Quantum enablers are nicely positioned to emerge as enticing funding alternatives in 2026 as quantum computing shifts from pure analysis towards early business use circumstances. Though totally fault-tolerant quantum programs stay a number of years away, capital spending and enterprise curiosity are already accelerating within the {hardware}, supplies, electronics, software program instruments and safety layers that help as we speak’s quantum growth.

This creates a good setup for traders: enablers can seize near-term revenues and earnings development now, whereas retaining significant upside as quantum adoption expands over time. As markets more and more stay up for scalable quantum functions, shares tied to this enabling ecosystem corresponding to Superior Micro Units AMD, Broadcom AVGO and Teradyne TER might expertise valuation re-rating and stronger capital inflows, making 2026 a well timed window for traders to carefully consider main quantum enablers with robust stability sheets, diversified income streams and clear publicity to long-term quantum development.

Let’s delve deeper.

Quantum Enablers: Clearer Income Visibility With Decrease Threat

In 2026, the outlook for quantum enablers is supported by verifiable development in adjoining, revenue-generating markets which might be scaling sooner than core quantum {hardware} gross sales. A key driver is post-quantum cryptography, the place market analysis from World Progress Insights estimates the phase increasing from roughly $810 million in 2025 to over $1.1 billion in 2026, reflecting accelerating adoption by governments, monetary establishments and critical-infrastructure operators getting ready for quantum-era safety dangers.

It additionally tasks the market to develop at a high-30% compound annual development price over the following decade, making it one of many earliest business beneficiaries of quantum consciousness.

On the broader ecosystem degree, McKinsey & Firm estimates that whole revenues throughout quantum computing, communication and sensing reached roughly $650–750 million in 2024 and are anticipated to exceed $1 billion by 2025, signaling a transition from research-led exercise towards early commercialization. Importantly for traders, McKinsey notes {that a} important share of this income accrues to the enabling layers, together with semiconductors, cybersecurity software program, programs integration and hybrid classical-quantum infrastructure quite than to pure-play quantum {hardware} distributors.

This income combine fortifies the view that quantum enablers supply better earnings visibility and decrease execution danger in 2026, whereas sustaining long-term upside as quantum applied sciences mature.

Three Quantum Enablers in Our Radar for 2026 Achieve

Superior Micro Units continues to place itself as a quantum enabler by means of strategic partnerships and its core compute applied sciences. In August 2025, AMD and IBM IBM introduced a collaboration to develop quantum-centric supercomputing architectures, combining AMD’s high-performance CPUs, GPUs and adaptive SoCs with IBM’s quantum programs to allow hybrid classical-quantum workflows, a key requirement for early sensible use circumstances earlier than fault-tolerant machines arrive. AMD’s presence in quantum-adjacent high-performance computing helps measurable near-term revenues whereas increasing its addressable market as enterprises spend money on quantum readiness.

This Zacks Rank #3 (Maintain) inventory is anticipated to report earnings development of 60.4% on income development of 27.9% in 2026.

Picture Supply: Zacks Funding Analysis

Broadcom In 2025, launched its Brocade Gen 8 Fibre Channel portfolio, together with the X8 Administrators and G820 switches, described by Broadcom because the trade’s first 128G Fibre Channel platforms with built-in quantum-safe cryptography, designed to guard mission-critical SAN environments from future quantum decryption threats. Broadcom additionally launched Emulex Safe Fibre Channel Host Bus Adapters, which implement hardware-based post-quantum cryptography and zero-trust encryption to safe data-in-motion with out efficiency degradation. These options are explicitly aligned with rising safety requirements corresponding to CNSA 2.0, NIS 2 and DORA, enabling enterprises and authorities clients to modernize infrastructure in anticipation of quantum dangers.

This Zacks Rank #3 inventory is anticipated to report earnings development of 41.5% on income development of 42.1% in 2026.

Broadcom Inc. Value and Consensus

Broadcom Inc. price-consensus-chart | Broadcom Inc. Quote

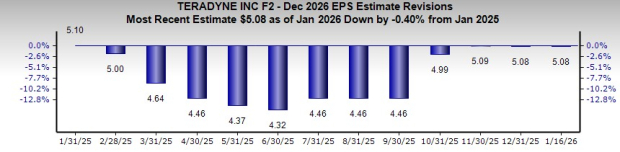

Teradyne is a quantum enabler, offering precision take a look at and measurement options for semiconductor, photonics and quantum {hardware}. In 2025, its acquisition of Quantifi Photonics strengthened its PIC testing portfolio, supporting optical interconnects in hybrid computing and rising quantum programs. Teradyne’s wafer probe and high-volume take a look at programs ship infrastructure for scaling next-generation quantum and AI/HPC units, producing present income whereas enabling enterprise adoption. These capabilities place Teradyne to learn from rising demand for high-precision take a look at options in 2026, giving traders publicity to the quantum ecosystem with out counting on speculative quantum {hardware} gross sales.

This Zacks Rank #3 inventory is anticipated to report earnings development of 43.9% on income development of twenty-two.2% in 2026. You may see the whole listing of as we speak’s Zacks #1 Rank (Sturdy Purchase) shares right here.

Picture Supply: Zacks Funding Analysis

#1 Semiconductor Inventory to Purchase (Not NVDA)

The unimaginable demand for information is fueling the market’s subsequent digital gold rush. As information facilities proceed to be constructed and always upgraded, the businesses that present the {hardware} for these behemoths will change into the NVIDIAs of tomorrow.

One under-the-radar chipmaker is uniquely positioned to make the most of the following development stage of this market. It makes a speciality of semiconductor merchandise that titans like NVIDIA do not construct. It is simply starting to enter the highlight, which is precisely the place you wish to be.

See This Inventory Now for Free >>

Superior Micro Units, Inc. (AMD) : Free Inventory Evaluation Report

Worldwide Enterprise Machines Company (IBM) : Free Inventory Evaluation Report

Teradyne, Inc. (TER) : Free Inventory Evaluation Report

Broadcom Inc. (AVGO) : Free Inventory Evaluation Report

This text initially revealed on Zacks Funding Analysis (zacks.com).

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.