After main world occasions, buddies and colleagues typically attain out asking what all of it means for markets, what’s going to occur subsequent and the way traders ought to reply. Whereas I’m at all times prepared to share a view, essentially the most trustworthy place is normally the only one: I don’t know. In extremely advanced programs like world politics and monetary markets, exact predictions are hardly ever sturdy. Extra typically, they develop into an train in false certainty that anchors traders to a particular consequence and limits flexibility when circumstances inevitably change.

That dynamic was on show once more over the weekend, when President Donald Trump threatened further tariffs on a number of EU nations following escalating tensions tied to Greenland. The headlines triggered a wave of messages asking for my take. The reality is, it’s unclear how occasions will unfold or the place negotiations finally land.

What is clear, nevertheless, is methods to place a portfolio for uncertainty while not having to forecast particular outcomes. Traders don’t have to predict the following geopolitical flip to arrange for a extra risky and security-focused world backdrop.

I’ve written extensively in regards to the function of gold, gold miners, and power shares in environments like this. One other space quietly displaying persistent energy is protection and aerospace. As governments reassess safety priorities and improve spending, the sector continues to draw capital, and a number of other shares stand out on each elementary and technical grounds. Amongst them are Teledyne Applied sciences (TDY), AAR (AIR), and Progressive Options and Help (ISSC).

Picture Supply: Zacks Funding Analysis

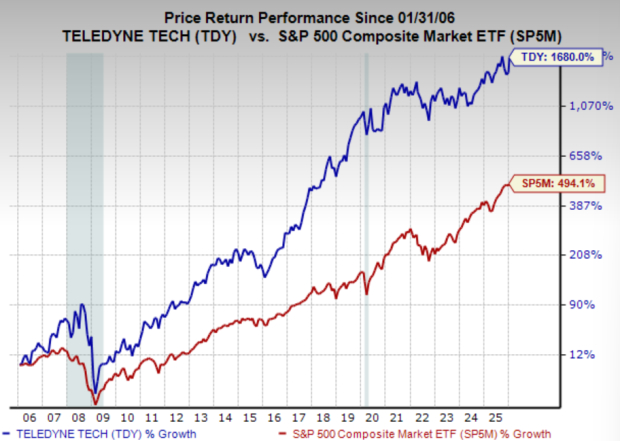

Teledyne Applied sciences: A Main Aerospace Inventory

Teledyne Applied sciences is without doubt one of the highest high quality operators within the protection and aerospace area, with a enterprise spanning superior instrumentation, digital imaging, aerospace electronics, and protection programs. Its merchandise are deeply embedded in mission-critical functions throughout protection, area, maritime, and industrial markets, giving the corporate a sturdy aggressive place and extremely recurring demand.

That high quality has translated into distinctive long-term inventory efficiency. Teledyne has compounded shareholder worth steadily for many years by way of a mixture of natural progress, disciplined acquisitions, and powerful execution. It stays a transparent trade chief with a popularity for reliability and technological depth.

From a fundamentals standpoint, Teledyne carries a Zacks Rank #2 (Purchase). The inventory trades at roughly 24.4x ahead earnings, which represents a modest premium to the broader market. Nonetheless, that valuation is supported by constant execution, sturdy money flows, and an earnings progress outlook of practically 10% yearly over the following 3–5 years. In an surroundings the place capital is gravitating towards protection stalwarts with confirmed monitor data, Teledyne’s mixture of momentum, institutional sponsorship, and enterprise high quality may proceed to help greater costs.

Picture Supply: Zacks Funding Analysis

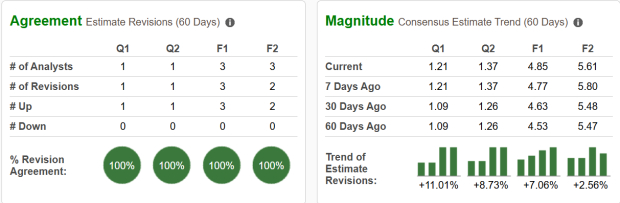

AAR: Inventory Pushes to All-Time Excessive

AAR gives aviation companies and logistics options to each business and protection prospects, with rising publicity to army sustainment, provide chain administration, and plane upkeep. As world protection exercise will increase, demand for these operational and help companies has strengthened meaningfully.

The inventory has began the 12 months with spectacular momentum, pushing to recent document highs simply final week. That value motion is being bolstered by enhancing fundamentals. AAR presently holds a Zacks Rank #2 (Purchase), supported by broad earnings estimate revisions. Most notably, present quarter earnings estimates have risen 11% over the previous 30 days, signaling enhancing visibility and stronger-than-expected working tendencies.

Valuation stays affordable given the expansion profile. Shares commerce at roughly 21.7x ahead earnings, whereas gross sales are anticipated to develop 15.2% this 12 months and earnings are forecast to climb roughly 24%. With sturdy momentum, enhancing estimates, and rising protection publicity, AAR stands out as a inventory that seems to be re-rating greater.

Picture Supply: Zacks Funding Analysis

Progressive Options and Help: Shares Breakout

Progressive Options and Help is a smaller, extra specialised participant within the protection and aerospace ecosystem, targeted on avionics programs utilized in army and business plane. Whereas much less well-known, the corporate operates in a distinct segment that advantages instantly from fleet upgrades, modernization applications, and rising protection budgets.

ISSC is establishing as a possible momentum standout. The inventory carries a Zacks Rank #1 (Sturdy Purchase), pushed by a dramatic surge in earnings expectations. Present quarter earnings estimates have jumped 233% over the past 60 days, reflecting a pointy enchancment in underlying enterprise circumstances.

From a technical perspective, shares have simply damaged out from a textbook momentum base, a sample typically related to the early levels of sustained advances, notably in small-cap shares when fundamentals inflect. Whereas ISSC carries greater volatility than bigger protection names, the mixture of explosive estimate revisions and enhancing value motion suggests it may emerge as a management identify inside the smaller-cap protection universe.

Picture Supply: TradingView

Ought to Traders Purchase shares in ISSC, TDY and AIR?

Intervals of geopolitical uncertainty are going to reward preparation over prediction. Protection and aerospace shares supply that preparation by aligning portfolios with enduring spending tendencies which are largely unbiased of headlines. Teledyne gives stability and high quality publicity to the core of the protection ecosystem, AAR provides momentum and earnings acceleration, and ISSC gives big upside potential as a small-cap identify.

For traders trying to place for uncertainty relatively than forecast it, these names signify compelling methods to realize focused publicity to one of many market’s strongest and most resilient sectors.

#1 Semiconductor Inventory to Purchase (Not NVDA)

The unimaginable demand for knowledge is fueling the market’s subsequent digital gold rush. As knowledge facilities proceed to be constructed and always upgraded, the businesses that present the {hardware} for these behemoths will develop into the NVIDIAs of tomorrow.

One under-the-radar chipmaker is uniquely positioned to make the most of the following progress stage of this market. It focuses on semiconductor merchandise that titans like NVIDIA do not construct. It is simply starting to enter the highlight, which is precisely the place you need to be.

See This Inventory Now for Free >>

AAR Corp. (AIR) : Free Inventory Evaluation Report

Teledyne Applied sciences Integrated (TDY) : Free Inventory Evaluation Report

Progressive Options and Help, Inc. (ISSC) : Free Inventory Evaluation Report

This text initially revealed on Zacks Funding Analysis (zacks.com).

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.