A mere handful of months in the past, Tesla (TSLA) shares appeared doomed, and it felt as if the bears might have lastly gotten their long-awaited second. Tesla CEO Elon Musk made his foray into politics by spending greater than 1 / 4 of a billion {dollars} to assist Donald Trump and the Republicans in 2024. Then, whereas already unfold skinny, he took a hiatus from Tesla and managed the ‘Division of Authorities Effectivity’ DOGE to assist search an answer to America’s hovering debt.

Nonetheless, Musk would quickly be taught the truth of getting concerned in politics in right this moment’s poisonous surroundings. Many democrats felt that Musk wielded an excessive amount of energy, resulting in mass left-wing protests towards Tesla, boycotts, and widespread vandalism. As if that weren’t unhealthy sufficient, Musk had a ugly falling out with President Trump, resulting in backlash from many partisans on the appropriate. In the meantime, Tesla’s legacy EV enterprise was slowing, Alphabet’s (GOOGL) ‘Waymo’ appeared poised to dominate the robotaxi market, and even a few of Musk’s staunchest followers started to lose religion in him, voicing issues that he was not interested by operating Tesla.

Tesla is on Tempo for its Greatest September Efficiency Ever

Nonetheless, if there’s one lesson Tesla has taught traders, it’s by no means to make a long-term guess towards Elon Musk and Tesla, irrespective of how unhealthy issues could seem. Regardless of the slew of bearish headlines and unfavorable earnings development, TSLA is about to register its greatest September in historical past. Tesla shares up greater than 30% in September and registered recent all-time closing highs final week.

Picture Supply: Zacks Funding Analysis

Why are Tesla Shares Rising?

Tesla shares are rising for a number of causes. The September rally was sparked when Elon Musk confirmed that he was accomplished with politics. For traders, the information was an enormous sigh of aid. The significance of Musk’s presence at Tesla was placed on full show when he stepped away from Tesla to give attention to his acquisition of social media platform Twitter, and TSLA shares dropped swiftly. Along with Musk leaving politics, traders additionally cheered the Tesla board’s $1 trillion pay package deal proposal for Musk, seeing the provide as a solution to hold Musk at Tesla and motivated.

Tesla shareholders are as soon as once more betting on the longer term. Tesla’s robotaxi service is lastly stay in Austin and San Francisco, with plans to increase into different cities like Miami and Chicago (pending regulatory approval). As well as, TSLA shares are rising on optimism surrounding its latest ‘Full Self Driving’ (FSD) replace, which is slated to launch this week. Tesla FSD v14 might be launched to a restricted variety of social media influencers this week, with v14.2 set to observe in just a few weeks. In a current tweet, Musk hyped the debut, saying that “The automotive will really feel like it’s sentient being by 14.2.”

Tesla Q3 Supply & Manufacturing Preview

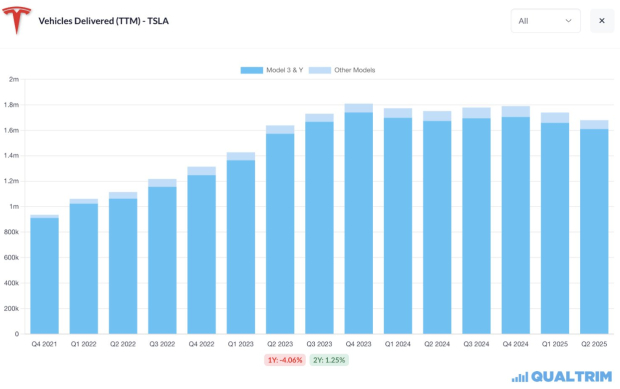

Although Tesla is working to diversify its enterprise with its vitality phase and its upcoming ‘Optimus” humanoid robotic, Tesla presently generates roughly three-quarters of its whole income from its legacy EV enterprise. Sadly for Tesla bulls, deliveries are 4% decrease over the trailing twelve months, and over the previous two years, development has been sluggish at +1%. Tesla deliveries peaked in This autumn 2023 and have been declining ever since.

Picture Supply: Zacks Funding Analysis

Nonetheless, Tesla has an opportunity to alter the narrative this week when it releases its third-quarter supply and manufacturing numbers, that are anticipated to drop on Thursday earlier than the US fairness market opens. Beneath is a breakdown of Wall Avenue’s expectations for Tesla’s Q3 supply numbers:

· Q3 Supply Expectations: Consensus Wall Avenue analyst expectations are for 448,000 items. (In accordance with FactSet)

· Supply Comparability to 2024: Tesla delivered 462,890 automobiles in Q3 2024.

