Dycom Industries, Inc. DY seems uniquely positioned to seize outsized good points from the subsequent section of fiber build-outs. The Broadband Fairness, Entry and Deployment (BEAD) program represents a big multi-year catalyst, with $29.5 billion in anticipated state and territory spending, primarily for accelerating broadband growth into underserved rural America.

Demand fundamentals throughout U.S. broadband infrastructure stay strong. Service suppliers are shifting capital expenditures towards fiber-to-the-home and middle-mile builds, the place long-term economics beat legacy copper upgrades. Rural deployments, typically much less commercially engaging with out subsidy help, are actually getting greenlit on an unprecedented scale because of authorities incentives geared toward closing the digital divide.

Roughly $26 billion of the BEAD funding is directed particularly towards fiber or HFC infrastructure, an space instantly aligned with DY’s core capabilities. About two-thirds of all BEAD-funded places shall be served utilizing these applied sciences, increasing DY’s addressable market over the subsequent four-plus years. Furthermore, Dycom’s decade-plus expertise in large-scale fiber deployment, mixed with its diversified end-market publicity, together with carriers, cable MSOs and hyperscale clients, provides it an edge versus smaller, regionally targeted contractors.

Aside, Dycom’s operational leverage stands to profit from increased margin fiber work relative to legacy telecom upkeep and retrofit providers. Strategic strikes, reminiscent of investments in fiber-specific engineering and workforce upskilling, additional fortify its aggressive moat. Dangers, together with supply-chain dynamics and execution on rural job websites, stay. Nonetheless, with rural broadband funding simply ramping and demand for high-speed connectivity intensifying, Dycom seems well-positioned to be one of many greatest beneficiaries of the approaching rural fiber wave.

Dycom’s Aggressive Place

Dycom is rising as one of the vital direct beneficiaries of the subsequent multi-year U.S. fiber and digital infrastructure construct cycle. Nevertheless, this doesn’t alter the aggressive facet on this huge market with key gamers, together with Quanta Providers, Inc. PWR and MasTec, Inc. MTZ.

Quanta provides a broader scale and deeper publicity to energy transmission, renewable power and long-haul infrastructure. Quanta’s benefit is resilience throughout cycles, however its upside from BEAD and last-mile fiber is much less concentrated than Dycom’s.

MasTec competes intently with Dycom in communications infrastructure and has significant fiber publicity, notably by way of giant nationwide provider packages. Nevertheless, MasTec’s earnings volatility, capital depth and publicity to power development dilute the purity of its fiber and information heart thesis relative to Dycom’s more and more targeted technique.

DY Inventory’s Worth Efficiency & Valuation Pattern

Shares of this specialty contracting agency, working within the telecom trade, have surged 44.4% previously six months, outperforming the Zacks Constructing Merchandise – Heavy Building trade, the broader Building sector and the S&P 500 Index.

Picture Supply: Zacks Funding Analysis

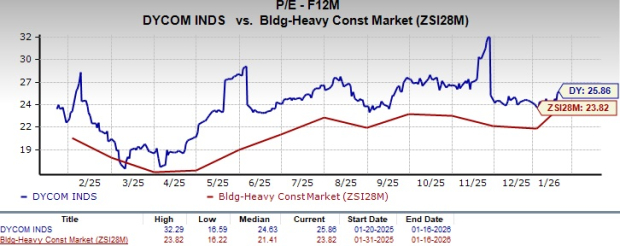

DY inventory is presently buying and selling at a premium in contrast with the trade friends, with a ahead 12-month price-to-earnings (P/E) ratio of 25.86, as evidenced by the chart beneath.

Picture Supply: Zacks Funding Analysis

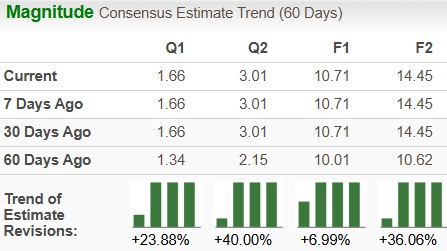

Earnings Estimate Pattern Favors Dycom

Dycom’s earnings estimates for fiscal 2026 and financial 2027 have trended upward over the previous 60 days. The estimated figures for fiscal 2026 and financial 2027 suggest year-over-year progress of 26.9% and 35%, respectively.

Picture Supply: Zacks Funding Analysis

Dycom inventory presently sports activities a Zacks Rank #1 (Sturdy Purchase). You possibly can see the whole record of at the moment’s Zacks #1 Rank shares right here.

#1 Semiconductor Inventory to Purchase (Not NVDA)

The unimaginable demand for information is fueling the market’s subsequent digital gold rush. As information facilities proceed to be constructed and continuously upgraded, the businesses that present the {hardware} for these behemoths will grow to be the NVIDIAs of tomorrow.

One under-the-radar chipmaker is uniquely positioned to benefit from the subsequent progress stage of this market. It focuses on semiconductor merchandise that titans like NVIDIA do not construct. It is simply starting to enter the highlight, which is strictly the place you wish to be.

See This Inventory Now for Free >>

Quanta Providers, Inc. (PWR) : Free Inventory Evaluation Report

Dycom Industries, Inc. (DY) : Free Inventory Evaluation Report

MasTec, Inc. (MTZ) : Free Inventory Evaluation Report

This text initially printed on Zacks Funding Analysis (zacks.com).

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.