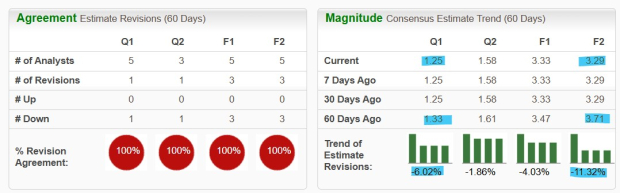

Columbia’s earnings outlook fell once more after its Q2 launch, with its estimate for 2026 down 11% over the previous two months. Its latest downward earnings revisions, which land it a Zacks Rank #5 (Robust Promote), are a part of an enormous destructive revisions spiral that started in 2022.

COLM inventory is down 8% over the past 10 years in comparison with the S&P 500’s 250% run. This poor efficiency features a 36% drop in 2025 as Wall Avenue pivots away from your entire attire business amid all the headwinds.

Buyers who’re bullish on a potential Columbia turnaround would possibly wish to wait till a minimum of its subsequent earnings report earlier than they contemplate shopping for the inventory.

Radical New Know-how May Hand Buyers Enormous Features

Quantum Computing is the following technological revolution, and it could possibly be much more superior than AI.

Whereas some believed the expertise was years away, it’s already current and transferring quick. Massive hyperscalers, similar to Microsoft, Google, Amazon, Oracle, and even Meta and Tesla, are scrambling to combine quantum computing into their infrastructure.

Senior Inventory Strategist Kevin Cook dinner reveals 7 rigorously chosen shares poised to dominate the quantum computing panorama in his report, Past AI: The Quantum Leap in Computing Energy.

Kevin was among the many early specialists who acknowledged NVIDIA’s huge potential again in 2016. Now, he has keyed in on what could possibly be “the following large factor” in quantum computing supremacy. Immediately, you’ve gotten a uncommon likelihood to place your portfolio on the forefront of this chance.

See Prime Quantum Shares Now >>

Columbia Sportswear Firm (COLM) : Free Inventory Evaluation Report

This text initially revealed on Zacks Funding Analysis (zacks.com).

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.