· Q3 Manufacturing Expectations: UBS expects 470k automobiles produced in Q3 2025.

· 2025 Full-Yr Supply Outlook: Tesla delivered 336,681 automobiles in Q1 and 384,122 vehicles in Q2. Wall Avenue consensus estimates anticipate ~1.85 million automobiles might be delivered in full-year 2025.

The Q3 supply and manufacturing numbers might be considerably totally different from these of earlier quarters for a number of causes, together with tariff impacts, the expiration of the EV tax credit score, and the discharge of the brand new Mannequin Y.

Why Tesla Will Beat Q3 Wall Avenue Supply Expectations

Although there are a number of crosscurrents heading into Thursday’s supply quantity, there are a number of causes for Tesla bulls to be optimistic, together with:

1. Tax Credit score Expiration-Associated Demand: Elon Musk has said that he helps ending the $7,500 US federal EV tax credit score, arguing that it could profit Tesla and negatively influence its rivals. Nonetheless, Musk later retracted his assertion, arguing that it’s unfair that President Trump’s ‘Huge Lovely Invoice’ leaves oil and gasoline subsidies whereas sunsetting EV and photo voltaic incentives. Nonetheless, no matter what Musk says, Q3 Tesla deliveries are prone to profit dramatically from a ‘pull ahead’ impact, as shoppers probably have rushed over the previous few months to benefit from the $7,500 EV tax credit score that gained’t be out there for the primary time for the reason that program began in 2009.

2. Elon Musk’s Political Backlash Has Dissipated: Whereas Tesla gross sales have undoubtedly suffered from Elon Musk’s political affiliations and controversial statements, his stepping again from politics and renewed give attention to Tesla ought to assist to alleviate these issues. Though there are critics on either side of the political aisle who won’t ever purchase a Tesla out of precept, Tesla stays the most secure, hottest, and highest-quality EV in the marketplace by far. As well as, Wall Avenue analysts are probably underestimating the loyalty of Tesla’s buyer base. Tesla, which is known for spending little to no cash on advertising and marketing, might even profit from loyalists shopping for Teslas merely to assist Musk. Moreover, Elon Musk was not too long ago seen shaking fingers with President Trump on the Charlie Kirk memorial service, an act that will assist restore his popularity in proper wing political circles. In abstract, time heals wounds, particularly within the hyperactive modern-day information cycle of 2025.

3. The Mannequin Y Retool is Full: Tesla’s Mannequin Y SUV has been a smash hit. Since 2023, the Mannequin Y has been the top-selling electrical automobile by far. Tesla not too long ago begun promoting a revamped and sleeker ‘Juniper’ Mannequin Y, that includes exterior and inside aesthetic updates, new lighting, improved suspension, a entrance bumper digicam, and enhancements to cabin consolation and noise ranges. Whereas the Mannequin Y has primarily obtained optimistic buyer evaluations, anticipation and a wait-and-see mindset for Tesla’s tech-forward prospects probably led to a lull in Mannequin Y gross sales in early 2025. Moreover, Tesla underwent an intensive revamp of its factories in early 2025 to retool them for the brand new Mannequin Y manufacturing. With these short-term boundaries within the rearview mirror, the stage is about for an upside shock on the Mannequin Y entrance. Additionally, Tesla’s Cybertruck manufacturing can be gaining momentum and changing into extra environment friendly.

4. China’s Financial Rebound Ought to Enhance Tesla Gross sales: China is Tesla’s second most necessary market, comprising ~22% of whole income. Over the previous few years, Tesla gross sales in China have suffered amid a floundering Chinese language economic system, suffering from excessive unemployment. Nonetheless, following a slew of presidency stimulus measures and a leisure of anti-business rules, China’s economic system is firing on all cylinders, registering strong GDP development of 5% final yr. In the meantime, following stringent lockdowns and government-driven worry surrounding COVID-19, Chinese language households presently take pleasure in huge extra financial savings. With a nonetheless unsure housing market, many of those Chinese language households are prone to spend on EVs, that are wildly well-liked in China. If August is any clue for Tesla China’s gross sales, bulls are in enterprise. Tesla gross sales jumped to 83,192 items in August, representing a wholesome 22.6% rise versus July. The important thing might be how Tesla fares towards powerful Chinese language competitors, comparable to Nio (NIO), XPeng (XPEV), and BYD Co. (BYDDF).

5. Decrease Curiosity Charges are a Constructive for Tesla: Earlier this month, Fed Chair Jerome Powell delivered a long-awaited rate of interest reduce. Price cuts not solely stimulate the economic system but additionally decrease month-to-month prices for potential Tesla consumers, incentivizing purchases.

