Arista Networks, Inc. ANET generated $3.11 billion of internet money from working actions in contrast with $2.68 billion within the year-ago interval, within the first 9 months of 2025. The development was primarily pushed by a stable enchancment in profitability, mixed with working capital effectivity.

Through the first 9 months of 2025, GAAP internet revenue improved to $2.55 billion, up from $2.05 billion a yr in the past. 27.6% surge in income development backed by wholesome traction within the AI networking vertical. ANET gives one of many broadest ranges of information heart and campus Gigabit Ethernet switches and routers within the business. The corporate’s product suite permits the implementation of high-performance, extremely scalable and applicable options for each setting. AI-driven momentum is predicted to drive the corporate’s high line and money circulation within the upcoming quarters.

A scalable price construction is one other constructive. Income development is outpacing the expansion in bills. Regardless of an increase in headcount, new product introduction prices and better variable compensation expenditures, Arista’s working bills remained round 22% of the whole income, enhancing profitability and money circulation.

Sturdy working capital effectivity is one other main tailwind. Within the first 9 months of 2025, working capital necessities decreased by a internet $424.5 million. Deferred revenues elevated $1.8 billion, backed by rising buyer contracts. These upfront money funds from prospects are a serious driver of money circulation. Accounts payable elevated by $117.7 million. That suggests Arista is utilizing provider credit score to fund its stock purchases. That is additionally bettering short-term money circulation.

Nonetheless, a $348.1 million improve in accounts receivable partially offset this constructive pattern. The rise was attributable to larger revenues, and it implies Arista has prolonged its credit score profit to prospects. Stock rose by $321 million yr over yr to help the rising demand for its merchandise. That mentioned, Arista’s money circulation momentum continues to be pushed by stable development in profitability, optimized price construction and environment friendly working capital administration.

Different Tech Corporations With Stable Money Circulation Improvement

Celestica, Inc. CLS generated an working money circulation of $126.2 million in contrast with $122.8 million within the year-ago quarter, bringing the respective tallies for the primary 9 months of 2025 and 2024 to $408.9 million and $330.5 million. Through the third quarter, Celestica’s free money circulation was $88.9 million within the third quarter in contrast with $76.8 million within the prior-year quarter. Its capital expenditure stood at $37 million, 1.2% of revenues and effectively beneath the anticipated 1.5-2% of the income vary. This accentuates environment friendly capital administration and implies that the corporate is well-positioned to put money into development initiatives, in addition to pay debt and dividends. Celestica is benefiting from stable demand for 400G switches and 800G switches in AI knowledge facilities.

Sanmina Company SANM generated $199.1 million of internet money from working actions in contrast with $51.9 million within the earlier yr’s quarter. In 2025, the corporate generated $620.7 million in money in comparison with $340.2 million in 2024. Sanmina locations a robust emphasis on a disciplined and balanced capital allocation framework. Along with that, stable momentum within the communications networks, cloud and AI infrastructure finish markets offers the corporate with larger monetary flexibility, enabling Sanmina to put money into development initiatives and return capital to shareholders.

ANET’s Value Efficiency, Valuation & Estimates

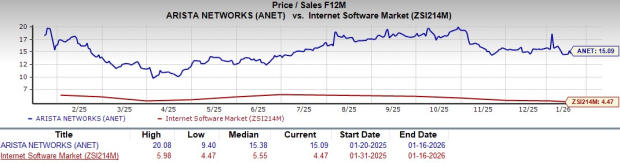

Shares of Arista have surged 8.3% over the previous yr in opposition to the business’s decline of 1.2%.

Picture Supply: Zacks Funding Analysis

From a valuation standpoint, Arista trades at a ahead price-to-sales ratio of 15.09, above the business common.

Picture Supply: Zacks Funding Analysis

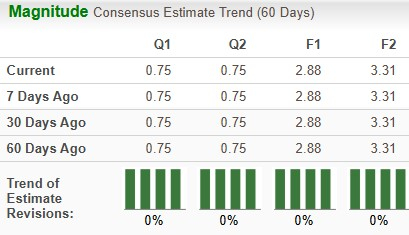

The Zacks Consensus Estimate for Arista’s earnings for 2025 and 2026 has remained unchanged over the previous 60 days.

Picture Supply: Zacks Funding Analysis

Arista presently carries a Zacks Rank #2 (Purchase). You’ll be able to see the entire listing of at present’s Zacks #1 Rank (Sturdy Purchase) shares right here.

#1 Semiconductor Inventory to Purchase (Not NVDA)

The unimaginable demand for knowledge is fueling the market’s subsequent digital gold rush. As knowledge facilities proceed to be constructed and always upgraded, the businesses that present the {hardware} for these behemoths will grow to be the NVIDIAs of tomorrow.

One under-the-radar chipmaker is uniquely positioned to make the most of the subsequent development stage of this market. It focuses on semiconductor merchandise that titans like NVIDIA do not construct. It is simply starting to enter the highlight, which is precisely the place you wish to be.

See This Inventory Now for Free >>

Celestica, Inc. (CLS) : Free Inventory Evaluation Report

Sanmina Company (SANM) : Free Inventory Evaluation Report

Arista Networks, Inc. (ANET) : Free Inventory Evaluation Report

This text initially revealed on Zacks Funding Analysis (zacks.com).

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.