- The Dow Jones rebounded over 350 factors on Friday, climbing again above 46,000.

- Fed fee lower expectations are nonetheless on observe after PCE inflation met market forecasts.

- Regardless of a coolish print, inflation continues to carry on the flawed aspect of the Fed’s 2% annual goal.

The Dow Jones Industrial Common (DJIA) rebounded on Friday, paring away the midweek’s losses and recovering footing as traders self-soothe over odds of a follow-up rate of interest lower in October. US Private Consumption Expenditures Worth Index (PCE) inflation got here in about the place median market forecasts predicted, protecting market hopes for an October fee trim on the excessive aspect.

Inflation holds regular, protecting fee lower bets on steadiness

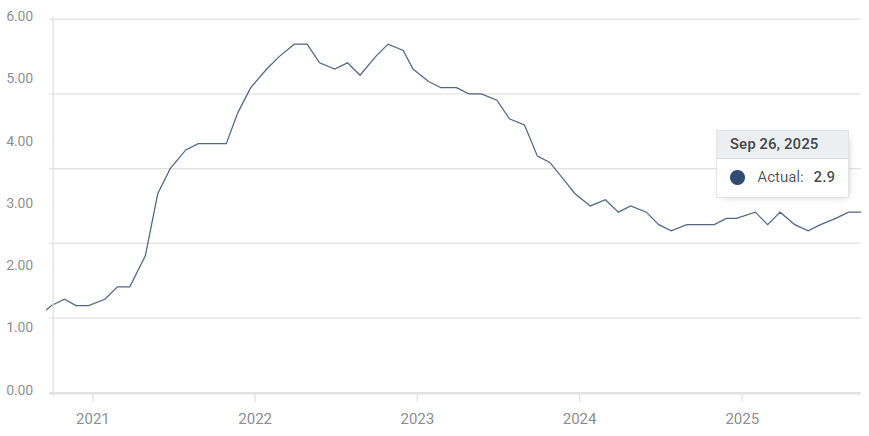

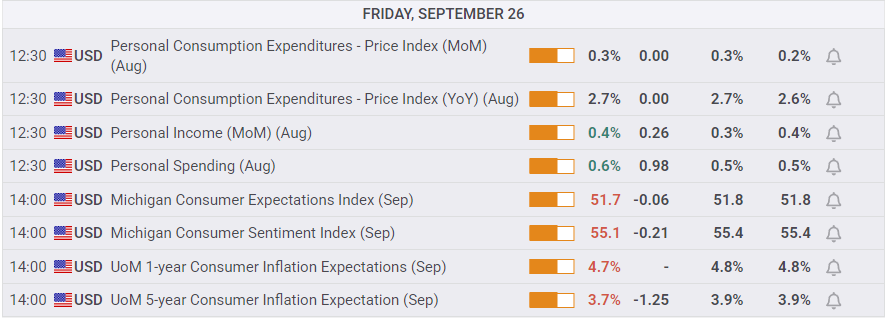

Core PCE inflation held regular at 2.9% on an annual foundation, assembly market forecasts. The month-to-month determine additionally held flat at 0.2% MoM, whereas headline PCE inflation accelerated to 0.3% MoM and a pair of.7% YoY. The US financial system is now eight months into its “one-time inflation passthrough” from the Trump administration’s tariffs, and core annual PCE inflation metrics are on the similar degree they have been practically 18 months in the past in March of 2024.

Regardless of the dearth of significant progress on inflation, markets are nonetheless leaning into the bullish aspect as Friday’s PCE inflation print was not excessive sufficient to spark any issues concerning the Fed falling again into hawkish territory. Amid a slumping labor market, the Fed remains to be on observe to ship a second straight quarter-point rate of interest lower on October twenty fifth. In accordance with the CME’s FedWatch Device, fee merchants are pricing in practically 90% odds that the Fed will ship a 25 bps fee trim to match the opening fee lower from September’s fee assembly.

Core PCE inflation, YoY

Private Earnings and Private Spending each rose in August, climbing to 0.4% and 0.6%, respectively. Whereas rising earnings and consumption metrics are optimistic indicators for the US financial system, accelerating wage pressures might bolster inflation metrics sooner or later, complicating the Fed’s path to a contemporary rate-cutting cycle.

Client sentiment eases barely, however loads of work nonetheless on the playing cards

September’s College of Michigan (UoM) Client Expectations and Sentiment Indexes each declined barely from the earlier month, however once more, the info was largely in step with market expectations. UoM 5-year and 5-year Client Inflation Expectations additionally ticked decrease in September, however the topline figures are nonetheless driving excessive at 4.7% and three.7%, respectively.

Customers have a robust tendency to overshoot real looking outcomes, however such constantly excessive figures over time could possibly be a warning of overly price-sensitive customers’ inflation expectations turning into entrenched in a self-fulfilling prophecy. So long as customers proceed to count on above-pace inflation, companies shall be extra inclined to satisfy these expectations.

Dow Jones day by day chart

Financial Indicator

Core Private Consumption Expenditures – Worth Index (YoY)

The Core Private Consumption Expenditures (PCE), launched by the US Bureau of Financial Evaluation on a month-to-month foundation, measures the modifications within the costs of products and companies bought by customers in the US (US). The PCE Worth Index can also be the Federal Reserve’s (Fed) most popular gauge of inflation. The YoY studying compares the costs of products within the reference month to the identical month a yr earlier. The core studying excludes the so-called extra unstable meals and vitality parts to provide a extra correct measurement of value pressures.” Usually, a excessive studying is bullish for the US Greenback (USD), whereas a low studying is bearish.

Learn extra.