6. Tariffs Assist Tesla Fend Off Overseas Competitors: Though Tesla skilled some preliminary unfavorable impacts from President Trump’s distinctive tariff coverage, total, they’re a web optimistic for the corporate. Tariffs enhance the prices for foreign-made EVs, making Tesla’s US-manufactured EVs comparatively extra engaging.

Betting Markets Counsel Huge Tesla Supply Beat

Betting markets are sometimes extra correct than analysts as a result of they profit from ‘the knowledge of the gang.’ Additionally, in contrast to polls, betting markets imply that betters are investing actual cash and have ‘pores and skin within the sport.’ Common betting market Kalshi is presently pricing in Q3 Tesla deliveries of 505k, effectively above Wall Avenue consensus estimates.

Picture Supply: Kalshi

Tesla Technical View

Since its inception, TSLA have elevated by a mind-blowing 34k%. That mentioned, long-term charts point out that TSLA inventory efficiency is available in bunches. From 2014 to 2020, Tesla shares moved sideways as the corporate transitioned to new merchandise. Nonetheless, over the following two years, TSLA shares would multiply 17X! At the moment, historical past seems to be repeating itself. Tesla shares have been stagnant since 2022 and are lastly breaking out. Because the previous Wall Avenue adage goes, “The longer the bottom, the upper in house.” Ought to the breakout succeed, the Fibonacci extensions recommend {that a} cheap value goal for TSLA over the following few months is ~$600.

Picture Supply: Zacks Funding Analysis

Can Tesla deliveries be the breakout catalyst?

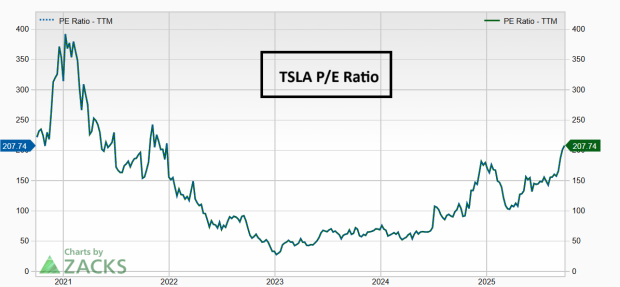

Why Buyers Ought to Ignore Tesla’s Sky-Excessive P/E Ratio

For value-oriented traders, Tesla’s price-to-earnings ratio of 207x makes the inventory an computerized keep away from.

Picture Supply: Zacks Funding Analysis

Nonetheless, savvy traders perceive that valuations require nuance. Buyers are keen to position the next valuation on Tesla as a result of it’s arguably essentially the most progressive firm on the earth. Tesla is prone to be a pacesetter in humanoid robots (which Musk sees as Tesla’s doubtlessly largest future product) and synthetic intelligence. As well as, Tesla is slated to launch a extra inexpensive model of its wildly well-liked Mannequin Y SUV in This autumn 2025. Lastly, Tesla’s vitality enterprise is dramatically ignored by Wall Avenue analysts. Because the US energy grid turns into more and more strained by the insatiable electrical energy demand from AI information facilities, utility firms are investing in Tesla’s Megapack to complement the grid. Tesla Power turned worthwhile in mid-2022 and has produced income in 13 consecutive quarters. In the meantime, year-over-year vitality deployments soared by 113% in 2024 alone. Power is among the most predictable tendencies on Wall Avenue, and Tesla is about to be a serious beneficiary.

Backside Line

After navigating a difficult interval marked by political backlash, slowing EV development, and market skepticism, Tesla shares are rebounding swiftly. Will this week’s supply numbers be the catalyst that validates the market’s renewed optimism in Tesla?

5 Shares Set to Double

Every was handpicked by a Zacks skilled because the #1 favourite inventory to achieve +100% or extra within the coming yr. Whereas not all picks might be winners, earlier suggestions have soared +112%, +171%, +209% and +232%.

Many of the shares on this report are flying beneath Wall Avenue radar, which gives an ideal alternative to get in on the bottom flooring.

Right now, See These 5 Potential Residence Runs >>

Tesla, Inc. (TSLA) : Free Inventory Evaluation Report

Alphabet Inc. (GOOGL) : Free Inventory Evaluation Report

NIO Inc. (NIO) : Free Inventory Evaluation Report

XPeng Inc. Sponsored ADR (XPEV) : Free Inventory Evaluation Report

This text initially printed on Zacks Funding Analysis (zacks.com).

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.